Ethereum News Update: Major Ethereum Holders Take Bold Leverage Positions as Liquidation Concerns Rise

- Ethereum (ETH) stabilized above $2,900 after $92.6M inflow into BlackRock’s ETF, reversing eight-day outflows and signaling renewed institutional interest. - Whale activity surged on HyperLiquid, with 10M USDC funding a $32.8M 20x ETH long position and BitMine adding 69,822 ETH ($200M) to control 3% of total supply. - High-leverage bets (up to 25x) by traders like "Brother Ma" and the "$10B HyperUnit Whale" highlight risks, with liquidation thresholds near $2,326–$2,662. - Fed rate cut odds jumped to 80%

Ethereum Holds Strong Above $2,900 Amid Major ETF Inflows

Ethereum (ETH) has maintained its position above the $2,900 mark, supported by a significant influx of $96.67 million into ETFs on November 24. Notably, BlackRock's Ethereum ETF contributed $92.6 million to this total, reversing an eight-day trend of outflows and signaling a resurgence of institutional interest in the asset.

Whale Activity Intensifies on HyperLiquid

Large-scale traders, often referred to as whales, have become increasingly active. One such investor, whose wallet begins with 0xa5B0, deposited 10 million USDC into HyperLiquid to back a 20x leveraged ETH long position valued at $32.8 million. This aggressive move, with a liquidation point near $1,990, highlights the bullish outlook among major players despite ongoing market volatility.

Significant Movements in the Ethereum Ecosystem

- BitMine, a prominent investor, expanded its holdings by acquiring 69,822 ETH (worth $200 million), bringing its total to 3.63 million ETH—approximately 3% of Ethereum’s circulating supply.

- Huang Licheng, also known as "Brother Ma," deposited 249,847 USDC into HyperLiquid to increase his ETH long position to 25x leverage. He currently holds 2,000 ETH, facing an unrealized loss of $257,189, with a liquidation threshold at $2,662. This underscores the high-risk, high-reward nature of leveraged trading.

HyperLiquid Emerges as a Whale Trading Hub

HyperLiquid has become a central platform for large traders. Another closely watched investor deposited 10 million USDC to initiate a 5x leveraged long position of 15,000 ETH at $2,946, totaling $44.3 million. This position faces a liquidation risk at $2,326.53, representing a potential 21% drawdown. The platform’s appeal lies in its non-custodial model and deep liquidity, attracting both institutional and retail participants.

Macroeconomic Factors and Market Sentiment

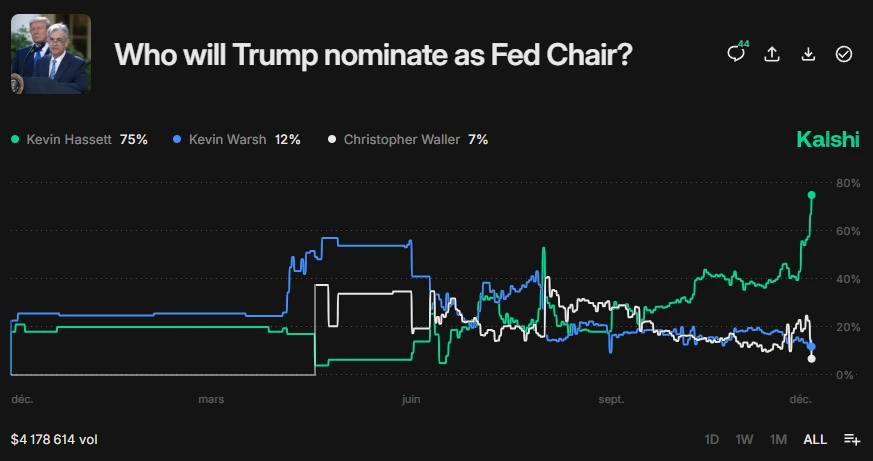

Broader market conditions are also influencing Ethereum’s price action. Expectations for a Federal Reserve rate cut at the December meeting surged from 30% to over 80%, coinciding with ETH’s price stability. Analysts point to improved investor confidence, as seen in the Coinbase Premium Index moving from -0.12 to -0.02, which aligns with increased liquidity in ETH futures. However, the $3,000 level remains a key psychological barrier, with technical indicators such as the MACD and RSI offering mixed signals.

The Mystery of the "$10B HyperUnit Whale"

Speculation surrounds the identity of the so-called "$10B HyperUnit Whale," who reportedly earned $200 million during the October 10 market crash. Blockchain investigators have linked the wallet to former BitForex CEO Garret Jin, though he has denied any association. Recently, this whale expanded their ETH long to $44.5 million by leveraging an additional $10 million in USDC, achieving $300,000 in gains within just one hour—demonstrating the potential rewards of high-leverage trading during periods of volatility.

Regulatory Landscape and the Rise of Decentralized Platforms

Ongoing regulatory scrutiny and liquidity challenges are shaping the strategies of large traders. Decentralized derivatives platforms like HyperLiquid are gaining popularity as traders seek alternatives to centralized exchanges, especially amid concerns over custodial risks and regulatory ambiguity. The recent surge in capital flowing into these platforms highlights their growing role in enabling substantial, leveraged trades that can significantly impact market dynamics.

Outlook: Navigating Risks and Opportunities

As Ethereum consolidates near $2,900, its short-term direction will likely be determined by the interplay of whale activity, macroeconomic developments, and technical signals. While optimism persists among bullish traders, the threat of liquidation remains significant for those employing high leverage. Market participants are watching closely, with Federal Reserve policy decisions and liquidity trends expected to be key drivers in the months ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump’s Fed Chair Announcement Likely This Week: Is It the Needed Crypto Bullish Catalyst?

XRP Price News: Breakout or Breakdown?

Huione Pay Halts Withdrawals After Run on Banks, Users Fear Major Losses

Bitcoin News Update: Vanguard Shifts Stance on Crypto Amid Growing Demand and Regulatory Clarity

- Vanguard Group, managing $11 trillion, will let clients trade regulated crypto ETFs from Dec 2, 2025, reversing long-term skepticism toward digital assets. - The firm supports Bitcoin , Ethereum , and major crypto ETFs but excludes memecoins and won't launch its own crypto products, prioritizing low-cost, regulated offerings. - This shift reflects growing retail/institutional demand and maturing regulatory frameworks, aligning with SEC-approved spot crypto ETFs showing liquidity and stability. - By joini