Has the "major correction" just begun?

Bitcoin has once again experienced its most severe plunge of the year: dropping from nearly $90,000 during the day all the way down to around $83,600. Accompanying this price dive, over $500 million in long positions were forcibly liquidated, and the market fear index has once again approached “extreme fear.”

This seemingly sudden crash actually conceals deeper structural changes. Macro liquidity is shifting, derivatives leverage is accumulating, and technicals have already shown a medium-term breakdown. These three forces have almost simultaneously weighed on Bitcoin.

The previous rally seemed to have priced in all of the market’s expectations for an “interest rate cut cycle” in advance; now, however, the market is repricing—reassessing what price real liquidity is willing to pay for Bitcoin.

The “Overdrawn Effect” of Bitcoin’s Gains Begins to Emerge

If you observe Bitcoin’s performance this year over a longer cycle, a clear phenomenon emerges: since the approval of the spot ETF, that round of rapid surge in both speed and scale far exceeded any previous rally phase.

This “overly steep” trend is known in macroeconomics as expectation overdraw: the market prices in all future easing, growth, or capital inflows in advance, and when reality does not immediately deliver, prices become more prone to losing support.

This drop from the $125,000 high down to over $80,000 is not just an ordinary technical correction, but more like a backlash against this year’s excessive optimism.

The first signal of this backlash comes from ETFs.

In November, Bitcoin spot ETFs saw a net outflow of up to $3.5 billion, making it the worst-performing month since February. As the main allocation tool for traditional funds, ETF inflows and outflows often represent the attitude of “long-term money.” Now, with consecutive outflows, it means the pace of external incremental capital is already slowing down.

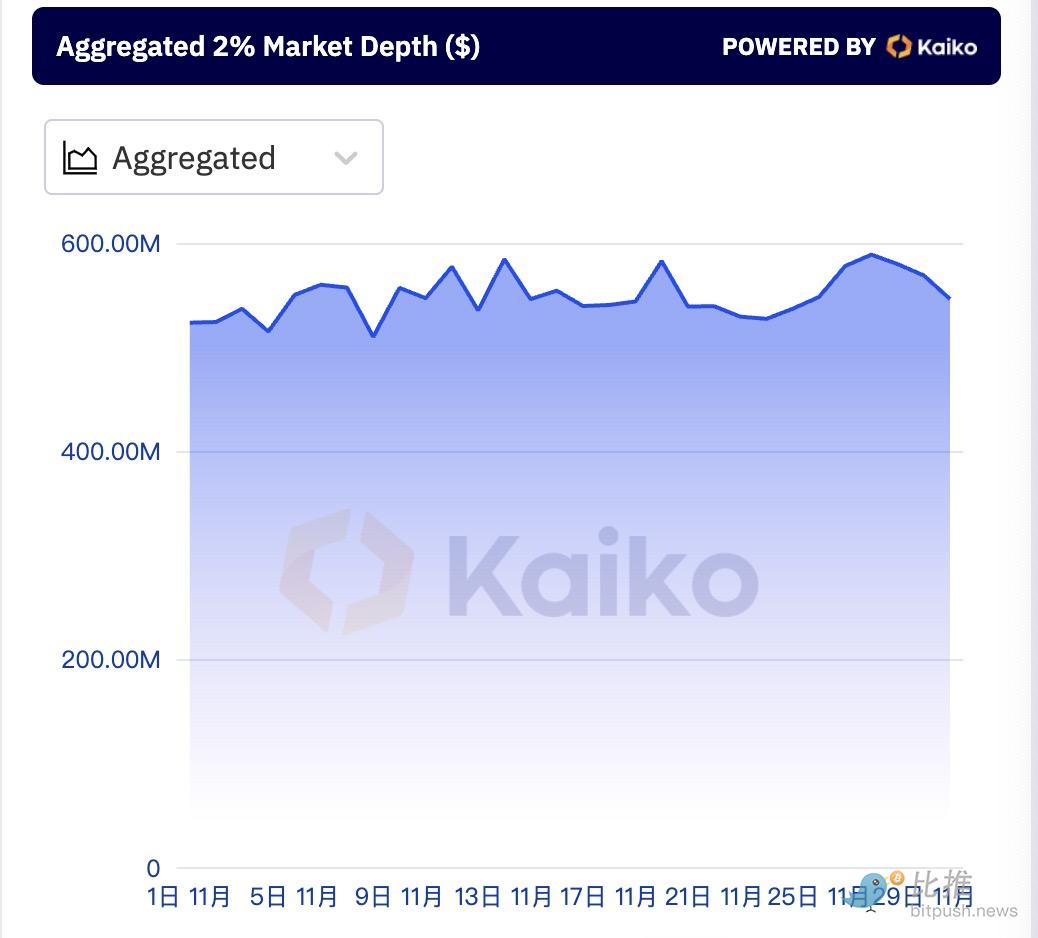

At the same time, data from Kaiko also shows that Bitcoin’s order book “market depth” (an indicator measuring how much resistance its price has to large trades causing volatility) hovered around $568.7 million last weekend, down from the early October peak of $766.4 million—a sharp drop of nearly 30% over the past month. Any large trade now brings greater volatility—and with leverage trading at high levels, this becomes a hidden trigger point.

The Stronger the Rate Cut Expectations, the More Nervous the Market Becomes

Every major fluctuation in Bitcoin cannot ignore the macro backdrop.

On the surface, the probability of a Federal Reserve rate cut in December has been priced in by the market at nearly 90%, which should be positive for risk assets. In reality, however, the current “rate cut expectations” are different from the past; it’s more like the market is forcing the central bank to give a signal of easing.

The problem is that a rate cut itself cannot immediately bring new liquidity.

With inflation still not returning to the 2% target, the Fed’s actual room for easing is very limited. As a result, the market is beginning to doubt: will there be enough new money in the future to push risk assets up again? Such doubts usually do not appear in economic data, but are first answered by highly volatile assets.

A more sensitive trigger point comes from Japan.

This week, Bank of Japan officials unusually stated that they may consider raising interest rates, a statement that quickly sparked global concerns about a possible reversal of the “yen carry trade”—if investors are forced to buy back yen, instead of continuing to borrow yen to buy US stocks or crypto assets, then global risk markets could enter a period of “passive deleveraging.”

Risk sentiment is much more fragile under macro disturbances, and as the most front-line risk asset, Bitcoin bears the brunt.

Looking back at an interesting change: just a few days before the drop, most traders on Myriad’s prediction market still believed Bitcoin would “first hit a new high of $100,000”; but after the decline, this expectation instantly reversed, with nearly half betting it would “first fall back to $69,000.”

This dramatic shift in sentiment is the most typical feature of the crypto market:

When rising, the market is willing to believe any good news;

But once a rapid decline occurs, the market will immediately embrace the most pessimistic narrative.

Technical Side Enters Medium-Term Bearish Zone

If we look at trading technical indicators, Bitcoin’s current technical structure has undergone substantial changes. Analyst Jose Antonio Lanz points out:

If we look at trading technical indicators, Bitcoin’s current technical structure has undergone substantial changes. Analyst Jose Antonio Lanz points out:

-

The 50-day moving average has crossed below the 200-day moving average, forming the classic “death cross,” a clear signal of a medium-term trend reversal;

-

ADX (an indicator measuring trend strength) has risen to 40, meaning the market is entering a trend with a clear direction and relatively fast speed;

-

Momentum indicators such as Squeeze Momentum still show that bearish momentum has not yet ended;

-

The current price range of $83,000 is a key pivot point over the past few months. If it breaks down, the next major support is around $70,000.

As the market continues to search for a bottom, a piece of news from the traditional financial world is worth noting: asset management giant Vanguard, which has always regarded cryptocurrencies as “speculative assets” and kept them at arm’s length, suddenly announced it would open crypto ETF trading to clients.

This shift comes against the backdrop of over $1 trillion in crypto market capitalization evaporating since October, making its signal complex. In a trending adjustment, whether the entry of a single institution is enough to reverse sentiment remains a question mark.

Because the market currently looks more like it’s in a trend reversal phase, rather than a simple pullback. Trend-driven declines tend to last longer than sentiment-driven ones and are harder to reverse with short-term positive news.

For ordinary investors, the most important thing in this environment is not to predict “how low it will go,” but to understand why the market has reached this point, how long the volatility may last, and whether you can withstand such volatility yourself.

The stage of risk repricing is the easiest time for mispricing and overselling; but it will also eliminate all positions based on fantasy.

Bitcoin is completing such a process.

Author: Bootly

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

569 XRP Whales Disappear—Yet Whale Holdings Hit 7-Year High. What’s Going On?

![Crypto News Today [Live] Updates On December 2,2025 : Federal Reserve News, Bitcoin Price Today, Ethereum Price And XRP Price](https://img.bgstatic.com/multiLang/image/social/cc963d16638fb3fac964f28463fe5c9a1764673944776.webp)

Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

HashKey prospectus in detail: 1.5 billion HKD loss over three years, 43% equity controlled by Wanxiang Chairman Lu Weiding

Despite HashKey's significant total revenue growth over the past two years, with rapid expansion in trading volume and client base, the underlying financial pressure remains evident: ongoing losses, long-term negative operating cash flow, and consistently high net debt all contribute to continued uncertainty regarding its financial resilience ahead of its IPO.