Layer-1 blockchain Sui has remained on the bearish side of the market, with the asset down 63.9% during this phase.

Sentiment could deteriorate further as the year draws to a close. Bears continue to gain dominance, while supply is expected to rise sharply due to additional capital inflows.

Token unlock to weigh on SUI

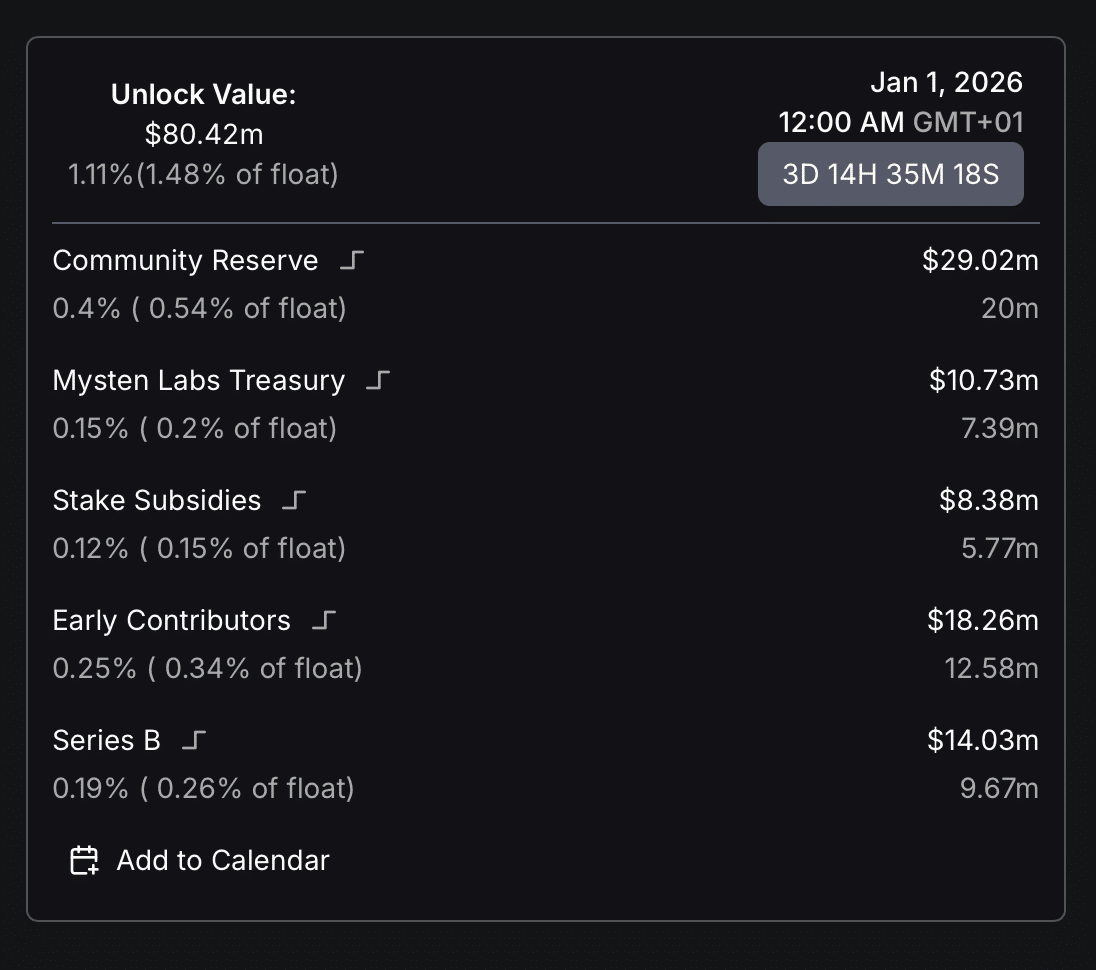

More Sui [SUI] tokens are set to enter circulation, according to recent unlock data.

DeFiLlama shows that the total unlock amounts to $80.41 million, representing 1.11% of SUI’s total supply and 1.48% of its circulating float.

An inflow of this magnitude is likely to pressure the asset, potentially pushing prices lower from its $1.41 level at press time.

The impact could be amplified as early contributors are scheduled to receive 0.25% of this supply, valued at roughly $12.58 million.

Early contributors are typically sellers and may view the unlock as an opportunity to exit, especially amid the prevailing bearish market sentiment.

If other sellers coordinate their exits, the downside move could extend further.

For now, SUI’s price action has yet to fully reflect this bearish pressure. The asset gained 3.45% over the past day. However, trading volume declined to $291.41 million, down 8.99%.

A falling volume alongside rising prices often indicates weak underlying momentum, suggesting the current upswing lacks strong conviction.

Sellers exit the market

Spot investors are already exiting positions. CoinGlass data shows a largely net outflow over the past 48 hours.

Total net outflows during this period reached $5 million, with selling activity peaking on the 27th of December.

This marks the first major outflow in over a week. The sudden shift in flows suggests investors are becoming more cautious about SUI’s long-term outlook.

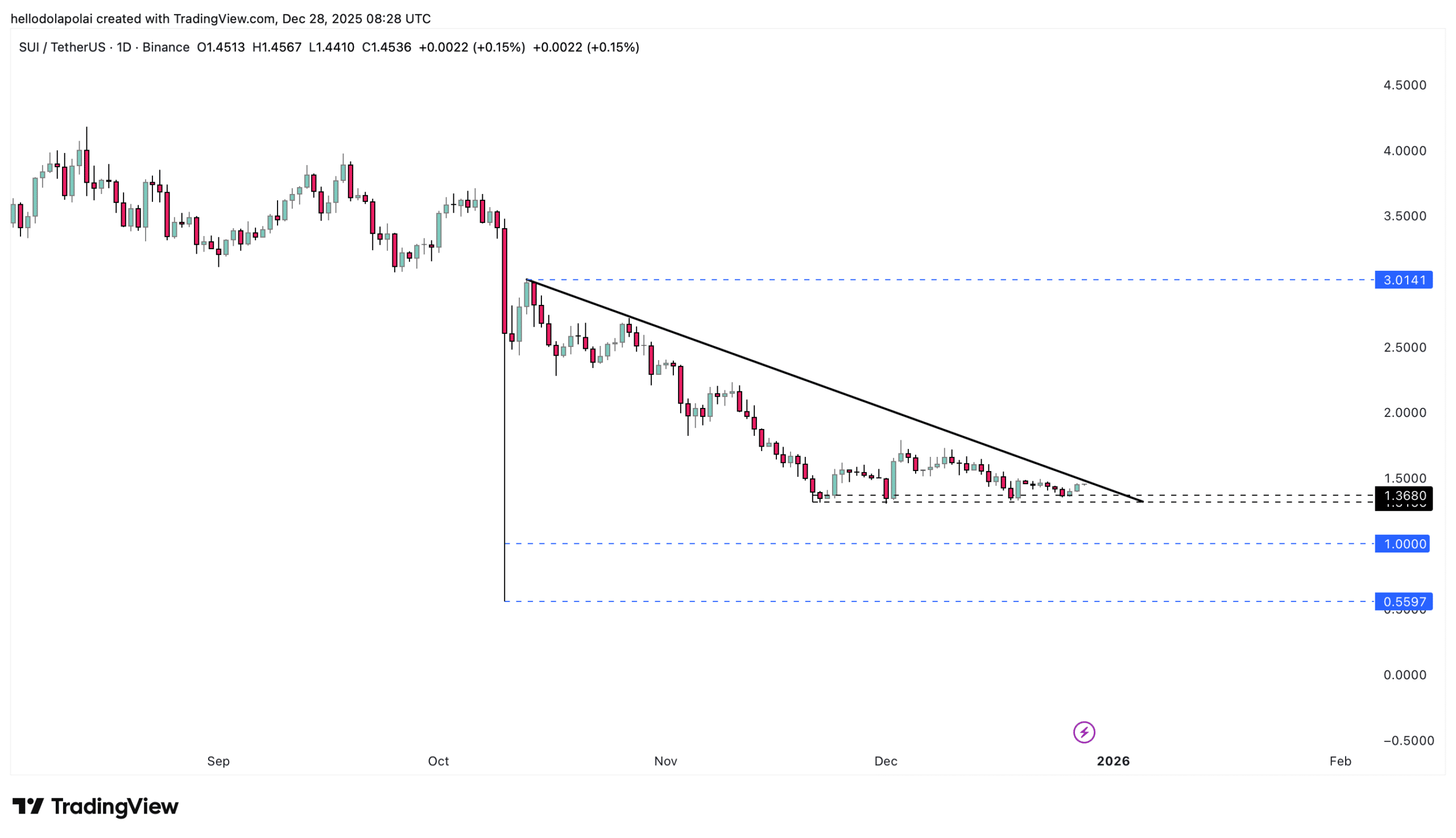

From a technical perspective, SUI faces mounting pressure as it trades into a key resistance zone on the chart.

This level remains critical. A failure to break above resistance would likely send the asset back to lower price levels, further weighing on its outlook.

On the upside, a successful breakout would increase the chances of SUI reclaiming the $3.1 level, last seen on October 6 before the major liquidation cascade.

Conversely, a downside sweep remains possible, with price potentially extending toward the $1 region. This places SUI in a mid-range setup, where the next move depends on which side gains control.

Building bullish pressure

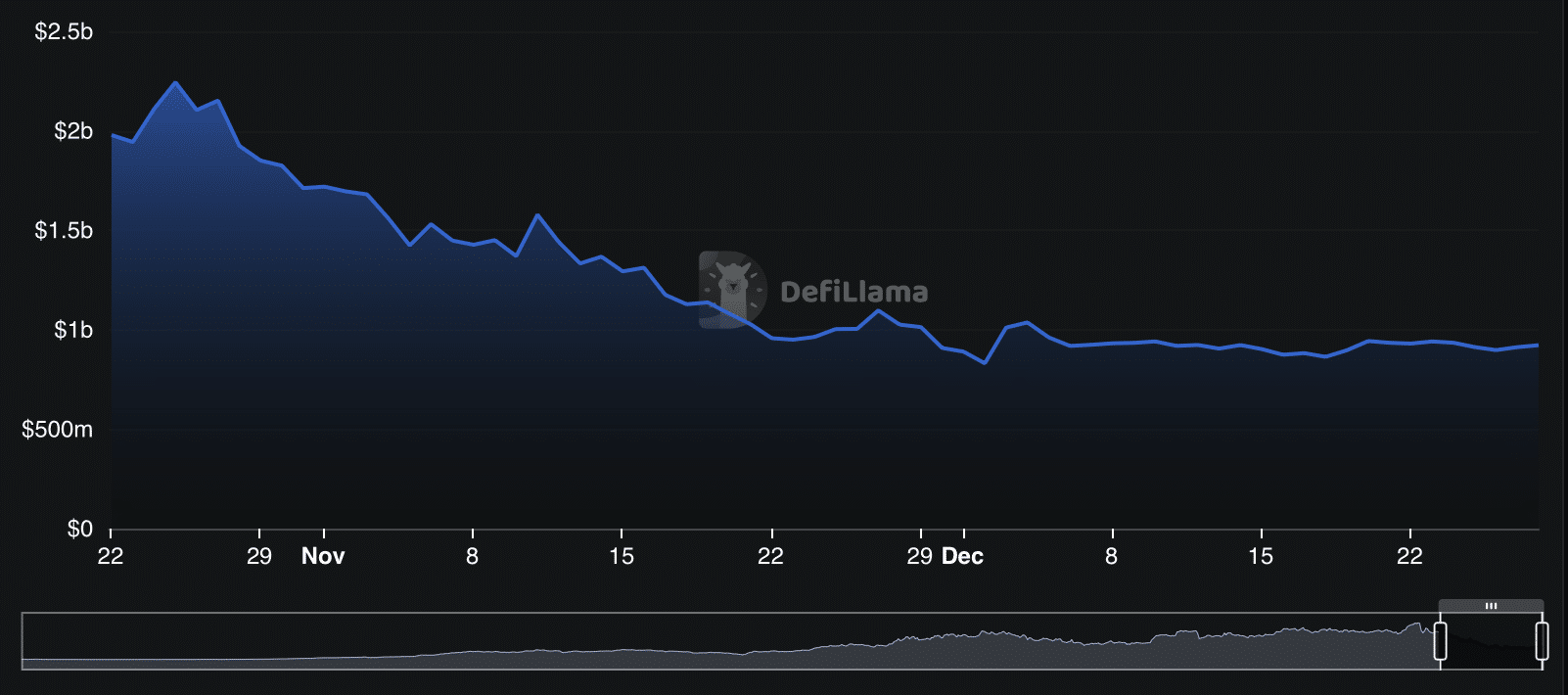

Despite the broader bearish sentiment, some indicators suggest pockets of bullish interest remain.

On-chain data shows a notable rise in total value locked (TVL), which climbed to $922.25 million over the past day.

Total inflows during this period reached $24.8 million, signaling renewed confidence among certain participants in the asset’s near-term performance.

Off-chain traders are also expressing bullish bias through SUI/USDT perpetual contracts.

CoinGlass reports a simultaneous increase in long-position volumes alongside a rising positive funding rate, indicating that long traders are increasingly dominating open positions.

SUI’s near-term outlook will largely depend on the market’s directional bias in the hours leading up to the token unlock.

Final Thoughts

- A massive token unlock is expected to weigh on SUI as the asset trades near a key resistance level.

- Spot investors have begun selling their holdings, with $5 million already exiting the market.