HBAR Price’s 25% Crash May Extend As Traders Fail To Pick A Direction

Hedera faces intensified selling pressure after a sharp weekly decline. Trader indecision and weakening indicators suggest HBAR may extend its correction.

Hedera’s price is under sharp pressure as the altcoin faces a significant decline driven by weakening market sentiment. HBAR has struggled to regain momentum after a steep pullback, and ongoing bearish conditions suggest further downside risk.

Traders remain cautious, and the broader market environment is offering little support for a recovery.

Hedera Futures Market Shows Uncertainity

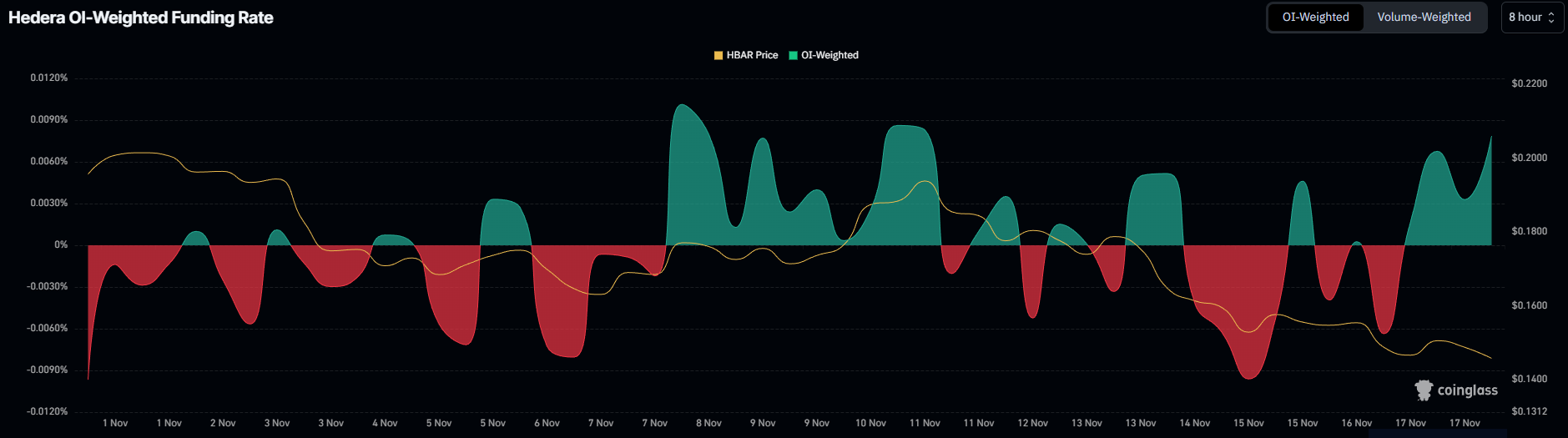

HBAR’s funding rate has fluctuated notably over the past several days, highlighting an absence of trader conviction. This inconsistency reflects uncertainty among market participants, who are reluctant to take decisive long or short positions. Such hesitation often keeps prices directionless and vulnerable to continued losses.

The lack of clear sentiment direction is bearish for Hedera at this stage. Funding rate instability typically signals indecision, which can weaken support levels and extend volatility during downtrends.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

HBAR Funding Rate. Source:

HBAR Funding Rate. Source:

The Relative Strength Index is dropping and currently sits below the neutral 50.0 mark, signaling a shift into bearish territory. Positioned closer to the oversold threshold of 30.0, the indicator suggests that downward momentum remains strong. This trend does not favor immediate recovery, as sellers continue to dominate.

Although assets often rebound once they enter oversold conditions, HBAR has yet to reach that zone. Until the RSI dips further, the bearish pressure is likely to persist. This signals that the altcoin may face additional weakness before any significant reversal emerges.

HBAR RSI. Source:

HBAR RSI. Source:

HBAR Price Could Continue Its Decline

HBAR has fallen 25% over the last week and trades at $0.144, hovering near the $0.145 level. The steep decline has pushed the token into a vulnerable position where bearish sentiment continues to overshadow attempts at stabilization.

Based on current indicators, HBAR could slip below its $0.139 support level. A drop to $0.133 or even $0.120 is possible if selling accelerates and market conditions worsen. Such a move may trigger panic among investors and deepen the correction.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

If HBAR manages to hold the $0.145 support and bounce, the price could attempt a recovery toward $0.154. A breakout above that level may open the path to $0.162 or even $0.175. This scenario would invalidate the bearish outlook and signal renewed buyer interest.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZEC Rises 8.55% Over 24 Hours as Significant Short Covering and Position Flips Occur

- ZEC surged 8.55% in 24 hours to $346.59, but fell 23.78% in 7 days amid volatile swings. - A major ZEC short position turned $21M loss into $5M+ profit after price declines in late October. - The same address holds ETH and MON shorts, with ETH shorts generating $9.5M gains (643% profit). - ZEC's 1-year 563% rise contrasts recent declines, highlighting liquidity-driven market risks for leveraged positions. - Analysts remain cautious as short-term gains coexist with uncertain long-term volatility in crypto

ALGO Climbs 5.83% as Recent Gains Counteract Overall Downtrend

- ALGO surged 5.83% in 24 hours on Dec 2, 2025, but remains down 58.74% annually amid broader crypto market declines. - Short-term buying interest drove the rally, though analysts warn of continued volatility due to macroeconomic uncertainties. - The 24-hour rebound contrasts with a 4.37% seven-day loss, highlighting uneven recovery in the crypto sector. - Traders remain cautious as isolated buying pressure emerges, but long-term bearish trends persist despite temporary optimism.

Chainlink ETF Set to Debut as LINK Slips Amid Market Weakness

Striking baristas win $38.9 million in compensation, yet contract disputes continue

- Starbucks settles NYC Fair Workweek Law violations for $38.9M, including $35.5M restitution to 15,000+ workers. - Striking baristas demand collective bargaining amid ongoing labor disputes and unionization efforts at 550 stores. - Mayor-elect Mamdani and Sen. Sanders join protests, framing demands as moral issues against corporate resistance. - Settlement addresses 500,000 scheduling violations since 2021, with workers receiving $50/week compensation. - Starbucks defends labor law complexity but faces cr