4E: BitMine holds over 3.5 million Ethereum, mining companies show significant performance divergence, and stablecoin M&A activity is heating up

News on November 11, according to 4E observation, the US stock crypto sector experienced significant volatility during Monday's night session. BitMine Immersion Technologies (BMNR) surged 5.7% intraday after the company disclosed its cryptocurrency and cash holdings reached $13.2 billion, including 3.5 million ETH, accounting for 2.9% of the total ETH supply. Following the announcement, investor sentiment improved, with Bitcoin and Ethereum rising by 1.6% and 1% respectively. Meanwhile, mining companies showed divergent performance. Bitdeer (BTDR) saw a 174% increase in Q3 revenue, but suffered a $266 million loss due to convertible bond revaluation, causing its stock price to plummet by 20%; TeraWulf (WULF) reported an 87% year-on-year revenue growth, yet its stock still fell by 1.3%; CleanSpark (CLSK) announced plans to issue $1 billion in convertible bonds for expansion and buybacks, signaling renewed enthusiasm for mining financing. On the institutional front, the proportion of traditional hedge funds holding crypto assets rose to 55%, with Bitcoin and Ethereum remaining the mainstream allocation assets. According to Reuters, "Digital Asset Treasury" (DAT) companies' total crypto asset holdings have risen to $150 billion, with some firms shifting to niche tokens in pursuit of higher yields, indicating a diversification in capital structure. In terms of policy and M&A, the Bank of England proposed that stablecoin issuers could invest 60% of reserves in short-term government bonds; an exchange is reportedly planning to acquire stablecoin infrastructure provider BVNK for about $2 billion, which could become the largest M&A deal in the stablecoin sector's history. 4E Commentary: The balance sheets of crypto companies are rapidly becoming "cryptofied", with the trend of institutional holdings and corporate reserves deepening the integration of crypto assets and traditional finance. However, against the backdrop of intensified regulatory policies and market liquidity differentiation, the focus of capital structure is shifting from "mining expansion" to "asset allocation", accelerating a new round of industry reshuffling.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CryptoQuant: BTC accumulation by "accumulation addresses" reaches an all-time high

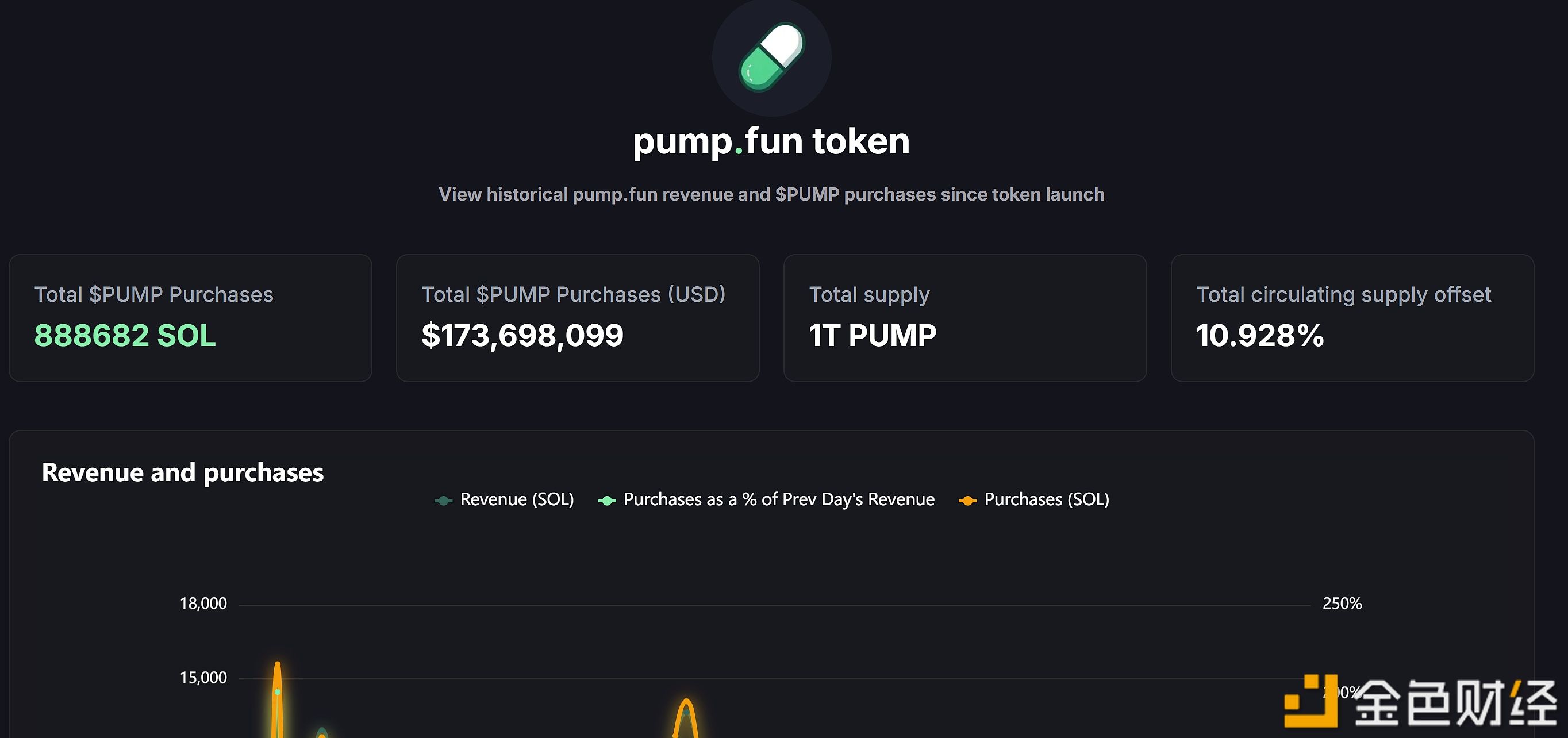

Pump.fun has cumulatively bought back over $170 million worth of PUMP tokens.

DBS collaborates with JPMorgan to develop an interoperable framework for tokenized deposits