Bitcoin tops $90,000 amid thin liquidity but remains range-bound, analysts say

Bitcoin climbed above $90,000 at one stage late Sunday night ahead of the New Year, though the world's largest cryptocurrency remained range-bound through December.

Bitcoin rose 2.8% in the past 24 hours to $90,200 late Sunday night ET, according to The Block's price page, before paring gains. The crypto was trading at $89,536 as of 2:55 a.m. Monday. Ethereum climbed 2.7% to $3,016.

Analysts said the move appeared driven more by technical factors than fresh catalysts.

"Bitcoin's move back above $90k looks largely driven by technicals rather than any single new catalyst," Rick Maeda, research associate of Presto Research, told The Block. "The $90k level had acted as a clear resistance zone, and once it was reclaimed, it likely triggered short covering and momentum-driven buying."

Vincent Liu, CIO of Kronos Research, echoed that view, saying bitcoin rebounded on technical support following a period of consolidation, "with key levels flipping back to support."

Andri Fauzan Adziima, research lead at Bitrue, said the momentum reflected technical relief from options expiries and and altcoin-led correlation. He added that bitcoin "remained range-bound" in December between roughly $86,500 and $90,000, weighed down by more than $1 billion in ETF outflows tied to tax-loss harvesting and broader de-risking.

Market sentiment has also shown tentative signs of stabilization. The Crypto Feed & Greed index has shifted to "fear" from "extreme fear" recorded in mid-December, signalling stabilizing sentiment and improving confidence that could help build momentum amid thin liquidity conditions, according to Liu.

Still, bitcoin has lagged traditional markets. Bitcoin showed little reaction last week even as U.S. equities rallied, with the S&P 500 climbing to a record high.

New Year momentum?

Holiday trading conditions might have amplified the latest price move. Maeda said thin year-end liquidity — as many market participants wind down for the holidays — has made prices "more sensitive to relatively small flows."

"Looking ahead to the New Year, traders are watching whether BTC can hold above $90k on a daily basis, alongside liquidity conditions which will continue to be thin through early January," said Maeda.

Some market participants see broader relative-value dynamics at play. Jeff Mei, COO of BTSE, said traders are increasingly recognizing that bitcoin and other cryptocurrencies appear undervalued, "especially when compared to U.S. stocks, gold, and silver, all of which are trading around all-time highs."

Further out, attention is turning to potential catalysts in early 2026. "Into 2026, attention focuses on potential January ETF inflow reversals, regulatory advancements (e.g., MiCA implementation), and Federal Reserve policy, potentially ushering in an institutionally driven phase if catalysts emerge," said Adziima of Bitrue.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

China Unveils Plan for Banks to Pay Interest Rate on Digital Yuan

Bitcoin Breaks New Price Levels Under Unforeseen Factors

Ghana Introduces State Regulation of Crypto Market

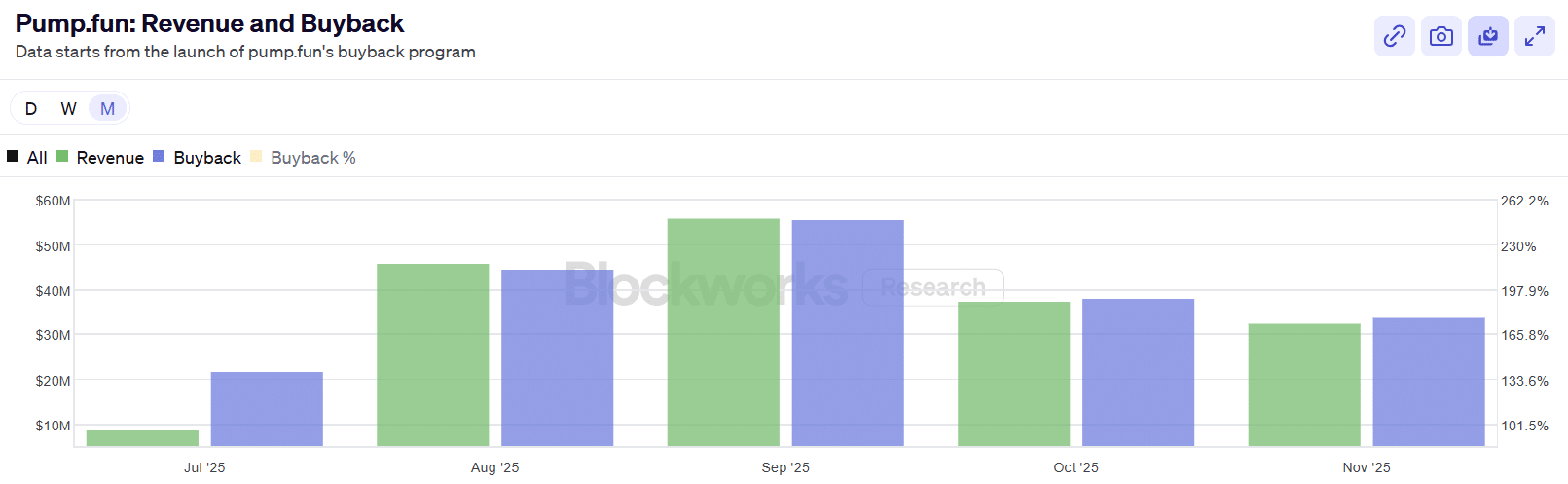

PUMP’s $615 mln cashout and a 60% drop: The story investors can’t ignore