Key Market Intelligence on November 28th, how much did you miss out on?

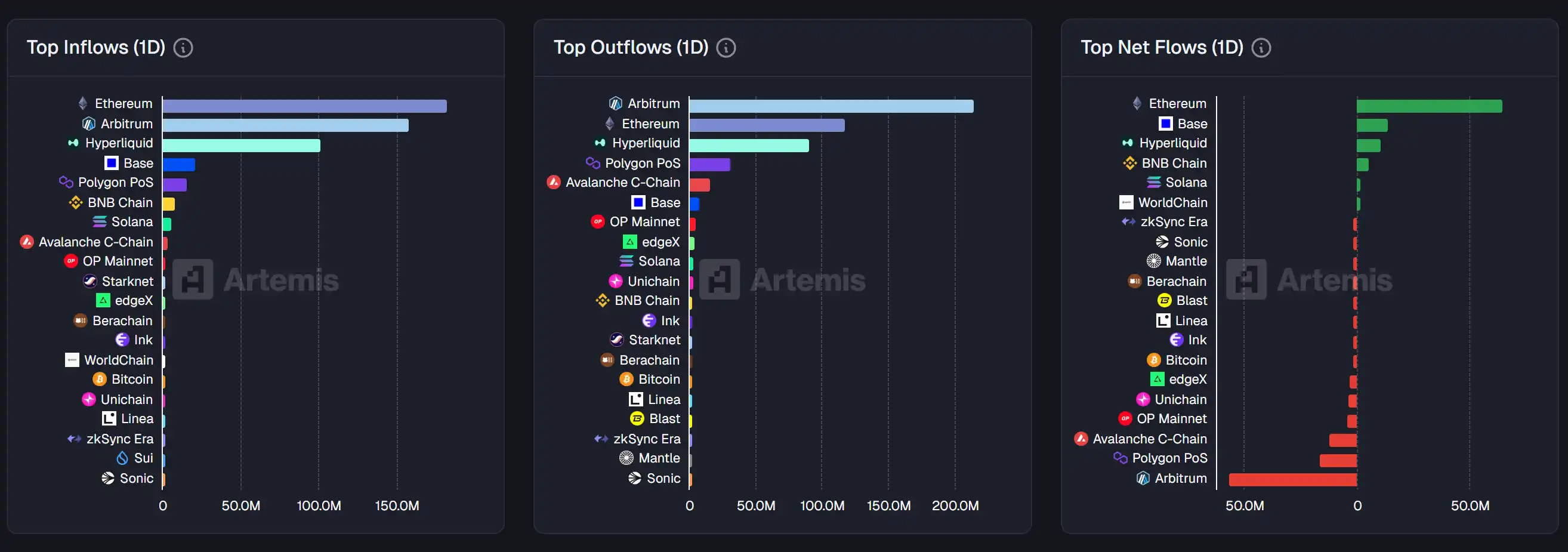

1. On-chain Funds: $64.5M USD inflow to Ethereum today; $56.3M USD outflow from Arbitrum 2. Largest Price Swings: $TRADOOR, $AT 3. Top News: Monad on-chain Meme "emo" with a 24-hour price surge of 290%, currently valued at $570,000 USD

Featured News

1. Monad On-Chain Meme "emo" Surges 290% in 24 Hours, Market Cap Currently at $570,000

2. "BNB Version MicroStrategy" BNC Price Drops Over 92% from its All-Time High, Currently at $5.97

3. ZEC Dips Below $450 Temporarily, 24-Hour Decline of 10.87%

4. Suspected Google Insider Leaks Gemini 3.0 Flash Release Schedule, Multiple Accounts Simultaneously Bet on Narrow Window

5. New Suspicion in Qian Zhimin Case, Whereabouts of Over 120,000 Bitcoins Unknown, with 20,000 Claimed to be "Lost Password"

Featured Articles

1. "Bitcoin Returns to $90,000, Will It Be Christmas or Christmas Robbery Next?"

Whether Chinese or foreigners, no one can escape the traditional psychological expectation of "having a good reunion holiday." Every year, on the fourth Thursday of November, is the traditional major holiday in the United States, Thanksgiving. And this year's Thanksgiving, what people in the crypto industry may be most grateful for is Bitcoin's return to $90,000. In addition to the "holiday market" factor, a "Brown Paper" that unexpectedly became a key decision basis due to government shutdown has also helped reshape the final monetary policy direction of the year. The probability of a Fed rate cut in December has skyrocketed from 20% a week ago to 86%.

2. "How to Speculate on US Stocks with 100x Leverage?"

Money always flows to where more money is, and liquidity is always in pursuit of deeper liquidity. Bitcoin has a market cap of $1.7 trillion, while the total market cap of the US stock market exceeds $50 trillion. Tech giants like Apple, Microsoft, and NVIDIA, each with a market cap that can dominate the entire cryptocurrency market. More and more savvy crypto enthusiasts also seem to have reached a subtle consensus that trading stocks may really be better than trading coins.

On-chain Data

On-chain fund flow last week on November 28

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BNB Latest Updates: YZi Labs Confronts BNC's Board Regarding Mismanagement of BNB Treasury Governance

- YZi Labs, linked to Binance's CZ, seeks to overhaul BNC's board amid a 92% stock price drop and governance disputes. - The firm accuses the current board of operational lapses, delayed filings, and conflicts of interest with 10X Capital. - BNC holds $412M in BNB but trades at a discount as the token's price decline exacerbates shareholder concerns. - YZi's consent solicitation aims to install new directors without a shareholder meeting, potentially reshaping governance. - The outcome could signal broader

Blockchain’s “irreversible” scams can now be tracked: Success in fund recovery is rising

- Crypto fraud victims now recover stolen assets at 58–72% rates within 90 days, driven by blockchain forensics and law enforcement collaboration. - A 2025 U.S. seizure of 127,271 BTC ($11B) marked a turning point, proving irreversible blockchain transactions can be traced and frozen at regulated exchanges. - Advanced tools and cross-agency efforts enable tracing through mixers and cross-chain bridges, but challenges persist: 66% of victims fail to report thefts, and privacy coins limit recovery to <10%. -

C3.ai Shares Rise Despite AI Industry Slump Thanks to Key Partnerships

- C3.ai reported a 25.3% Q3 revenue drop to $70.26M but saw a 35% stock surge after expanding Microsoft partnerships and alliances with Capgemini, Google Cloud, and AWS. - Analysts project 20.5% YoY revenue decline for Q4 2025, with full-year forecasts at $370M-$395M, highlighting challenges converting AI pilots into long-term contracts. - Strategic consumption-based pricing and Azure/Capgemini collaborations aim to boost customer acquisition, though profitability hurdles persist amid competitive pressures

Astar 2.0 and What Lies Ahead for DeFi Advancements

- Astar Network's 2.0 upgrade introduces a capped ASTR supply and deflationary model, aligning with Bitcoin's scarcity to attract institutional investors. - Enhanced cross-chain interoperability via Plaza and partnerships with LayerZero/Chainlink reduces operational complexity for institutions. - Governance reforms and ESG alignment with Japanese firms aim to address regulatory concerns and expand real-world use cases. - Despite progress, legal uncertainties and smart contract risks persist, limiting large