- UK regulators now examine stablecoins as payment tools rather than speculative trading assets.

- UK Finance reports 2025 triggered intense reviews of stablecoin reserves and market abuse rules.

- Global policy momentum adds pressure as markets deal with volatility and low regulatory clarity.

UK regulators are entering 2026 with stablecoins positioned at the center of financial reform, as policy work shifts away from speculation toward payments, reserves, and market structure. Regulatory discussions do not focus only on crypto trading risks. Instead, attention has turned to how digital tokens could operate inside the UK’s monetary and payments framework.

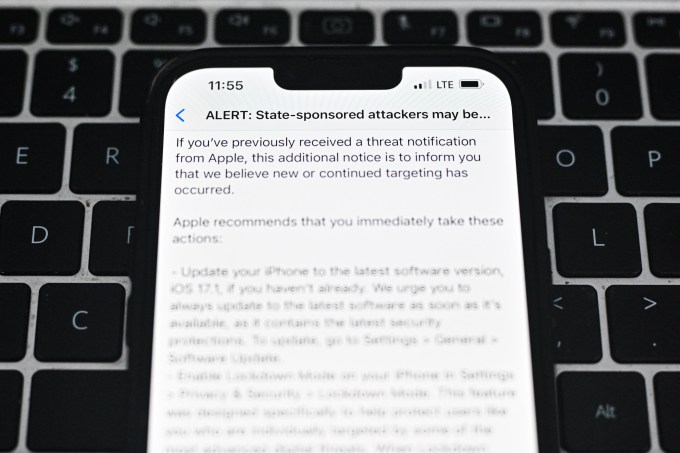

UK Finance said 2025 marked an unusually active year for crypto regulation, driven by sustained engagement between industry participants and supervisory bodies. That activity translated into long technical sessions within UK Finance’s Stablecoins and Cryptoassets Working Group, where draft rules faced close review.

According to UK Finance, discussions covered controls intended to prevent market manipulation, address trading abuse, and define expectations for stablecoin issuers managing backing assets.

Stablecoins Push Beyond Market Infrastructure

UK Finance stated that the majority of cryptoasset-like instruments are still supported by real-world assets, with central bank treasuries and short-term debt securities being the primary ones. Currently, these instruments facilitate the movement of unbacked cryptoassets in and out of the market, but they do not function independently as payment tools.

This restricted role has enabled regulators to implement conventional oversight approaches while stablecoins have remained directly connected to trading activity. These complications arise when stablecoins are used for payments or the storage of value alongside their settlement function.

UK Finance further pointed out that stablecoins are still considered as specified investment-type instruments, just like unbacked cryptoassets. Through this framework, consumers buy stablecoin tokens on cryptoasset trading platforms and are subject to market risks, thus potentially gaining or losing their investments. This classification plays a significant role in the way regulators view consumer risk as the different use cases for stablecoins evolve.

2026 Sets the Regulatory Clock

Regulators have identified 2026 as a critical point for introducing a unified framework covering digital asset risks. The timeline reflects pressure to address volatility, cross-border exposure, and the expanding role of decentralized finance platforms.

Market participants have raised concerns that strict rules could restrict innovation or push firms to relocate outside the UK. Industry feedback has consistently pointed toward the need for safeguards that protect investors without discouraging legitimate activity.

Regulatory agencies have outlined objectives focused on transparency, resilience, and consistent enforcement across markets. These objectives include measures against market manipulation, stronger anti-money laundering controls, and closer alignment with international standards.

Global Context and Market Signals

The UK’s regulatory activities are against a backdrop of rapidly developing global stablecoin policies. According to recent reviews, more than 70 percent of the countries under consideration are moving forward with the development of formal stablecoin frameworks.

This development not only reinforces the position of stablecoins as a major player in the areas of institutional adoption and payment innovation but also the acceptance of their role by the regulators. Hence, the market participants are observing the impact of the UK rule-making process on the liquidity, capital flows, and access to crypto products.

Related: UK Crypto Regulation Set for 2027 Under Full FCA Control

In fact, compliance frameworks of many UK-based financial institutions have already experienced changes to conform to the rising expectations. Technical indicators associated with UK financial instruments are signaling a bearish trend, with the RSI (Relative Strength Index) and moving averages pointing to sell pressure in the market.

Investing.com analysts have characterized the market’s situation as a combination of high volatility and a lack of regulatory clarity. The regulators have also mentioned the issue of regulatory arbitrage as one of the risks, where companies shift their business to regions with less regulatory oversight.

The FCA (Financial Conduct Authority) is having talks with its global counterpart to set a set of common regulatory baselines. As stablecoins are introduced into the payment infrastructure, the UK regulatory framework is becoming a significant part of how the digital currency is assimilated into the traditional finance sector.