ETH Bullish Momentum as He Yi Hua’s Trend Research Increases Ethereum Holdings to Over 590,000 ETH (~$1.78B)

Liquid Capital founder He Yi Hua posted on social media a bullish stance on ETH and a move toward 3,000 since the 10/11 event. He bills himself as the industry’s largest ETH bull and cites BNNR as a fixed-investment method. He favors a long-term thesis, with emphasis on Q1, noting deploying large longs at the trough is difficult and that modest volatility is tolerable for a big position. He argues ETH contract holdings are at fresh highs and a key price driver, with some platforms showing holdings well above spot. He also expects 2026 to be favorable for on-chain finance, stablecoins, and crypto policy, with continued accumulation across ETH, WLFI, and major assets.

Trend Research added 11,520 ETH, about $34.93 million, lifting holdings to over 590,000 ETH (~$1.78 billion). The move signals continued institutional demand for ETH and on-chain metrics, with ongoing allocation to WLFI and key assets into 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Macro Analyst Who Announced Selling All His Bitcoin by the End of 2025 Explains Why – “I’m Not Rejecting BTC, But…”

Bitcoin Reclaims $90,000 on Technical Momentum Amid ETF Outflows, Options Expirations Boost Rally

Lido Development Skyrockets 690%, Paving Way for LDO Price Upside

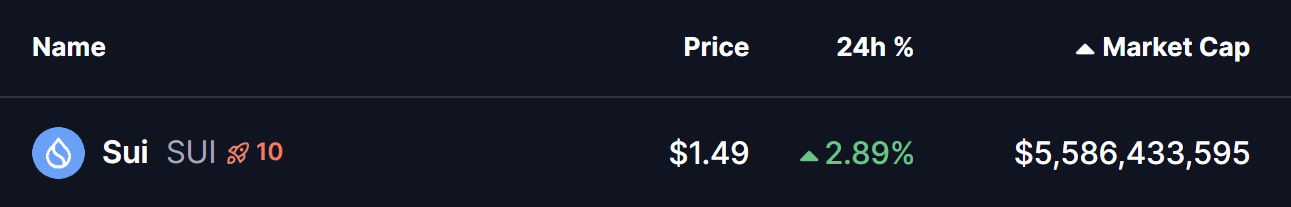

Sui (SUI) To Rise Higher? Key Harmonic Pattern Signals Potential Upside Move