Solana extended its recovery on the 29th of December, posting a fourth straight daily gain as the price rebounded from a key support zone.

The asset rose 2.45% during the session, while the broader market tone improved. Several traders on X shared optimistic projections, pointing to further upside.

At press time, Solana traded near $127.5, up 2.45% over 24 hours. Trading activity expanded sharply during the move.

CoinMarketCap data showed Solana’s [SOL] 24-hour trading volume jumped 161% to $4.15 billion, signaling elevated market participation.

That volume expansion suggested growing interest in SOL’s near-term direction, even as traders weighed conflicting signals.

Support retest steadies SOL price

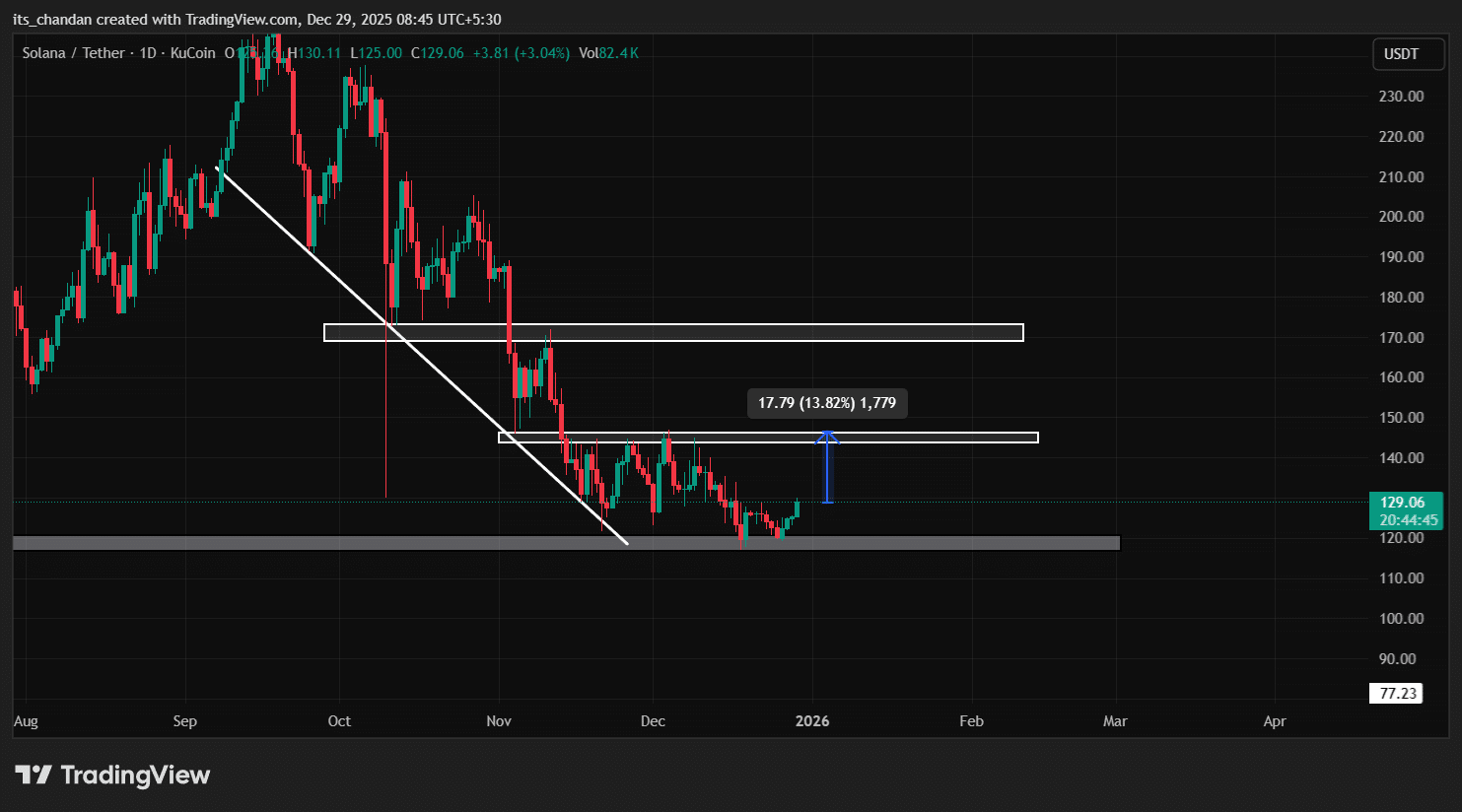

Solana’s daily chart showed price rebounding after a successful retest of the $119 support zone.

That level had previously acted as a reversal area, with price respecting it across the last four sessions.

Based on the chart’s structure, a sustained hold above $119 could allow a move toward $145, implying roughly 13.8% upside.

In addition to the price action, the Average Directional Index (ADX) value has reached 25.62, right at the key threshold of 25, indicating that the ongoing trend is gaining strength and a sustained directional move could be underway.

However, the CMF (Chaikin Money Flow) value remains negative and was at -0.13, indicating that selling pressure dominates the market, signaling weak buying interest at current price levels.

Despite mixed signals from technical indicators, crypto experts on X appear to be making bold predictions.

Some suggest that SOL could soar to $144, while others predict a move to $147. A few also believe that the SOL price has the potential to climb above the $150 level in the coming days.

Traders’ over-leveraged levels

Amid this bullish outlook, intraday traders continue to show a bearish bias.

According to the latest data, $122.2 on the lower side (support) and $130.4 on the upper side (resistance) were the major liquidation levels at press time. At these levels, traders have built $114.12 million worth of long-leveraged positions and $149.74 million worth of short-leveraged positions.

This clearly indicates that intraday traders are tilted toward the bearish side, as they believe SOL’s price is unlikely to cross the $130.4 level anytime soon.

Final Thoughts

- Solana’s rebound reflected improving momentum and renewed participation after defending a key support zone.

- Whether that strength holds may depend on how price behaves near resistance, where leverage remains heavily concentrated.