Bitcoin Chip Concentration at 11% Signals Potential Volatility Ahead of CPI Data and BoJ Rate Decision

On-chain data analyst Murphy notes that BTC’s chip concentration acts as a practical pre-warning indicator for volatility, with a defined threshold in a 5% price band. When the concentration rises above 13%, the market enters a caution zone; readings above 15% indicate a high-risk regime. While higher concentration raises the probability and potential magnitude of moves, it does not determine direction. Presently, BTC’s chip concentration hovers near 11%, a relatively elevated reading but not yet in the caution territory—signaling no immediate chain reaction from chip structure alone.

Investors will monitor the macro calendar: the CPI release due at 21:30 on the 18th and the Bank of Japan policy decision on the 19th. Unless inflation or policy surprises materially exceed expectations, the near-term impact should manifest as modest volatility rather than outsized moves. In historical context, a chip concentration around 15% has coincided with sharper swings, underscoring the role of on-chain data in framing risk and hedging strategies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

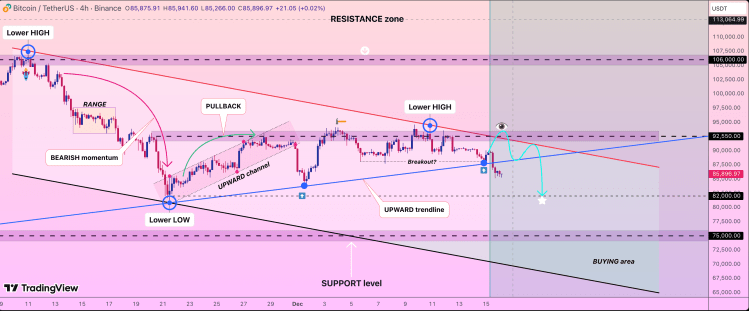

The Bearish Structure That Puts Bitcoin Price At $92,550, And Then $82,000

Is Monero (XMR) Gearing Up for a Bullish Breakout? This Key Pattern Formation Suggest So!

Aave charts post-SEC expansion as DeFi lender sharpens growth strategy

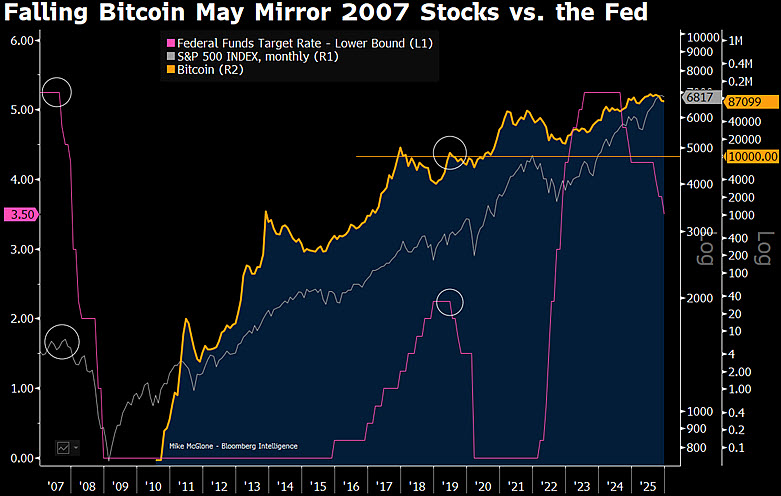

Don't Be Surprised If Bitcoin Resets to $10,000: Top Bloomberg Expert Reveals 2007 Parallel