Bitcoin Updates: Yen Carry Trade Reversal: The $20 Trillion Factor Disrupting the Crypto Market

- Bitcoin's price drop below $87,000 in December linked to BOJ's hawkish pivot and unwinding $20T yen carry trade, triggering $643M in crypto liquidations. - BitMEX founder Arthur Hayes identifies $80,000 as potential support level but warns U.S. Treasury issuance and AI sector risks could prolong volatility. - South Korea's expanded crypto "travel rule" increases compliance costs for exchanges , compounding market pressures amid global macroeconomic uncertainty. - Bitcoin Munari's $0.22 presale and Blazpa

Bitcoin Faces Pressure Amid Global Economic Shifts

Bitcoin has experienced a notable decline in value recently, with analysts attributing the downturn to a mix of global economic factors. Among the most significant influences are the Bank of Japan's (BOJ) signals toward tighter monetary policy and the unwinding of yen carry trades. Early December saw Bitcoin fall below $87,000, accompanied by more than $643 million in forced liquidations, highlighting the market's struggle with changing liquidity and policy uncertainty.

Arthur Hayes, the founder of BitMEX, has suggested that the $80,000 mark could serve as a crucial support level for Bitcoin. However, he warns that ongoing volatility may persist due to broader market issues, such as increased U.S. Treasury debt issuance and concerns within the AI sector.

Impact of BOJ Policy and Yen Carry Trade

The BOJ's recent shift toward a more hawkish stance has become a major driver of market activity. On December 1, Governor Kazuo Ueda hinted at a possible interest rate hike, which pushed Japanese 10-year bond yields to 1.86%—a level not seen since 2008. This development has disrupted the yen carry trade, a strategy where investors borrow yen at low rates to invest in higher-risk assets. As yields rise and the yen strengthens, this trade is being unwound, reducing global liquidity and putting additional pressure on leveraged crypto positions. Prediction markets now estimate a 57% likelihood of a BOJ rate hike, up from 50% before Ueda's comments.

Crypto Market Repercussions

The effects of these macroeconomic changes are evident in the cryptocurrency sector. Both Bitcoin and Ethereum have suffered significant liquidations, with Bitcoin dropping 5.2% to $86,062 and Ethereum falling 5.4% to $2,826 on December 1. Over $600 million in long positions were liquidated as bullish traders were forced to exit their trades. This continues a trend from November, when crypto market liquidations surpassed $1.33 billion, indicating ongoing deleveraging. Hayes points to institutional investors reducing their Bitcoin ETF holdings and increased Treasury bill issuance as factors draining liquidity from the market.

Regulatory Developments in Asia

Additional pressure is coming from regulatory changes in Asia. South Korea's Financial Services Commission has broadened its "travel rule" to include all crypto transactions, even those below 1 million won (about $680). This requires exchanges such as Upbit and Bithumb to verify the identity of every trader, increasing compliance costs and potentially slowing retail trading activity. While the measure aligns with international anti-money laundering standards, it adds further complexity to an already challenged market.

Emerging Crypto Projects Amid Market Volatility

Looking Forward: Policy and Market Dynamics

The future direction of the crypto market will be shaped by the interplay between BOJ policy decisions and actions by the U.S. Federal Reserve. While there is an 80% chance of a Fed rate cut in December, according to CME FedWatch, Hayes cautions that liquidity constraints driven by Treasury activity and uncertainties in the AI sector could limit any potential recovery. The ongoing unwinding of the yen carry trade, with $20 trillion in exposure, remains a significant risk that could trigger further global market disruptions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vanguard Breaks Conservative Tradition, Opens to Crypto ETFs

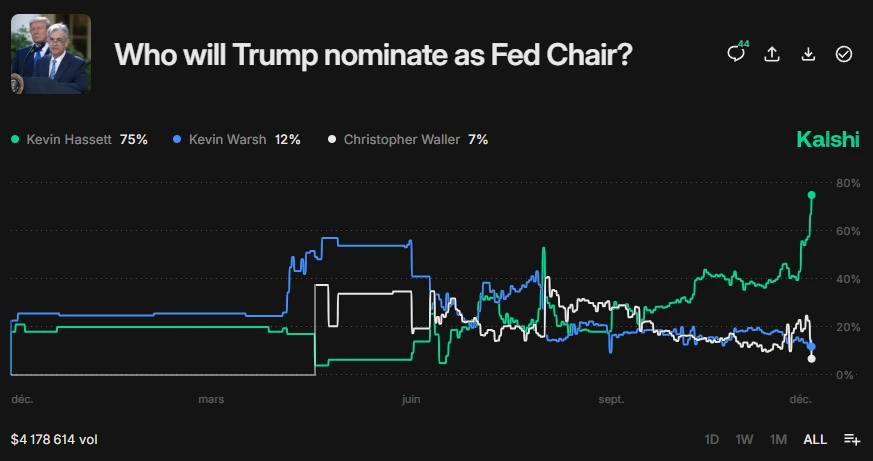

Trump’s Fed Chair Announcement Likely This Week: Is It the Needed Crypto Bullish Catalyst?

XRP Price News: Breakout or Breakdown?

Huione Pay Halts Withdrawals After Run on Banks, Users Fear Major Losses