Brazil's Approach to Crypto Regulation: Combating Crime and Enhancing Investor Confidence

- Brazil's Central Bank (BCB) introduced strict crypto regulations requiring VASPs to obtain authorization by Feb 2026, with non-compliant firms facing closure by Nov 2026. - Stablecoin transactions are reclassified as FX operations under new rules, subject to transparency requirements and a $100,000 cap on unapproved cross-border transactions. - The framework mandates robust AML controls, cybersecurity, and compliance frameworks for VASPs, aiming to curb fraud and position Brazil as Latin America's crypto

Brazil Implements Extensive Crypto Regulations to Oversee Digital Asset Industry

The Central Bank of Brazil (BCB) has introduced a far-reaching set of rules designed to place cryptocurrency companies and stablecoin activities under tight regulatory supervision, representing a significant move to bring the country’s digital asset market in line with conventional banking practices. Starting February 2026, all virtual asset service providers (VASPs)—such as exchanges, custodians, and brokers—must obtain approval from the central bank to operate. Firms that fail to comply will be forced to shut down by November 2026,

A key aspect of the legislation is the reclassification of stablecoin transactions as foreign exchange (FX) operations, making them subject to the same transparency and regulatory standards as traditional currency exchanges,

The new framework also sets a $100,000 ceiling on transactions with unregistered parties, including international payments and transfers,

To comply, VASPs must implement strong governance, cybersecurity, and risk management systems similar to those required of traditional banks,

Brazil’s digital asset industry has grown rapidly, with $318.8 billion in transactions recorded between July 2024 and June 2025—accounting for nearly a third of all crypto activity in Latin America,

The BCB’s regulatory strategy follows international trends, as countries like the U.S., EU, Singapore, and UAE also work to integrate stablecoins into their financial systems,

Although these rules may increase compliance costs for smaller operators, regulators are confident that the measures will create a safer and more transparent environment for digital assets,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar News Today: Blockchain Opens Up Clean Energy Investment Opportunities While Turbo Taps Into $145B EaaS Sector

- Turbo Energy partners with Stellar and Taurus to tokenize solar energy financing via blockchain, targeting Spain's supermarket sector. - The pilot uses Energy-as-a-Service (EaaS) models with tokenized PPAs, enabling fractional investor ownership and reducing capital barriers. - Blockchain streamlines liquidity and transparency, aligning with a $145B EaaS market growth projection by 2030 driven by sustainable infrastructure demand. - Taurus manages token compliance via its platform, while Stellar's low-co

Ethereum Updates: Major Holders Increase Their Ethereum Stash Fivefold While BTC/ETH ETFs See Outflows—Altcoins Draw in $126 Million

- Bitcoin and Ethereum spot ETFs lost $605M in outflows, contrasting with $126M inflows into Bitwise's Solana ETF (BSOL), highlighting shifting investor priorities toward altcoins. - Ethereum's largest whale quintupled ETH holdings to $138M while closing Bitcoin longs, reinforcing institutional confidence in Ethereum's long-term potential amid stable technical indicators. - Solana's ETF success ($545M total inflows) reflects growing institutional demand for altcoins despite 16% price declines, driven by it

Red Bull Racing’s advantage? An engineer who approaches workflows with the precision of timing laps

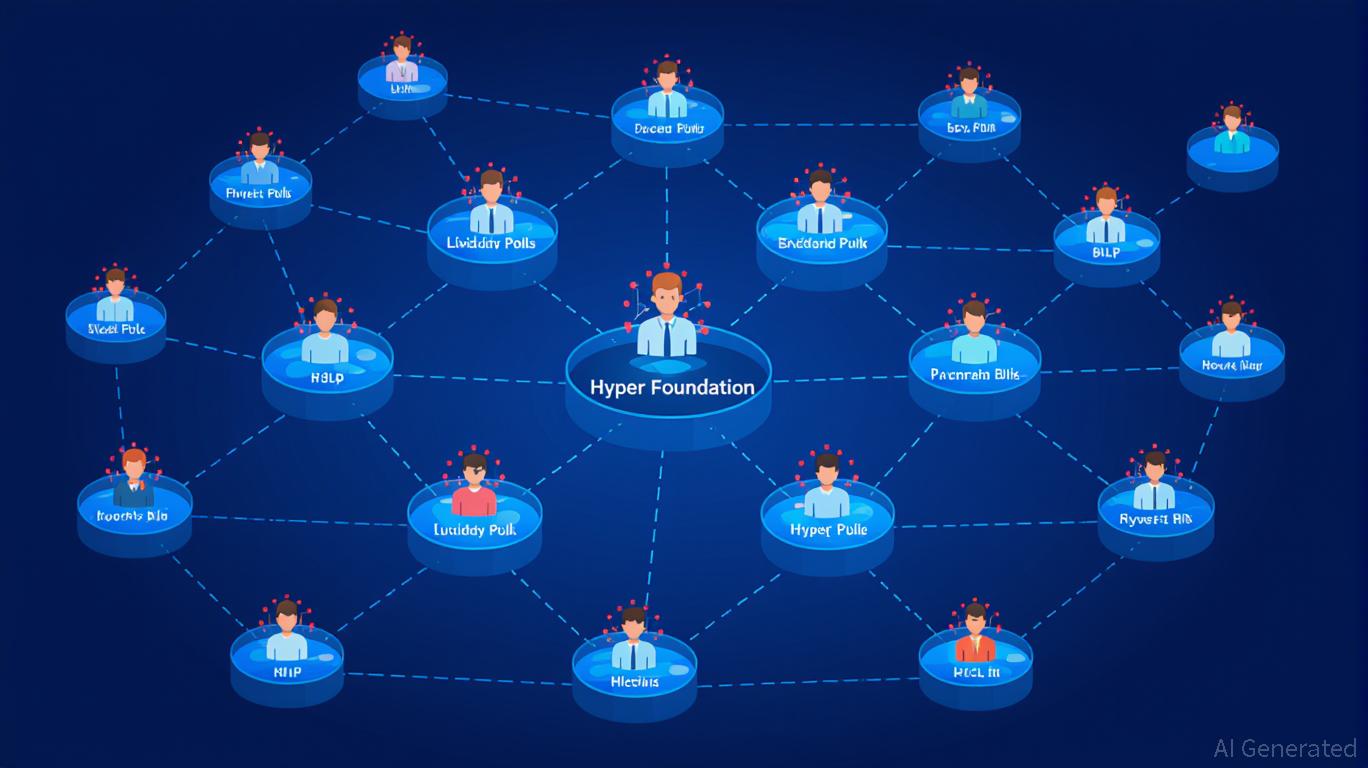

Hyperliquid's Growing Influence in Crypto Trading: Can It Maintain Long-Term Investment Appeal?

- Hyperliquid dominates 80% of 2025 perpetual contract market via on-chain governance and user-driven liquidity innovations. - Centralized governance (HIP-3 protocol, USDH stablecoin launch) balances permissionless market creation with validator dominance risks. - HLP liquidity model generates $40M during crashes but faces regulatory scrutiny and token economics challenges from 2025 HYPE unlock. - TVL growth to $5B and 518K active addresses highlight adoption, yet governance centralization and institutiona