The tokenized silver market has experienced significant growth, driven by a series of record-breaking price surges of the precious metal over the past month. This trend, progressing in tandem with the activity in futures and exchange-traded funds, has also notably boosted Blockchain-based markets. Over the past 30 days, the demand for tokenized silver products has reached remarkable levels, both in terms of transfer volume and the number of investors. The divergence between the physical market and paper pricing has made the underlying dynamics of this surge more visible.

Tokenized Silver Market Soars with Unprecedented Volume Growth

Explosion in Tokenized Silver Volume

Blockchain data reveals that interest in silver is not confined to traditional markets alone. According to RWA.xyz, the monthly transfer volume of the tokenized iShares Silver Trust (SLV) product has increased by over 1,200% in the past 30 days. During the same period, the number of investors holding the token rose by approximately 300%, and the net asset value grew by nearly 40%. This growth indicates that investors are turning to Blockchain-based tools amid intensified price fluctuations.

For those unfamiliar, tokenization enables commodities and financial assets to be represented digitally on the Blockchain. This structure allows assets to be divided into smaller parts for trading, transferred at any time of the day, and increases liquidity. The tokenized silver product also allows investors outside the United States to access SLV, expanding the global demand base. Continuous minting and burning processes offer a more flexible use area compared to traditional markets.

The increase in Blockchain-based activity highlights that tokenized assets have become a permanent market layer rather than a temporary trend. The rise in silver underscores the role of digital representations in price discovery and investor behavior.

Physical Supply Pressure and Price Divergence

The silver price rally has occurred during a period of tight physical supply. In Asian markets, premiums have exceeded double-digit percentages of the COMEX futures reference prices, showcasing the strength of physical demand. The London futures curve entering backwardation, where spot prices become more expensive than future prices, is considered a significant indicator of short-term supply stress.

Analysts highlight China’s decision to require licenses for refined silver exports from January 1 as a key factor supporting the rise. This regulation has increased uncertainties about global supply accessibility, further lifting prices. Additionally, increased margin requirements for futures and end-of-year position adjustments have made traditional market trading more intricate.

On the demand side, the solar energy sector plays a decisive role. The amount of silver used in photovoltaic production has largely maintained its flexibility, even as prices have tripled compared to 2024 levels. This structure emerges as a fundamental factor supporting interest in silver in both physical and tokenized markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

China Digital Yuan Shifts to Interest-Paying Bank Money

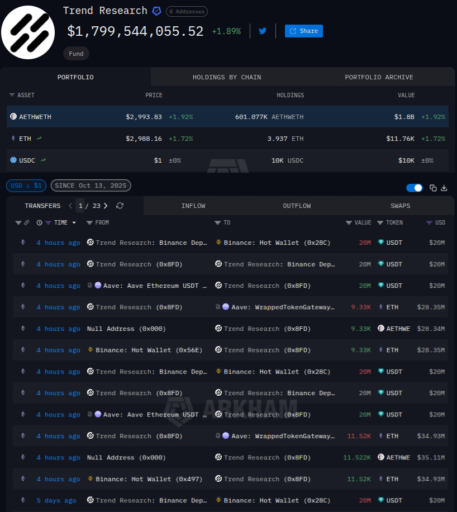

Investment Firm Borrows $1B in Stablecoins on Aave to Buy Ethereum

China Unveils Plan for Banks to Pay Interest Rate on Digital Yuan

Bitcoin Breaks New Price Levels Under Unforeseen Factors