BitMEX co-founder Arthur Hayes is in the news today after he accelerated accumulation across LDO and PENDLE within a tight window. In fact, he committed roughly $1.03M into LDO and about $973K into PENDLE.

Here, the timing stands out. Especially since both assets seemed to be trading near compressed structures after extended downtrends on the charts.

Rather than spreading capital broadly, Hayes’s focus is on two DeFi primitives tied to staking and yield. Such a concentration matters.

These buys arrived before confirmed trend reversals, not after breakouts. Therefore, the activity could be a sign of positioning ahead of expected movement.

When large capital enters during structural compression, it often alludes to preparation rather than reaction.

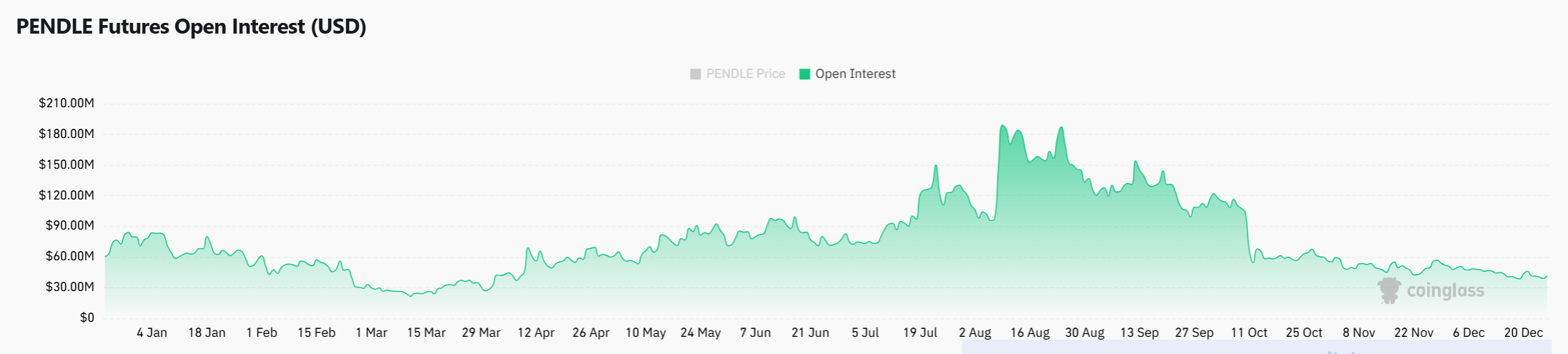

PENDLE derivatives activity starts warming up

PENDLE’s derivatives metrics confirmed growing participation at press time. Trading volume surged by 29% to $78.9M, while Open Interest expanded by 7% to $43.09M. Such a combination usually signals fresh leverage entering the market, not traders closing positions.

The price reacted constructively to the same, pushing higher instead of stalling. Importantly, leverage growth remained controlled, reducing liquidation risks.

Therefore, speculative interest appeared to rebuild gradually rather than aggressively. Such an environment ordinarily favors continuation attempts.

When Open Interest rises alongside the price and volume, markets often transition from compression to expansion.

Hayes’s PENDLE entry seemed to align with this shift, reinforcing the idea of early positioning rather than late momentum chasing.

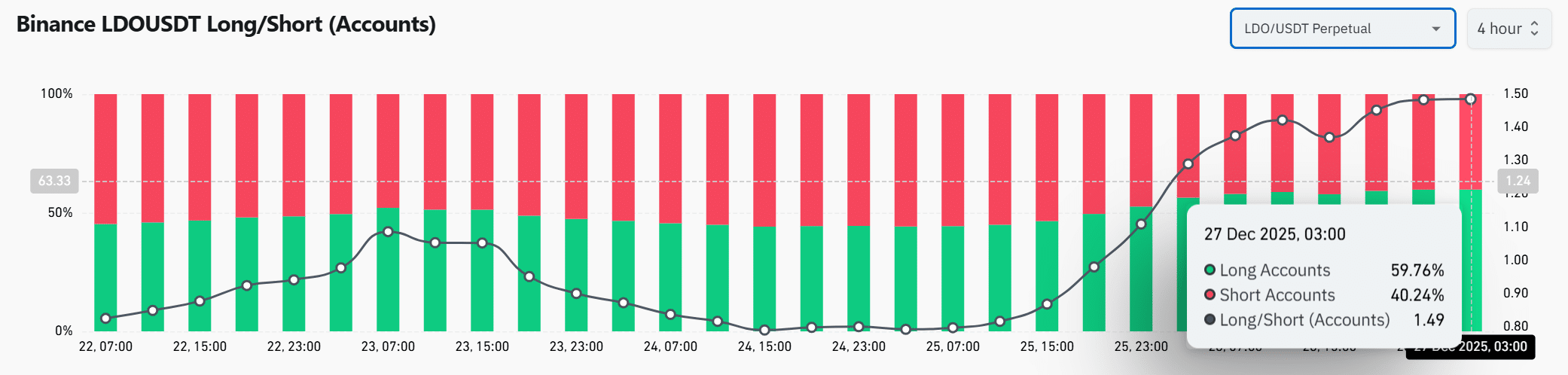

LDO traders lean long, but stay measured

LDO positioning data lent more confirmation. Binance long accounts climbed towards 60%, pushing the long-short ratio close to 1.5.

Bulls now hold a clear edge. And yet, shorts remain active too. Overcrowded longs often precede reversals, but LDO has not reached that stage yet.

The price has also continued to grind higher, rather than spike vertically. Such behavior often reflects controlled optimism.

However, broader market caution still lingers. Therefore, LDO’s long bias could be a sign of early confidence, not exhaustion. When rising long exposure aligns with large spot accumulation, probability favors continuation rather than renewed downside.

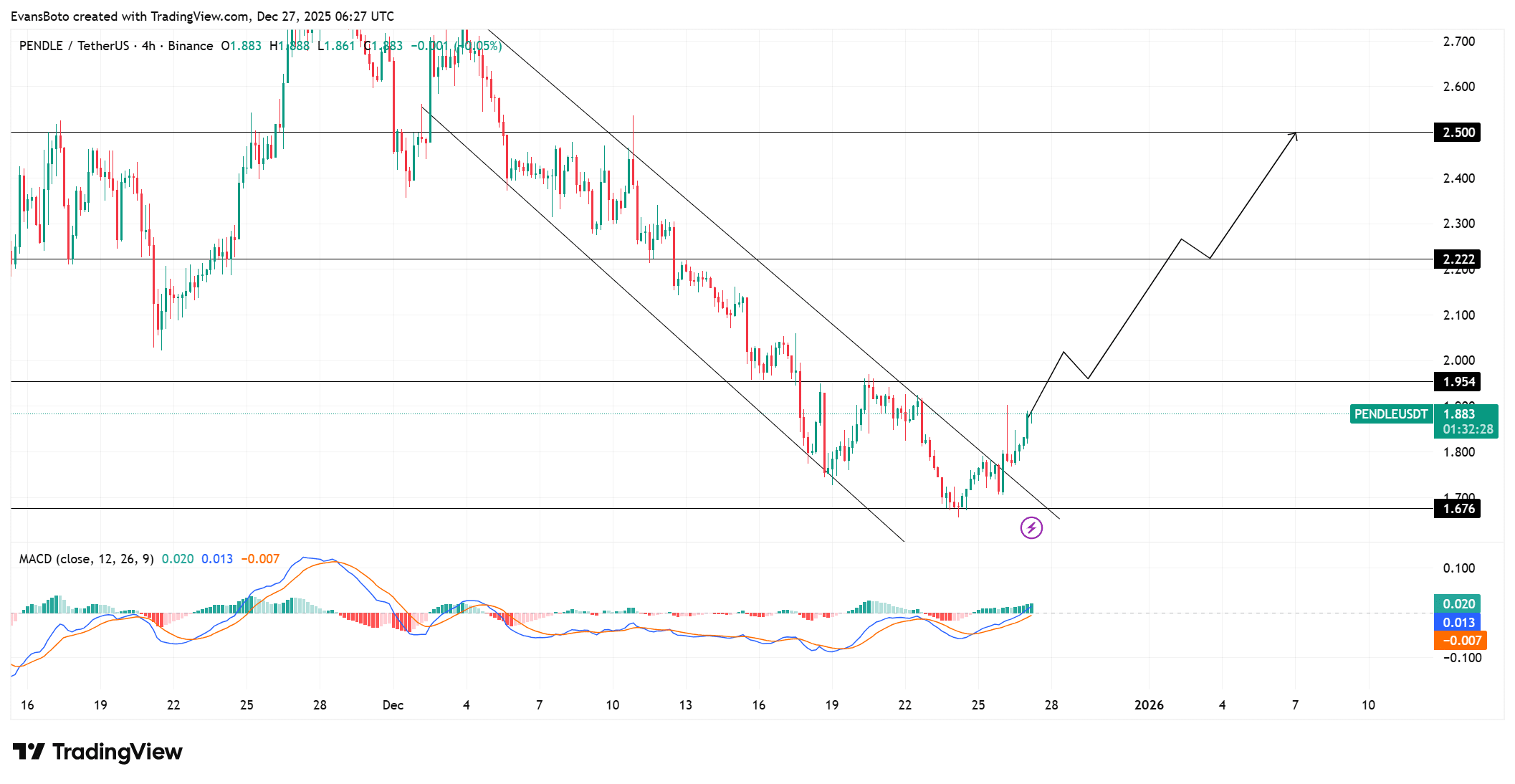

PENDLE structure confirms early reversal attempt

On the price charts, PENDLE broke above its descending channel after defending the $1.67 demand zone – A level that halted downside pressure multiple times.

At press time, it was trading near $1.88, reclaiming the channel midpoint and shifting short-term structure bullish.

This move did not occur in isolation though. Open Interest rose by 5% to $43.09M, while derivatives volume surged by 29% to $78.9M – Confirming active participation during the breakout.

Momentum also seemed to support continuation. The MACD histogram flipped positive, with Signal Lines turning north and indicating a hike in upside momentum.

Holding above $1.95 will keep the reversal intact, while rejection risks a pullback towards $1.67 – A level that now acts as key invalidation.

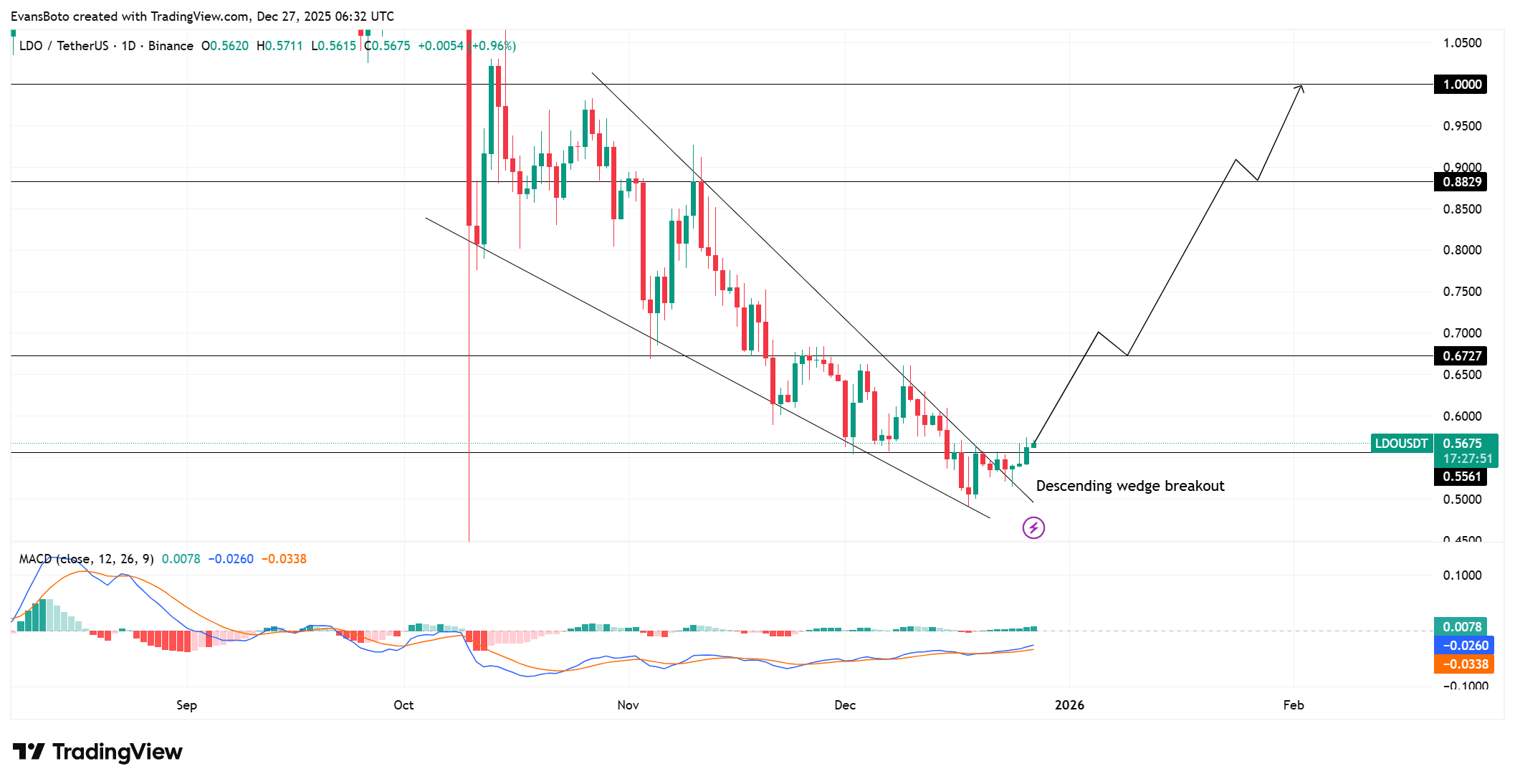

LDO wedge break signals stabilization

On the other hand, LDO has pushed out of a prolonged descending wedge after repeatedly holding the $0.55–$0.56 support band – A zone that absorbed selling pressure throughout December.

The altcoin was valued at $0.57 at press time, stabilizing above the wedge breakout level. Momentum conditions have improved meaningfully too. In fact, the MACD histogram turned positive, while the Signal lines converged and hinted at a bullish crossover.

Positioning data seemed to support this shift too, with long accounts rising towards 59–60%, yet without excessive crowding.

Structurally, the next resistance lies at $0.67, where the prior breakdown occurred, followed by a higher target near $0.88.

A breakout above $0.67 would confirm trend continuation, while a loss of $0.56 would invalidate the breakout and reopen downside risk.

Are LDO and PENDLE being positioned for a DeFi rally?

Hayes’s clustered accumulation, rising Open Interest in PENDLE, strengthening long bias in LDO, and confirmed technical breakouts all align clearly. The positioning remains early, not crowded. Therefore, risk might be skewed towards continuation rather than rejection.

If PENDLE holds above $1.95 and LDO reclaims $0.67, both assets could head towards higher resistance zones.

This could be indicative of strategic preparation for a DeFi-led move, one driven by structure and participation rather than speculation alone.

Final Thoughts

- LDO and PENDLE exhibited aligned structural strength backed by positioning and participation.

- Hayes’s accumulation might be anticipatory, favoring continuation rather than reactive buying.