Fed Rate-Cut Prospects for 2026 Rise as US Labor Market Softens and Consumer Spending Holds Up

COINOTAG News notes that RBC’s assessment ties softer non-farm payrolls to resilient consumer demand, creating a nuanced macro backdrop for the crypto market. The signal could recalibrate policy risk premia and liquidity, as traders price in a potential path for the Fed rate cut 2026 and its impact on digital assets.

With last week’s dissenters stepping down from voting roles and new members joining the FOMC, the near-term stance may tilt toward hawkishness, complicating bets for Bitcoin and Ethereum. Yet, continued labor-market cooling could erode hawkish resolve and raise the odds of policy easing ahead of schedule, supporting crypto risk sentiment.

Traders should monitor macro data, central-bank commentary, and liquidity conditions, as these inputs shape funding costs for digital assets. The environment favors selective exposure to high-quality tokens and robust risk controls, with a focus on crypto market resilience and credibility in risk management strategies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

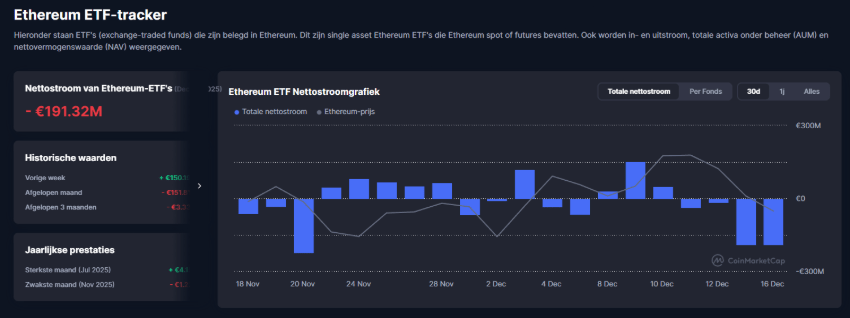

Grayscale Lanceert Mini ETH ETF. Redt Dit De Ethereum Koers?

Bitcoin Price Prediction: BTC Extends Fragile Phase as Technical Pressure, Flows, and Macro Signals Converge

Πρόβλεψη τιμής Bitcoin για το 2026