Bitget US Stock Daily Report | Spot Silver Continues to Surge, Refreshing 83 USD High; CME Raises Metal Performance Margins; US Stocks Focus on Fed Policy at Year-End (December 29, 2025)

I. Hot News

Fed Developments

US Stocks Approach Historic Peaks, Year-End Focus Shifts to Fed Meeting Minutes and Chair Nomination

- The S&P 500 is just a step away from 7000 points, potentially marking the longest monthly winning streak in eight years.

- Markets are closely monitoring the Fed's minutes this week for clues on further rate cut timing.

- Trump's new Fed chair selection could become a key variable, influencing monetary policy expectations. Market Impact: These factors may solidify rate cut consensus, sustaining upward momentum in stocks while highlighting rotation from tech to undervalued sectors.

International Commodities

Spot Silver Maintains Strong Rally, CME Comprehensively Increases Margin Requirements for Metal Futures

- Silver prices break through the 83 USD/ounce mark, with year-to-date gains exceeding 185%, the best annual performance in nearly 45 years.

- CME raises performance margins for gold, silver, lithium, and other varieties, effective after December 29 close.

- Speculative inflows combined with supply chain disruptions drive silver's six-session streak, with a 10% single-day surge last Friday. Market Impact: Margin adjustments aim to mitigate extreme volatility, but ongoing supply shortages may continue supporting precious metal prices, benefiting related mining companies.

Macroeconomic Policies

Trump Administration Expected to Ease Trade Tariffs, China Emphasizes Consumption Stimulus in Fiscal Plans

- Bank of America CEO predicts average tariffs of 15% for most countries, higher for non-cooperative ones, with exemptions for North American partners.

- Trump highlights prices and economic success as core issues for 2026 midterms, urging abolition of Senate filibuster rules to prevent government shutdowns.

- China's fiscal conference outlines proactive policies for 2026, intensifying support for consumer goods trade-in programs. Market Impact: Eased tariff expectations could alleviate global trade tensions, combined with fiscal stimulus, boosting multinational corporate confidence and consumer demand.

II. US Stock Market Recap

Index Performance

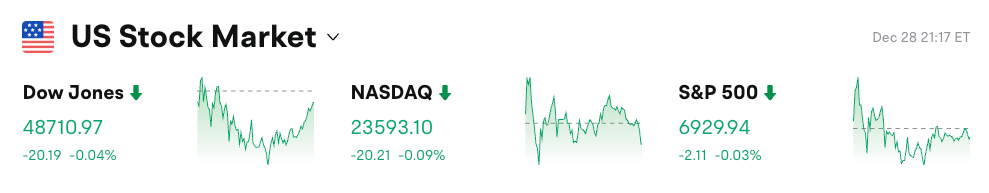

- Dow Jones: Down 0.04% to 48,710.97 points, ending a five-day winning streak.

- S&P 500: Down 0.03% to 6,929.94 points, still near record highs, with year-to-date gains nearing 18%.

- Nasdaq: Down 0.09% to 23,593.10 points, dragged mainly by tech weakness, with year-to-date rises at 22%.

Tech Giants Dynamics

- NVIDIA: Up 1.02%, hitting peak since November 13, driven by AI infrastructure demand.

- Apple: Down 0.15%, facing ongoing valuation pressures.

- Google: Down 0.22%, amid intensifying search business competition.

- Microsoft: Down 0.06%, with cloud service growth slowing.

- Amazon: Up 0.06%, supported by e-commerce peak season effects.

- Meta: Down 0.64%, due to increased uncertainty in ad revenues.

- Tesla: Down 2.1%, impacted by EV market saturation and competitive sales outlook. Summary: The Magnificent Seven showed mixed performance, with NVIDIA leading on AI hype, while Tesla's decline reflects cyclical challenges in autos, signaling fund outflows from tech.

Sector Movements Observation

Metals Sector Leads Gains

- Representative Stocks: Silvercorp Metals up 3.61%, Endeavour Silver up 2.96%.

- Driving Factors: Historic silver price surge sparks buying in mining stocks, amplified by supply disruptions and speculation.

Semiconductor Sector Up 0.05%

- Representative Stocks: TSMC up 1.35%, Intel up 1.02%.

- Driving Factors: Steady chip demand recovery, supported by supply chain optimizations and expanding AI applications.

III. In-Depth Stock Analysis

1.NVIDIA - Driving Data Center Power Architecture Upgrades

Event Overview: NVIDIA is leading a global shift in data centers from traditional AC to 800V DC standards to align with next-gen Vera Rubin architecture and 2027 Kyber systems. Cabinet power density will reach 1 MW, with partnerships involving over a dozen entities like CoreWeave and Oracle, addressing power and cooling challenges from explosive AI computing growth—this marks the largest infrastructure overhaul in history. Market Interpretation: Institutions view this as reinforcing NVIDIA's AI ecosystem dominance, though it requires massive investments to revamp facilities, potentially straining supply chains. Investment Insights: Long-term positive for NVIDIA and partners; monitor opportunities in transformation-related infrastructure.

2.NVIDIA - Signs $20 Billion Licensing Deal with Groq

Event Overview: NVIDIA and Groq have entered a non-exclusive licensing agreement focused on expanding AI inference chip tech. The deal aims to solidify NVIDIA's full system stack amid rapid inference market growth, valued at $20 billion, structured to navigate antitrust scrutiny. Market Interpretation: Bernstein analysts stress it preserves competitive appearances; BofA sees it as a strategically costly investment; Cantor notes it balances offense and defense, underscoring AI future emphasis. Investment Insights: Strengthens NVIDIA's market moat; investors may target AI inference subsectors.

3.Nike - Positive Signals Emerge in Bear Market

Event Overview: Nike's stock is in its longest bear cycle in 40 years, but Apple CEO Cook bought $2.9 million worth, doubling holdings. UBS surveys show Nike leading global net promoter scores, with rebounding consumer intent; new CEO's "return to wholesale" and "focus on sports" strategies show early success, though transformation remains lengthy. Market Interpretation: UBS maintains neutral rating, noting data improvements but extended timelines; institutions optimistic on brand loyalty-driven recovery. Investment Insights: Consumption warmup may support stock rebound; watch for sportswear sector cycle turns.

4.Novo Nordisk - Long-Acting Growth Hormone Approved in China

Event Overview: Novo Nordisk's long-acting growth hormone injection, Norditropin, gains approval from China's NMPA for treating growth delays in children over 2.5 years, becoming the first international original product in the market, expanding the company's biopharma footprint in emerging regions. Market Interpretation: Analysts see approval accelerating China revenue growth, strengthening Novo Nordisk's global hormone therapy leadership. Investment Insights: Positive for pharma diversification; track Asia market penetration rises.

5.JPMorgan - Freezes Stablecoin Firm Accounts

Event Overview: JPMorgan has frozen at least two stablecoin startup accounts in recent months, involving high-risk regions like Venezuela, but the bank denies direct ties to stablecoin nature, maintaining support for crypto ecosystems, including aiding issuer listings. Market Interpretation: Institutions view this as routine risk management, not targeted strikes, emphasizing banks' collaborative intent in crypto. Investment Insights: Crypto firms need stronger compliance; cautious banking services may affect short-term liquidity.

IV. Today's Market Calendar

Key Events Preview

- Fed Meeting Minutes: This week - Focus on rate paths and economic outlooks.

- Corporate Earnings Season Tail: Multiple tech and consumer firms reporting - Monitor profit guidance and market reactions.

Bitget Research Institute Views:

As of December 28, 2025, US stocks closed at high levels, with the S&P 500 index around 6,930 points and a full-year gain of 17-18%, benefiting from advancements in artificial intelligence and Federal Reserve rate cuts amid the ongoing bull market. Major indices such as the Dow Jones and Nasdaq also reached weekly highs in thin holiday trading volumes, reflecting cautious optimism despite low turnover. We maintain an optimistic outlook for the US stock market's performance in 2026, driven by factors including technology, AI, the financial sector, tax cuts, deregulation, and the influence of potential catalytic events like large IPOs such as SpaceX, while continuing to monitor corporate earnings exceeding expectations and inflation data trends.

Disclaimer: The above content is compiled by AI search and manually verified for release only, not constituting any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Insights: Novogratz Discusses the Future of Altcoins

Ethereum vs Solana Shows Crypto’s Multi-Chain Reality

China’s Digital RMB Remains Non-Interest-Bearing

Michael Burry’s AI Bubble Bet: $1 Billion Short