- Chainlink’s new Rewards Season 1 program has reignited holder engagement and lifted market optimism noticeably.

- Technical signals point to easing bearish pressure as whales accumulate and optimism grows toward a possible breakout near $18.

Chainlink (LINK) traded near $16.19 on Wednesday after holding firm around a lower trendline of the falling wedge pattern the previous week. The recent launch of the Chainlink Rewards Season 1 program on November 11 sparked renewed participation from holders and revived optimism in the market.

The rewards event allows eligible users to earn points from nine build projects, including Dolomite, Space and Time, XSwap , Brickken, Folks Finance, Mind Network, Suku, Truf Network by Truflation , and bitsCrunch.

Participants can distribute non-transferable cubes from November 11 to December 9, while claims will begin on December 16 and will be released over a period of 90 days.

Market analysts describe this program as a key community initiative that boosts on-chain activity and strengthens token engagement. Linking staking rewards to Build projects encourages long-term holding and enhances the utility of the Chainlink token .

On-Chain Metrics Point to Growing LINK Interest

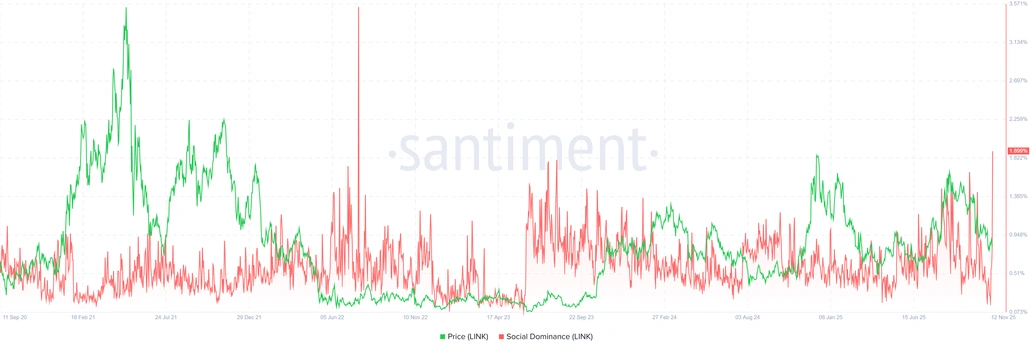

Positive indicators from both social and on-chain data indicate renewed interest. According to Santiment’s Social Dominance Index, Chainlink’s rate rose from 0.15% on Saturday to 1.89% by Wednesday, marking its highest level since July 2022. This sharp rise reflects growing discussion and engagement within the cryptocurrency community.

Source: Santiment

Source: Santiment

CryptoQuant data shows that whale activity in both spot and futures markets has increased, indicating a possible buying trend. This rise suggests that large investors are taking positions ahead of a potential upward move, while buying pressure is outweighing recent profit-taking sales.

The technical chart has improved since the token found strong support at the lower boundary of the falling wedge on November 5. By Monday, LINK had gained around 11%, followed by a drop of more than 6% on Tuesday. If the support holds, the recovery could push LINK toward the 50-day EMA, which is around $18.12.

Analysts Split as LINK Tests Key Levels

Technical indicators suggest that bearish pressure is easing. The Relative Strength Index (RSI) is currently around 40 and is moving toward the neutral level of 50. If this level is crossed, analysts expect continued buying momentum. Meanwhile, since Monday, the MACD has maintained a bullish crossover, reinforcing the potential for further upward movement.

However, opinions about the next possible market trend vary. Analyst Ali Martinez has described the current range, which lies between $13 and $26, as a “no-trade zone,” advising traders to remain patient until a clear breakout occurs. Martinez believes that a move beyond this range will determine the next strong trend phase.

The range between $13 and $26 is a no-trade zone for Chainlink $LINK . The next major move will come once price breaks out of this range. pic.twitter.com/y69Adpc5un

— Ali (@ali_charts) November 12, 2025

Investor Jordan takes a more confident approach, calling Chainlink a “monster in the making” and predicting that LINK will trade above $100 by year-end. This forecast indicates an increase of more than 500% compared to current prices, reflecting his strong belief in the project’s long-term potential.

Recommended for you:

- Chainlink (LINK) Wallet Tutorial

- Check 24-hour LINK Price

- More Chainlink News

- What is Chainlink?