Placeholder partner: Bull market top signals have appeared, plans to re-enter when BTC falls back to $75,000 or lower

ChainCatcher reported that Chris Burniske, former head of crypto at Ark Invest and now a partner at Placeholder VC, recently stated that although this crypto cycle has been disappointing, core assets such as bitcoin (BTC) and ethereum (ETH) remain in historically high ranges. He cautioned investors to be wary of short-term correction risks while maintaining long-term allocations.

Burniske pointed out that the sharp drop on October 11 has had a lasting impact on the market, making it difficult to quickly establish sustained buying momentum. The monthly charts for BTC and ETH show some cracks, but they are still within the "top range." Meanwhile, the decline in MicroStrategy (MSTR) stock, frequent warning signals from the gold and credit markets, all suggest a broader asset adjustment is imminent. "This bull market is different, and the next bear market will also be different," Burniske wrote. He has adjusted his positions accordingly and plans to re-enter when BTC falls to $75,000 or lower, but emphasized a gradual strategy of "never going all-in or all-out."

In his portfolio disclosure, Burniske revealed that about 39% of his personal holdings are "free cash" (money market funds), and 61% are long-term capital, including non-crypto assets. This reflects his belief in the essence of capitalism: "Capitalism is about growing capital, so always maintaining an allocation is the wisest." He warned that private market valuations are already near the cycle top, and if BTC continues to decline, no crypto asset will be immune.

At the same time, he cited historical lessons, such as gold surging before the crashes in 2000 and 2008, reminding investors to avoid blindly chasing "escape pods" when all assets are overvalued. Looking ahead, Burniske is cautious about the return of liquidity, believing it will arrive late and be less stimulative than in 2021, possibly prompting a shift toward "four-year fundamentalism." He observed that bull market peak characteristics are already present: positive news (such as Robinhood-related developments) no longer triggers rebounds, while bear market bottoms require bad news to lose its effect. He called on investors to be patient and resilient, especially in the AI and crypto sectors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

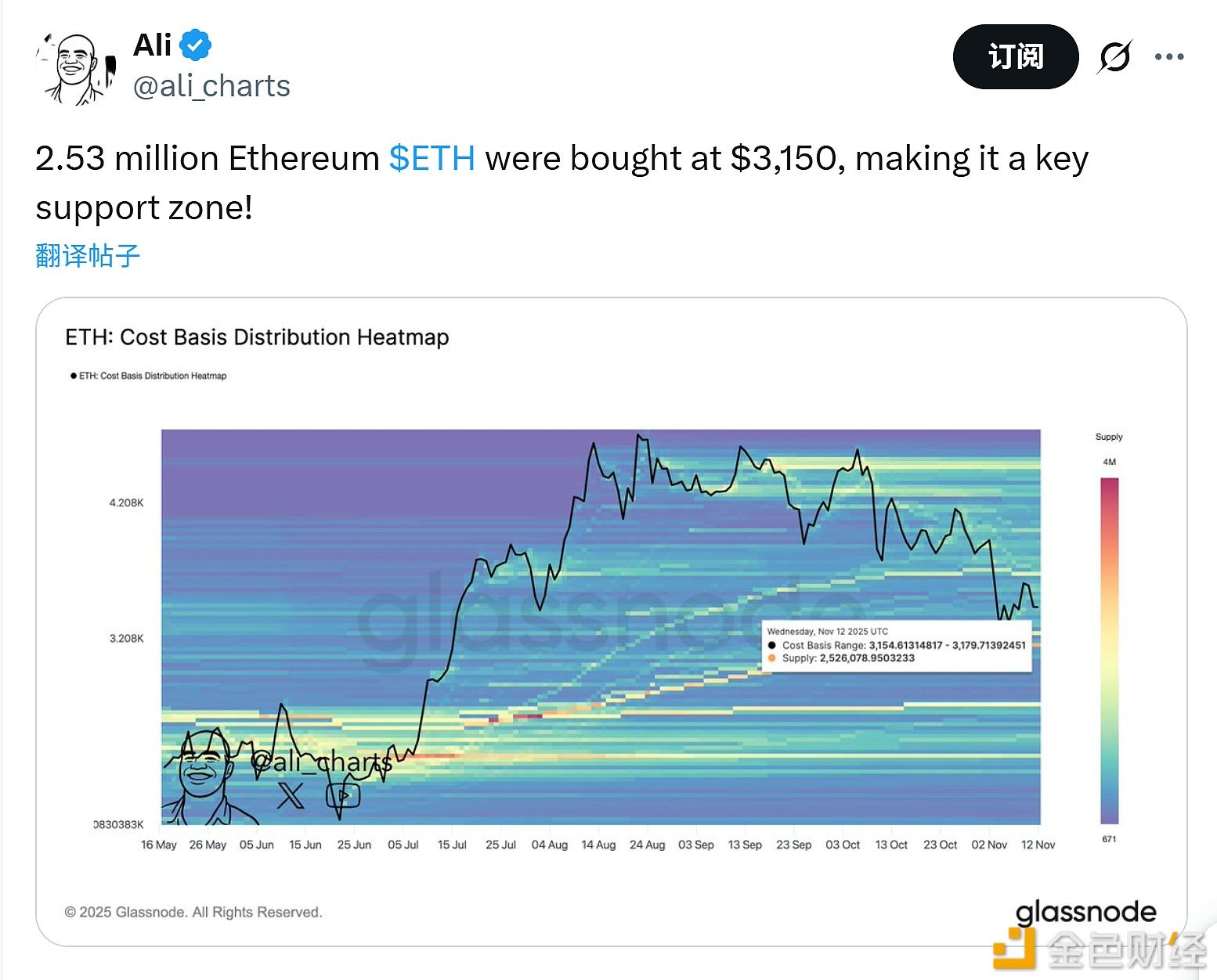

Analysis: $3,150 is an important support level for Ethereum

Summary of the 169th Ethereum Consensus Layer Core Developer Meeting (ACDC)