Grayscale submits IPO application: The crypto giant with $35 billion in assets under management finally approaches the US stock market

The $35 billion includes ETPs and ETFs with $33.9 billion in assets under management (mainly Bitcoin, Ethereum, and SOL related products), as well as $1.1 billion in private funds.

Original Title: "Grayscale, Which Once Stood Firm Against the SEC, Is About to Land on the NYSE"

Original Author: Eric, Foresight News

On the evening of November 13, East 8th District time, Grayscale submitted an IPO application to the New York Stock Exchange, planning to enter the US stock market through Grayscale Investment, Inc. The IPO is being underwritten by Morgan Stanley, BofA Securities, Jefferies, and Cantor as lead underwriters.

It is worth noting that Grayscale is using an Up-C (umbrella partnership) structure for this listing. This means that Grayscale’s operating and controlling entity, Grayscale Operating, LLC, is not the listed entity; instead, the newly established Grayscale Investment, Inc. will go public, and public trading will be achieved by acquiring part of the LLC’s equity. Company founders and early investors can convert their LLC equity into shares of the listed entity, enjoying capital gains tax benefits and only needing to pay personal income tax during the conversion. IPO investors, on the other hand, must pay corporate tax on profits and personal income tax on dividends from the shares.

This listing structure not only benefits company "veterans" in terms of taxes, but also allows for absolute control of the company after listing through AB share structure. According to the S-1 filing, Grayscale is wholly owned by its parent company DCG, and Grayscale has clearly stated that after the listing, its parent company DCG will still have decision-making power over major matters at Grayscale through 100% ownership of the higher-voting Class B shares. All funds raised from the IPO will be used to acquire equity from the LLC.

Grayscale is naturally well known, having been the first to launch bitcoin and ethereum investment products, and through a hard-fought battle with the SEC, succeeded in converting its bitcoin and ethereum trusts into spot ETFs. Its digital large-cap fund also has the power of a "crypto version of the S&P 500." In the last bull market cycle, every adjustment to the large-cap fund caused significant short-term price fluctuations for tokens that were removed or newly added.

According to the S-1 filing, as of September 30 this year (local time), Grayscale’s total assets under management reached $35 billion, making it the world’s largest crypto asset manager. It offers more than 40 digital asset investment products, covering over 45 cryptocurrencies. Of the $35 billion, $33.9 billion is in ETPs and ETFs (mainly bitcoin, ethereum, and SOL-related products), and $1.1 billion is in private funds (mainly altcoin investment products).

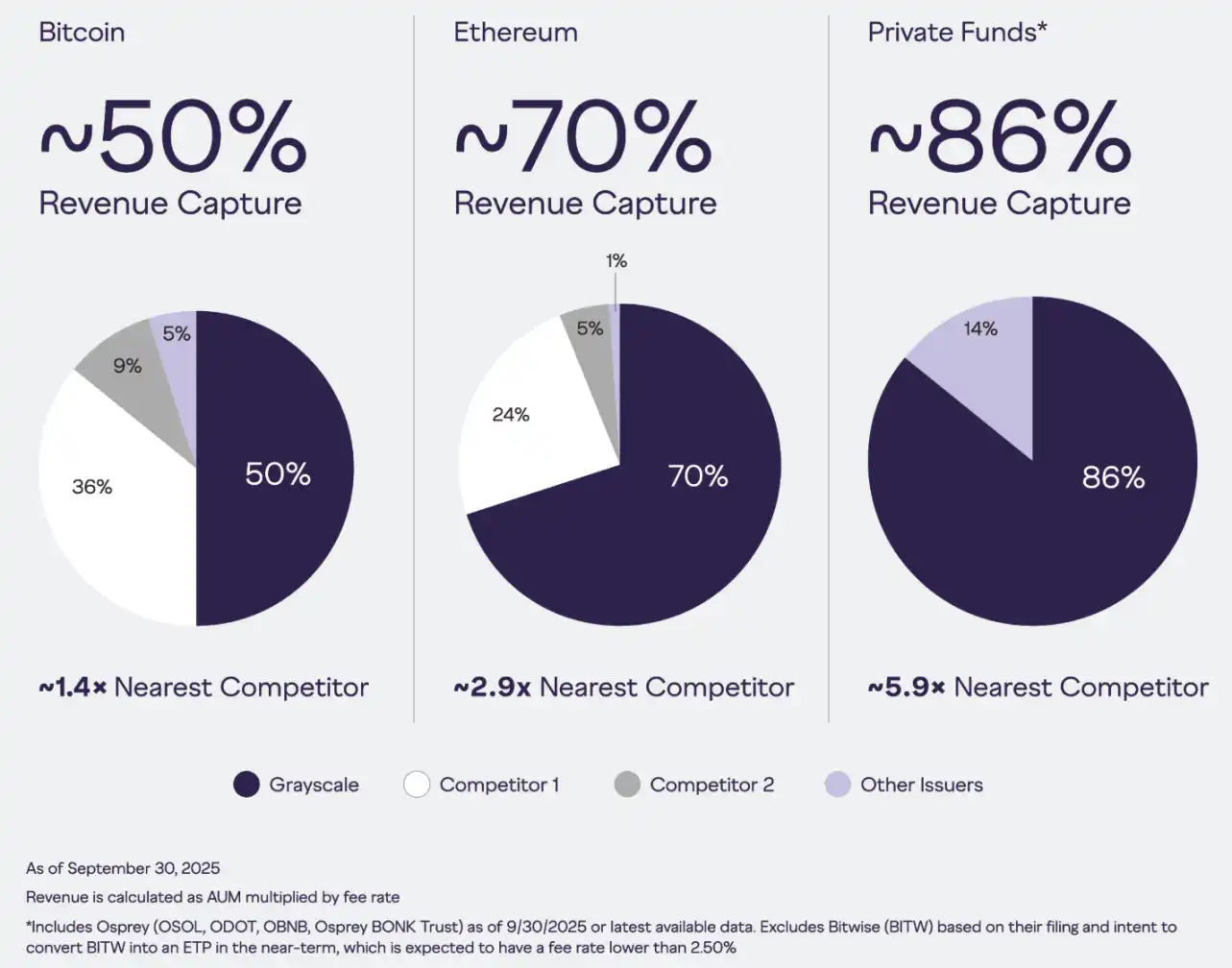

In terms of revenue alone, Grayscale’s main investment products outperform major competitors, but this is mainly due to previously non-redeemable trusts accumulating AUM and management fees above the industry average.

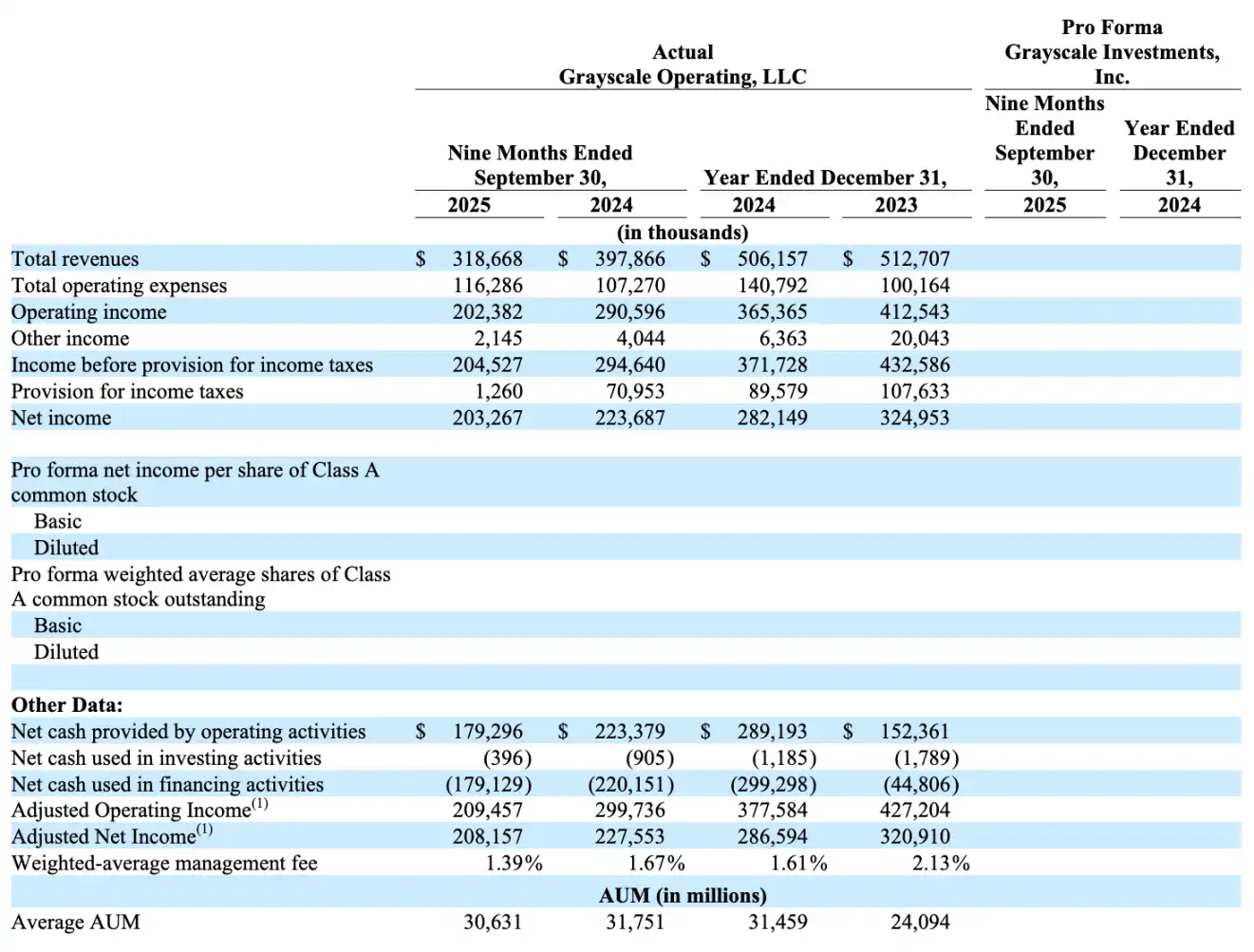

In terms of financial performance, for the nine months ending September 30, 2025, Grayscale’s operating revenue was about $319 million, down 20% year-on-year. Operating expenses were about $116 million, up 8.4% year-on-year. Operating profit was about $202 million, down 30.4% year-on-year. Net profit, after adding other income and deducting income tax reserves, was about $203 million, down 9.1% year-on-year. In addition, average AUM data shows that this year’s AUM may have declined compared to last year.

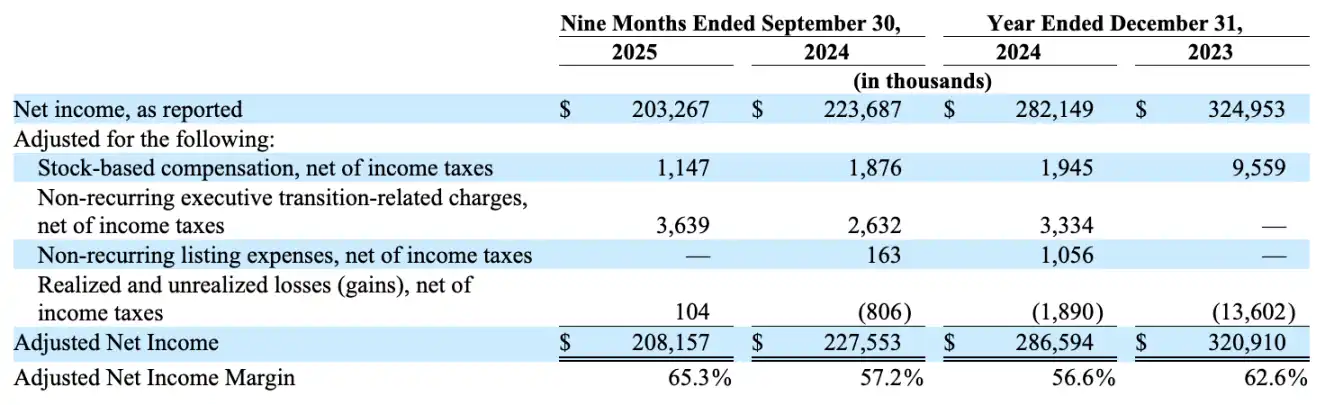

Excluding non-recurring items, adjusted net profit during the reporting period was about $208 million, with a net profit margin of 65.3%. Although the former fell by 8.5% year-on-year, the net profit margin increased from 57.2% in the same period last year.

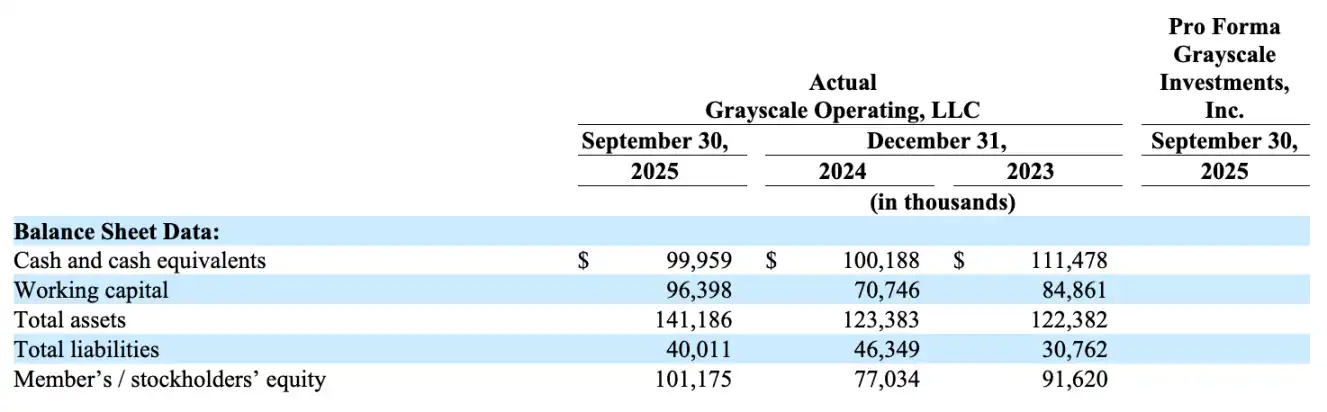

Currently, Grayscale’s debt ratio is quite healthy. Although both revenue and profit have declined, the company’s operating situation is continuously improving, as seen from the increase in asset value, decrease in liabilities, and improvement in profit margin.

The S-1 filing also disclosed Grayscale’s future development plans, including expanding the types of private funds (launching more altcoin private investment products); launching actively managed products to supplement passive investment products (ETF, ETP); and making active investments in its own investment products, cryptocurrencies, or other targets.

In terms of expanding distribution channels, Grayscale disclosed that it has completed due diligence on three brokerages with a combined AUM of $14.2 trillion, and this month launched bitcoin and ethereum mini ETFs on the platform of a large independent broker-dealer with over 17,500 financial advisors and more than $1 trillion in advisory and brokerage assets. In August this year, Grayscale partnered with iCapital Network, which consists of 6,700 advisory firms. According to the agreement, Grayscale will provide digital asset investment channels to companies in the network through its actively managed strategies in the future.

Overall, the information disclosed by Grayscale shows that the company is a relatively stable asset management firm, with its main source of income being management fees from investment products, and not much room for imagination. However, given the precedents of listed traditional asset management companies, there are clear references for estimating Grayscale’s market value and P/E ratio, making it a relatively predictable investment target.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Silent Revolution: The Cryptocurrency Market is Undergoing a "Wealth Redistribution"

Ethereum Crash Revelation: Leverage Liquidations and Volatility Amid Macroeconomic Shadows

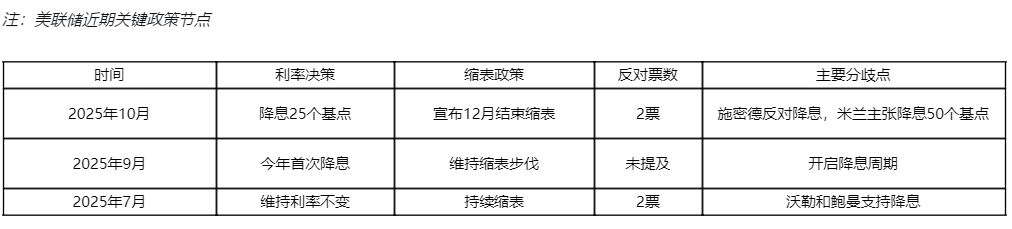

Undercurrents in the Race for Federal Reserve Chair: "Draining Wall Street" Becomes the Core Issue

Trump desires low interest rates, but the Federal Reserve chair candidates he favors advocate for restricting the central bank's primary tool for achieving low rates—quantitative easing.