Safety Emergency Grounds Older MD-11 Aircraft Amid Renewed Cost Worries

- FAA's emergency order grounds 50+ MD-11 cargo planes after UPS crash kills 14, citing engine detachment risks. - NTSB reveals cockpit audio showed 37 seconds of pilot struggle before fatal crash during Louisville takeoff. - Boeing backs FAA directive as MD-11s face phaseout due to high maintenance costs and outdated design flaws. - UPS/FedEx report MD-11s handle 13% of combined cargo operations, highlighting aging fleet's critical supply chain role.

The U.S. Federal Aviation Administration (FAA) has issued an emergency suspension of MD-11 flights, causing significant disruption in both the aviation and logistics industries.

The grounding has impacted logistics networks, with UPS noting that MD-11s make up 9% of its fleet, while FedEx reported these aircraft account for 4% of its total planes,

Elsewhere in the financial world, UBS upgraded Linde (LIN) to “Buy” with a $500 price target, citing stronger fundamentals for the industrial gas leader,

In the biotechnology sector, Inflarx shares jumped 24% after Raymond James increased its price target from $2 to $9, following encouraging Phase 2a trial results for its hidradenitis suppurativa therapy,

The FAA’s action on the MD-11 and recent corporate earnings updates illustrate how safety, efficiency, and investor sentiment influence business strategies. As the NTSB continues to probe the cause of the crash, the aviation industry prepares for possible long-term regulatory changes, while investors monitor ratings changes across various sectors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar News Today: Blockchain Opens Up Clean Energy Investment Opportunities While Turbo Taps Into $145B EaaS Sector

- Turbo Energy partners with Stellar and Taurus to tokenize solar energy financing via blockchain, targeting Spain's supermarket sector. - The pilot uses Energy-as-a-Service (EaaS) models with tokenized PPAs, enabling fractional investor ownership and reducing capital barriers. - Blockchain streamlines liquidity and transparency, aligning with a $145B EaaS market growth projection by 2030 driven by sustainable infrastructure demand. - Taurus manages token compliance via its platform, while Stellar's low-co

Ethereum Updates: Major Holders Increase Their Ethereum Stash Fivefold While BTC/ETH ETFs See Outflows—Altcoins Draw in $126 Million

- Bitcoin and Ethereum spot ETFs lost $605M in outflows, contrasting with $126M inflows into Bitwise's Solana ETF (BSOL), highlighting shifting investor priorities toward altcoins. - Ethereum's largest whale quintupled ETH holdings to $138M while closing Bitcoin longs, reinforcing institutional confidence in Ethereum's long-term potential amid stable technical indicators. - Solana's ETF success ($545M total inflows) reflects growing institutional demand for altcoins despite 16% price declines, driven by it

Red Bull Racing’s advantage? An engineer who approaches workflows with the precision of timing laps

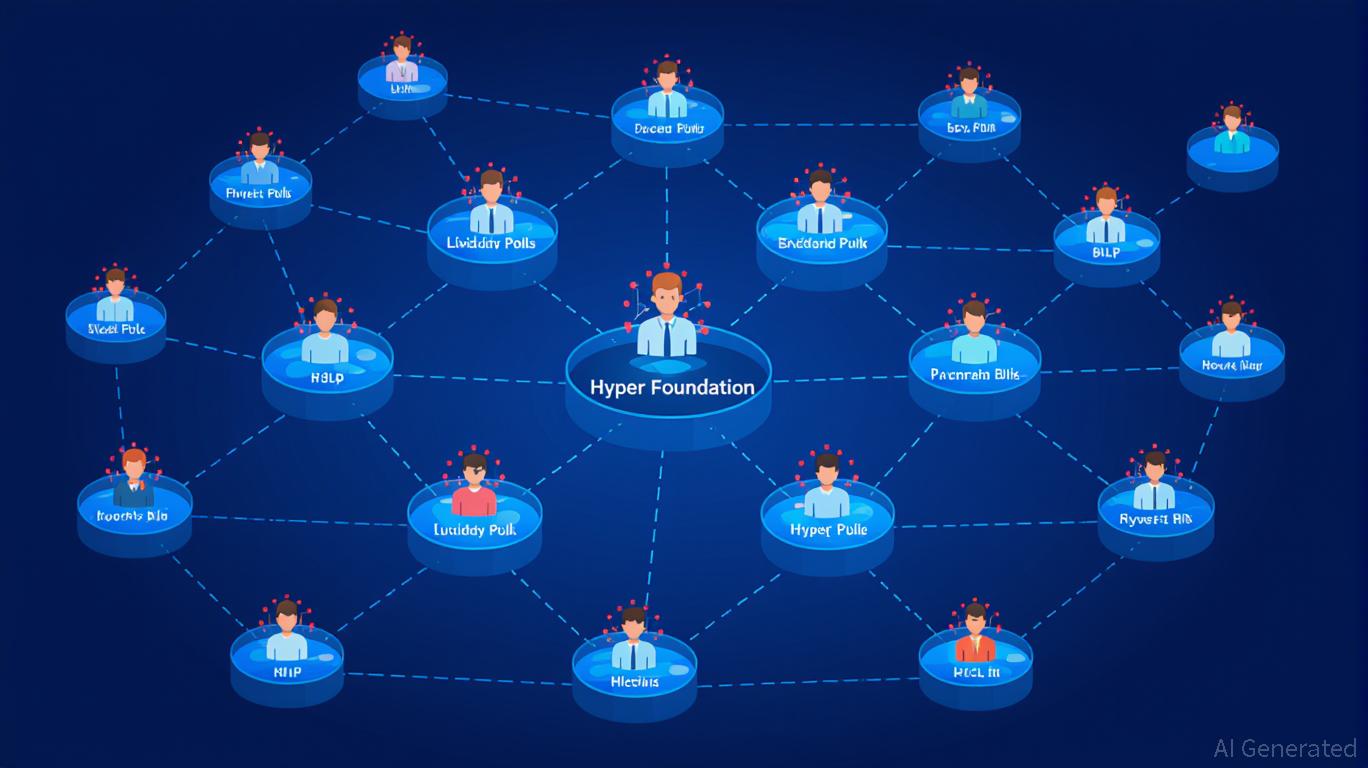

Hyperliquid's Growing Influence in Crypto Trading: Can It Maintain Long-Term Investment Appeal?

- Hyperliquid dominates 80% of 2025 perpetual contract market via on-chain governance and user-driven liquidity innovations. - Centralized governance (HIP-3 protocol, USDH stablecoin launch) balances permissionless market creation with validator dominance risks. - HLP liquidity model generates $40M during crashes but faces regulatory scrutiny and token economics challenges from 2025 HYPE unlock. - TVL growth to $5B and 518K active addresses highlight adoption, yet governance centralization and institutiona