The $150,000 Collective Illusion: Why Did All Mainstream Institutions Misjudge Bitcoin in 2025?

There is a significant discrepancy between the expected and actual performance of the bitcoin market in 2025. Institutional forecasts have collectively missed the mark, mainly due to incorrect assessments of ETF inflows, the halving cycle effect, and the impact of Federal Reserve policies. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

At the beginning of 2025, the bitcoin (BTC) market was filled with feverish optimism, with institutions and analysts collectively betting that the year-end price would soar above $150,000, even aiming directly for $200,000+ or higher. However, reality played out as a "contrarian" drama: BTC plummeted more than 33% from its early October peak of around $126,000, entered a "bloodbath" mode in November (with a single-month drop of 28%), and as of December 10, the current price stabilized in the $92,000 range.

This collective misjudgment is worth a deep review: Why were the early-year predictions so unanimous? Why were almost all mainstream institutions wrong?

I. Early-Year Predictions vs. Current Situation

1.1 The Three Pillars of Market Consensus

At the start of 2025, the bitcoin market was permeated with unprecedented optimism. Almost all mainstream institutions gave a year-end target price above $150,000, with some aggressive forecasts even pointing directly to $200,000–$250,000. This highly unified bullish expectation was built on three "certainties":

Cyclical Factor: The Halving Spell

In the 12–18 months following the fourth halving (April 2024), historical price peaks have repeatedly occurred. After the 2012 halving, the price rose to $1,150 in 13 months; after the 2016 halving, it broke $20,000 in 18 months; after the 2020 halving, it reached $69,000 in 12 months. The market generally believed that the supply-side contraction effect would appear with a lag, and that 2025 was in a "historic window".

Capital Inflow Expectation: The ETF Wave

The approval of spot ETFs was seen as the opening of the "institutional capital floodgates". The market expected cumulative net inflows to exceed $100 billions in the first year, with traditional funds such as pensions and sovereign wealth funds making large allocations. Endorsements from Wall Street giants like BlackRock and Fidelity deeply ingrained the "bitcoin mainstreaming" narrative.

Policy Tailwind: The Trump Card

The Trump administration's friendly attitude toward crypto assets, including discussions of a strategic bitcoin reserve proposal and expected SEC personnel changes, was seen as long-term policy support. The market believed that regulatory uncertainty would be greatly reduced, clearing obstacles for institutional entry.

Based on these three logics, the average year-start target price from mainstream institutions reached $170,000, implying an expected annual increase of over 200%.

1.2 Institutional Forecast Panorama: Who Was Most Aggressive?

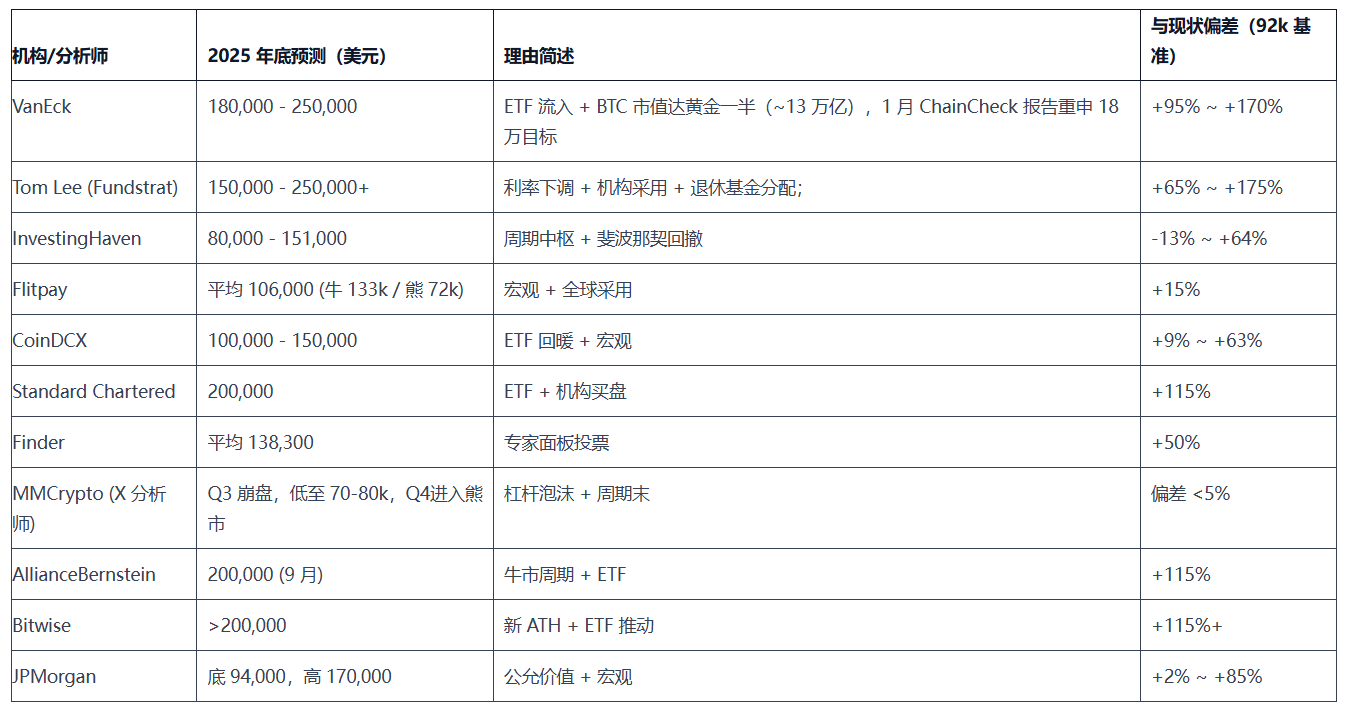

The table below summarizes the early-year forecasts of 11 mainstream institutions and analysts. Compared to the current price ($92,000), the deviation is clear at a glance:

Forecast Distribution Features:

- Aggressive Camp (8 institutions): Target price $150,000+, average deviation over 80%, representative institutions include VanEck, Tom Lee, Standard Chartered

- Moderate Camp (2 institutions): JPMorgan gave a range forecast, Flitpay provided bull and bear scenarios, retaining downside space

- Contrarian Camp (1 institution): Only MMCrypto explicitly warned of crash risk, becoming the only accurate predictor

It is noteworthy that the most aggressive forecasts came precisely from the most well-known institutions (VanEck, Tom Lee), while the accurate prediction came from a relatively niche technical analyst.

II. Root Causes of Misjudgment: Why Did Institutional Forecasts Fail Collectively?

2.1 Consensus Trap: When "Bullish News" Loses Marginal Effect

Nine institutions coincidentally bet on "ETF inflows", forming highly homogenized prediction logic.

When a certain factor is fully recognized by the market and reflected in the price, it loses its marginal driving force. At the start of 2025, ETF inflow expectations were already fully priced in—every investor knew about this "bullish news", and the price had already reacted in advance. What the market needs is a "positive surprise", not "meeting expectations".

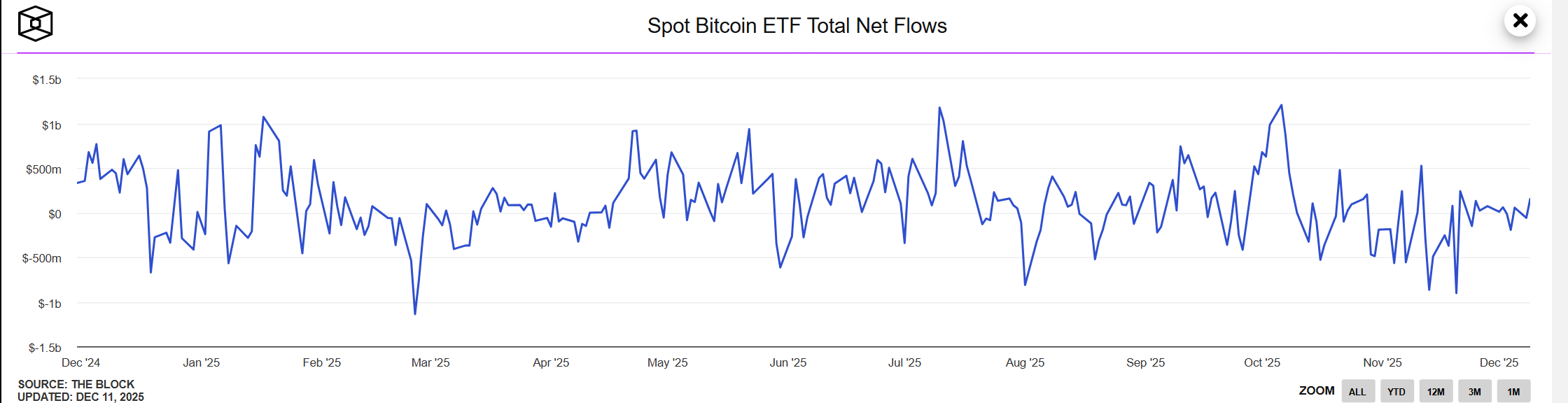

Total ETF inflows for the year fell short of expectations, with net outflows of $3.48–4.3 billions in November. More crucially, institutions ignored that ETFs are a two-way channel—when the market turns, they not only fail to provide support, but actually become a highway for capital flight.

When 90% of analysts are telling the same story, that story has already lost its alpha value.

2.2 Cycle Model Failure: History Does Not Simply Repeat

Institutions such as Tom Lee and VanEck heavily relied on the historical pattern of "price peaks 12–18 months after halving", believing the cycle would automatically play out.

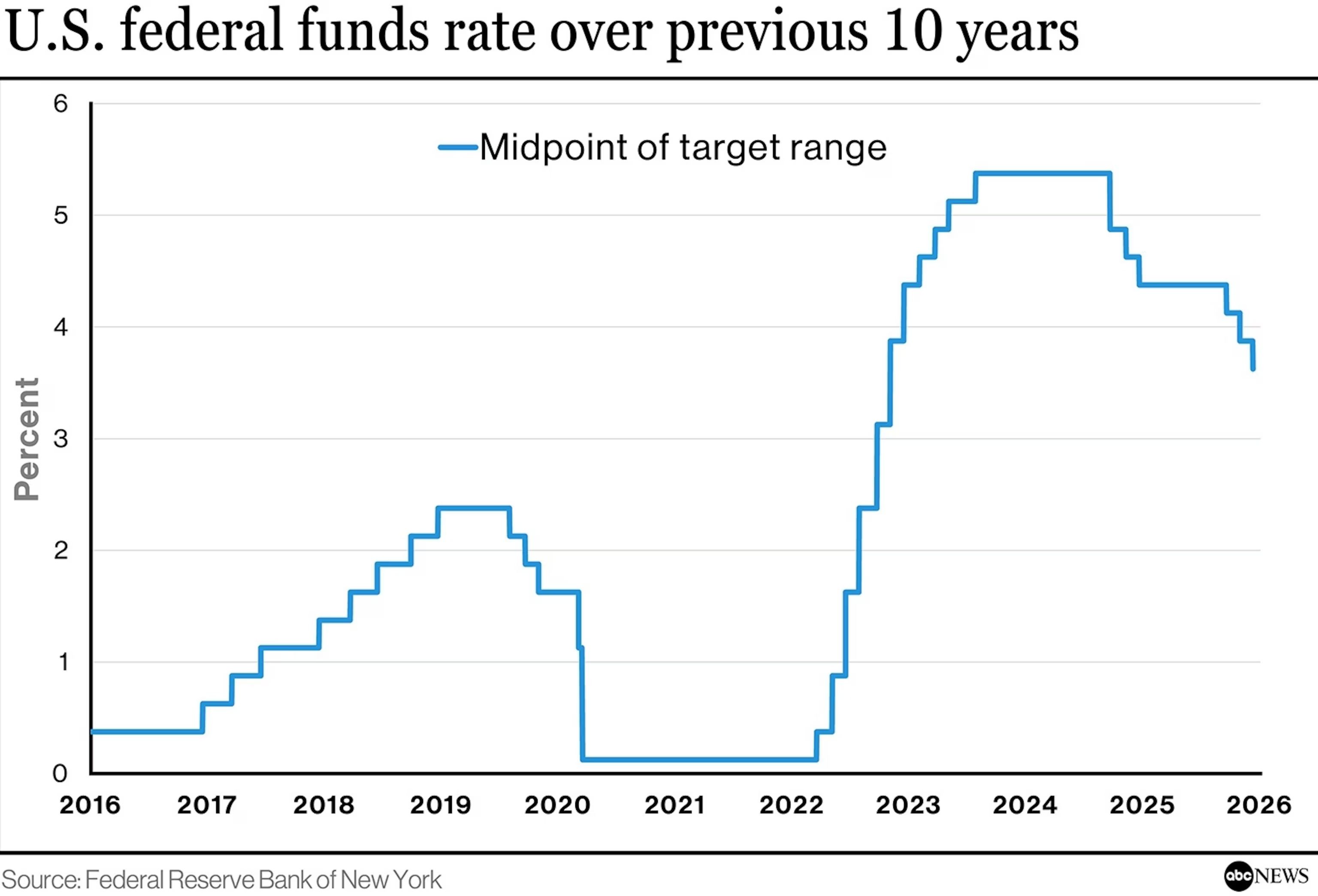

Environmental Upheaval: The macro environment faced in 2025 is fundamentally different from previous cycles:

- 2017: Global low interest rates, loose liquidity

- 2021: Pandemic stimulus, central bank money printing

- 2025: Aftermath of the most aggressive rate hike cycle in 40 years, Federal Reserve remains hawkish

The probability of a Fed rate cut dropped sharply from 93% at the start of the year to 38% in November. Such a sudden shift in monetary policy has never occurred in previous halving cycles. Institutions treated the "cycle" as a deterministic law, ignoring that it is essentially a probability distribution and highly dependent on the macro liquidity environment.

When environmental variables change fundamentally, historical models are bound to fail.

2.3 Conflict of Interest: Structural Bias of Institutions

Top institutions such as VanEck, Tom Lee, and Standard Chartered had the largest deviations (over +100%), while niche players like Changelly and MMCrypto were the most accurate. The size of an institution often correlates negatively with forecast accuracy.

Fundamental Reason: These institutions are themselves stakeholders:

- VanEck: Issuer of bitcoin ETF products

- Standard Chartered: Provider of crypto asset custody services

- Fundstrat: Serves clients holding crypto assets

- Tom Lee: Chairman of Ethereum treasury BMNR

Structural Pressure:

- Being bearish is like smashing their own rice bowl. If they publish bearish reports, it is tantamount to telling clients "our products are not worth buying". This conflict of interest is structural and unavoidable.

- Clients need a "$150,000+" target price to justify their positions. Most clients served by these institutions entered at high levels in the middle of the bull market, with holding costs in the $80,000–$100,000 range. They need analysts to provide a "$150,000+" target price to prove their decisions were correct and to provide psychological support for continuing to hold or even increase positions.

- Aggressive forecasts are more likely to get media coverage. Headlines like "Tom Lee predicts bitcoin at $250,000" obviously get more clicks and shares than conservative forecasts. The exposure brought by aggressive forecasts directly translates into institutional brand influence and business traffic.

- Famous analysts find it hard to overturn their historical stance. Tom Lee became famous for accurately predicting the bitcoin rebound in 2023, establishing a public image as a "bullish flag-bearer". At the start of 2025, even if he had reservations about the market, it would be difficult for him to publicly overturn his optimistic stance.

2.4 Liquidity Blind Spot: Misjudging Bitcoin's Asset Attributes

The market has long been accustomed to comparing BTC to "digital gold", believing it to be a safe-haven asset against inflation and currency depreciation. In reality, bitcoin is more like a Nasdaq tech stock, extremely sensitive to liquidity: when the Federal Reserve remains hawkish and liquidity tightens, BTC's performance is closer to high-beta tech stocks than to safe-haven gold.

The core contradiction lies in the natural conflict between bitcoin's asset characteristics and a high interest rate environment. When real interest rates remain high, the attractiveness of zero-yield assets systematically declines. Bitcoin neither generates cash flow nor pays any interest; its value depends entirely on "someone being willing to buy at a higher price in the future". In a low interest rate era, this is not a problem—since money in the bank yields little, you might as well take a gamble.

But when the risk-free yield reaches 4–5%, investors' opportunity cost rises significantly, and bitcoin as a zero-yield asset lacks fundamental support.

The most fatal misjudgment was that almost all institutions assumed that "the Fed's rate-cutting cycle is about to begin". At the start of the year, the market priced in 4–6 rate cuts for the year, with a cumulative cut of 100–150 basis points. But November data gave a completely opposite answer: inflation risks reignited, rate-cut expectations collapsed, and the market shifted from expecting "rapid rate cuts" to pricing in "higher rates for longer". When this core assumption collapsed, all optimistic forecasts based on "loose liquidity" lost their foundation.

Conclusion

The collective misjudgment of 2025 tells us: precise prediction itself is a pseudo-proposition. Bitcoin is affected by multiple variables such as macro policy, market sentiment, and technicals; any single model can hardly capture this complexity.

Institutional forecasts are not worthless—they reveal mainstream market narratives, capital expectations, and sentiment direction. The problem is, when a prediction becomes consensus, consensus becomes a trap.

True investment wisdom is: use institutional research to understand what the market is thinking, but don't let it decide what you should do. When VanEck and Tom Lee are collectively bullish, the question you need to ask is not "Are they right?", but "What happens if they are wrong?". Risk management always takes precedence over return forecasts.

History repeats, but never simply copies. Halving cycles, ETF narratives, policy expectations—all these logics failed in 2025, not because the logic itself was wrong, but because environmental variables fundamentally changed. Next time, the catalyst will have a different name, but the essence of market over-optimism will not change.

Remember this lesson: independent thinking is more important than following authority, contrarian voices are more valuable than mainstream consensus, and risk management is more crucial than precise prediction. This is the true moat for long-term survival in the crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stunning $500 Million USDT Transfer to Aave: What This Whale Move Means for Crypto

S&P 500 Index: Why Vanguard Is Bearish on the Index