Top 5 Cryptos Gaining Momentum Ahead of New Year

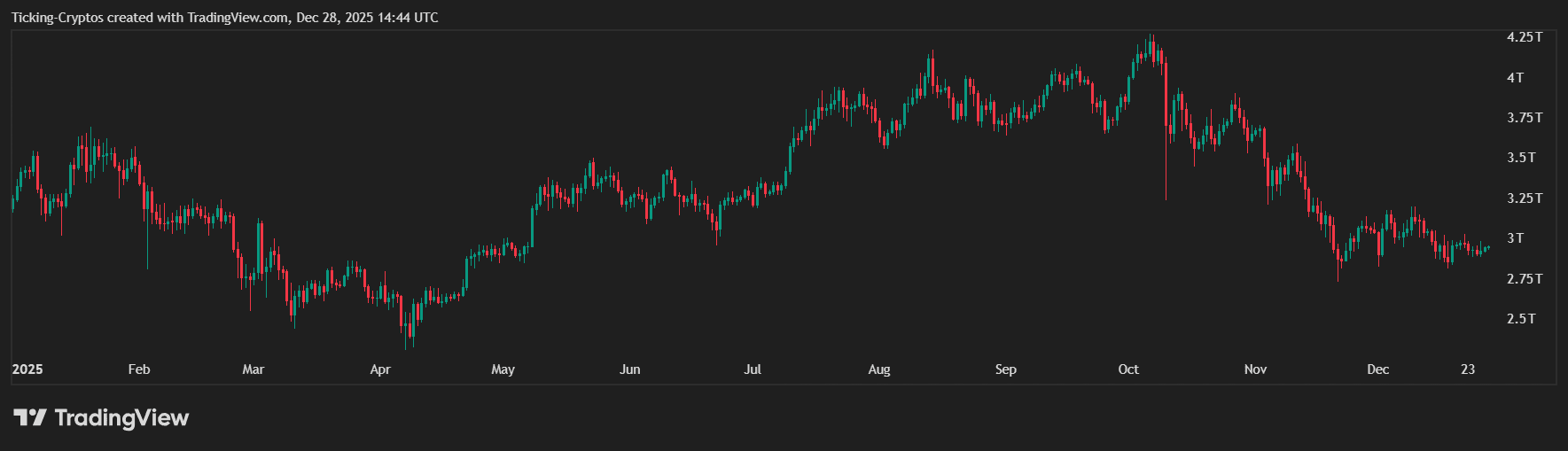

Market Overview: Selective Strength Before Year-End

As the broader crypto market remains cautious heading into New Year, selective buying is starting to show up in specific altcoins. While Bitcoin is trading sideways and liquidity remains thin due to holidays, some projects are attracting attention thanks to rotation, narratives, and relative strength.

The top-performing cryptos show green weekly and daily performance across several mid and large-cap coins, suggesting that capital is flowing into names perceived as undervalued or strategically positioned for 2026.

Rather than a broad rally, this looks like early positioning.

Top 5 Cryptos Before New Year

#5 Dash (DASH)

$Dash is seeing renewed interest after a strong weekly move. As one of the older payment-focused cryptocurrencies, DASH often benefits from defensive rotations when traders look for established projects during uncertain market phases.

DASH/USD 1W - TradingView

#4 Polkadot (DOT)

$Polkadot continues to show steady performance, supported by its long-term interoperability narrative. DOT’s recent strength reflects renewed confidence in Layer-1 ecosystems as infrastructure plays regain relevance.

DOT/USD 1W - TradingView

#3 Story (IP)

$Story (IP) stands out as a smaller-cap mover with solid short-term momentum. Tokens in this category often attract speculative flows near year-end as traders look for higher beta opportunities.

IP/USD 1W - TradinView

#2 Filecoin (FIL)

$Filecoin is benefiting from its position in decentralized storage and Web3 infrastructure. Increased volume and consistent gains suggest accumulation rather than short-lived hype, especially as AI and data narratives stay in focus.

FIL/USD 1W - TradingVIew

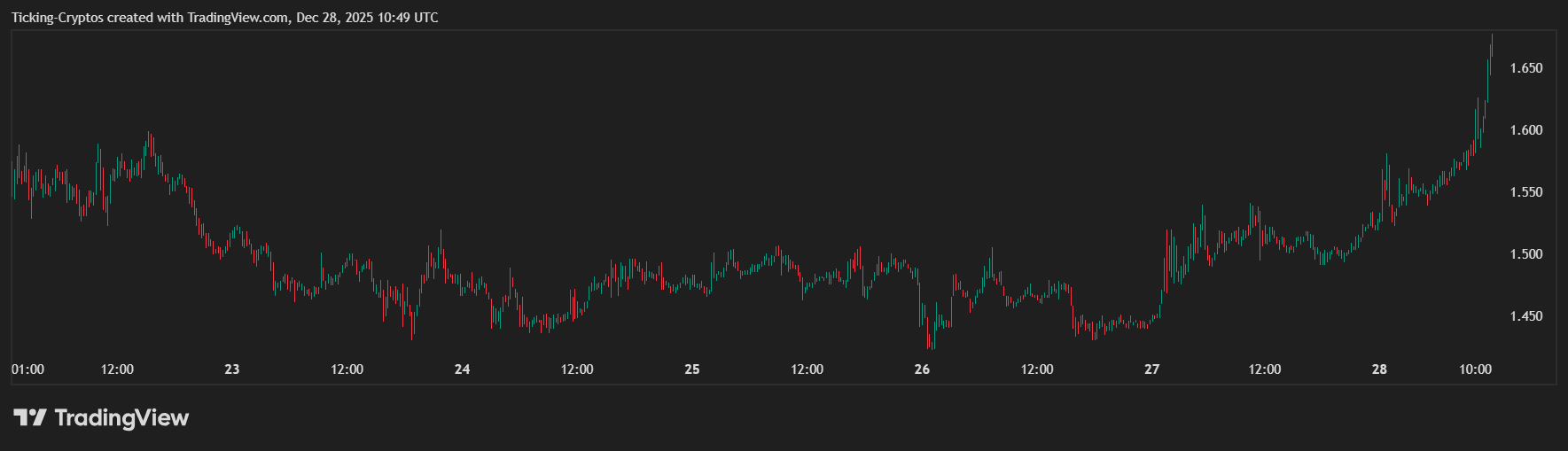

#1 Canton (CC) — The Standout Performer

$Canton (CC) leads the list with the strongest overall performance.

Canton is designed as an institution-focused blockchain, targeting regulated financial use cases rather than retail speculation. Its recent price surge appears driven by:

- Growing interest in real-world asset tokenization

- Institutional blockchain adoption narratives

- Rising visibility compared to traditional DeFi-focused chains

Unlike many short-term pumps, CC’s move aligns with a broader institutional infrastructure theme, which is gaining traction going into 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Prepares For A Rally Nobody’s Rooting For—Analyst

AI Predicting Bitcoin: How Machine Learning Is Redefining Crypto Price Forecasts

Bitcoin Price Volatility Exposes Liquidity Gaps and Growing Market Divergence

Why Crypto Underperformed in 2025, and What It Could Mean for 2026