The TAO index continues to fall into a downward trend, with each rebound being limited by resistance.

TAO continues to trade within a clear bearish structure on the daily chart, with recent price action reflecting ongoing selling pressure and limited follow-through from buyers.

Consecutive lower closing prices indicate that the market has yet to find a convincing bottom, with each rebound attempt encountering a new wave of selling. This pattern suggests that traders remain cautious, with risk appetite skewed to the downside rather than aggressive position building.

Trend Structure Indicates Continued Weakness

From a broader trend perspective, TAO remains below both the short-term and medium-term moving averages, further confirming the current downward bias.

The declining trend of these moving averages suggests that recent price rebounds have lacked strength and are being absorbed by sellers. In this scenario, unless the price can regain and effectively hold key levels, the trend is likely to continue—a situation that has yet to appear on the daily chart.

TAO Momentum Indicators Point to Bearish Continuation

Momentum indicators continue to reflect weakening bullish pressure. The MACD shows the market shifting from recovery to weakness, indicating that sellers have regained control after a brief pause. This transition typically signals further price declines rather than a sustained reversal.

TAO/USDT Daily Chart (Source: TradingView)

Meanwhile, the RSI continues to decline, indicating strengthening bearish forces, but has not yet reached extremely oversold levels. This means there is still room for further price drops, though short-term rebounds are also possible.

Key Resistance Zones to Watch During Any Rebound

On the upside, TAO faces immediate resistance near $262, a region that previously provided support and now acts as short-term resistance. If this area is breached, the price may test the $269 region, where selling pressure could intensify again. For a more significant shift in market sentiment, the price needs to decisively break and hold above $302, which coincides with broader structural resistance and would indicate buyers are regaining control. Until then, upward moves are likely to remain corrective in nature.

Support Levels Determine Downside Risk

If selling pressure persists, downside risk remains pronounced. The support zone between $231 and $225 is critical, where buyers may attempt to stabilize the price. If the price falls below this area, it would indicate the downtrend is continuing and could trigger a deeper decline or a volatility-driven rebound.

Failure to hold this area would severely weaken the technical outlook and expose TAO to further downside risk.

Order Book Data Highlights Volatility Potential

Order book dynamics provide important context for technical analysis. Large buy walls are positioned below the current price, indicating that some participants are willing to defend lower levels, but also highlighting the risk of a sharp drop if these buy orders are removed.

On the positive side, strong selling resistance in the $300 range suggests significant selling pressure above. Absorbing these sell orders would require a notable change in volume and momentum, but doing so could trigger a rapid price surge toward higher resistance zones.

Trading Scenarios and Risk Considerations

From a trading perspective, with the overall structure still bearish, long positions may be more suitable for short-term tactical setups rather than trend-following strategies.

More conservative traders may wait for clear stabilization signals near major support levels or confirmation that the price has regained higher resistance. Short strategies remain more closely aligned with the current trend, especially when the price rebounds to resistance, but traders should closely monitor for sudden volatility near key support zones.

Outlook: Bearish Bias Remains

Overall, TAO maintains a bearish bias on the daily chart, with both trend and momentum indicators pointing downward.

Although short-term rebounds are possible, the technical pattern suggests that sellers remain in control until the price convincingly regains key resistance levels. The market is still searching for a more solid bottom, so caution is warranted.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

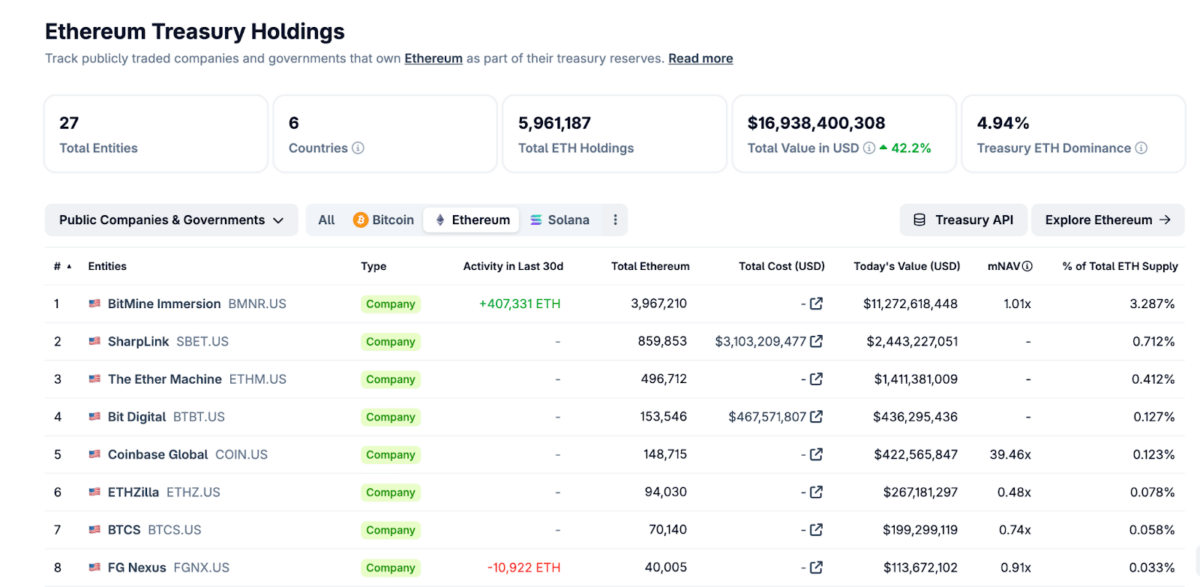

SharpLink Gaming Appoints New CEO as Ethereum Treasury Surpasses 863K ETH

Critical Challenge for Bitcoin Miners in 2026: The AI Temptation

Bhutan says 10,000 bitcoins will be used to build its new administrative city

Analyst to XRP Holders: Hold On to Your Hats. We Wait for a Decision