Key takeaways

- BTC is down 1.35% and is trading around $90,500.

- The leading cryptocurrency has stabilized ahead of tomorrow’s FOMC meeting.

BTC stays above $90k ahead of the Fed rate decision

Bitcoin began the week bullish, hitting the $93k level on Monday. However, it has lost 1% of its value in the last 24 hours and is now trading above $90k.

The mixed performance comes as traders look forward to tomorrow’s Fed rate decision. The Federal Reserve is expected to reduce its benchmark lending rate by a minimum of 25 basis points.

The US Personal Consumption Expenditures (PCE) Price Index, released last Friday, did little to influence expectations for further policy easing by the apex bank.

In addition to that, institutional demand for Bitcoin-related funds shows a decline in selling pressure compared to previous weeks. Data obtained from SoSoValue revealed that S-listed spot Bitcoin ETFs recorded a mild outflow of $60.48 million on Monday.

Bitcoin’s recovery could be determined by the ETF inflow as institutions play a crucial role in boosting demand.

Finally, Michael Saylor’s Strategy announced on Monday that it had acquired 10,624 bitcoin for $962.7 million between December 1–7 at an average price of $90,615. Thanks to this acquisition, the company now holds 660,624 BTC, valued at $49.35 billion.

Bitcoin could rally towards $97k

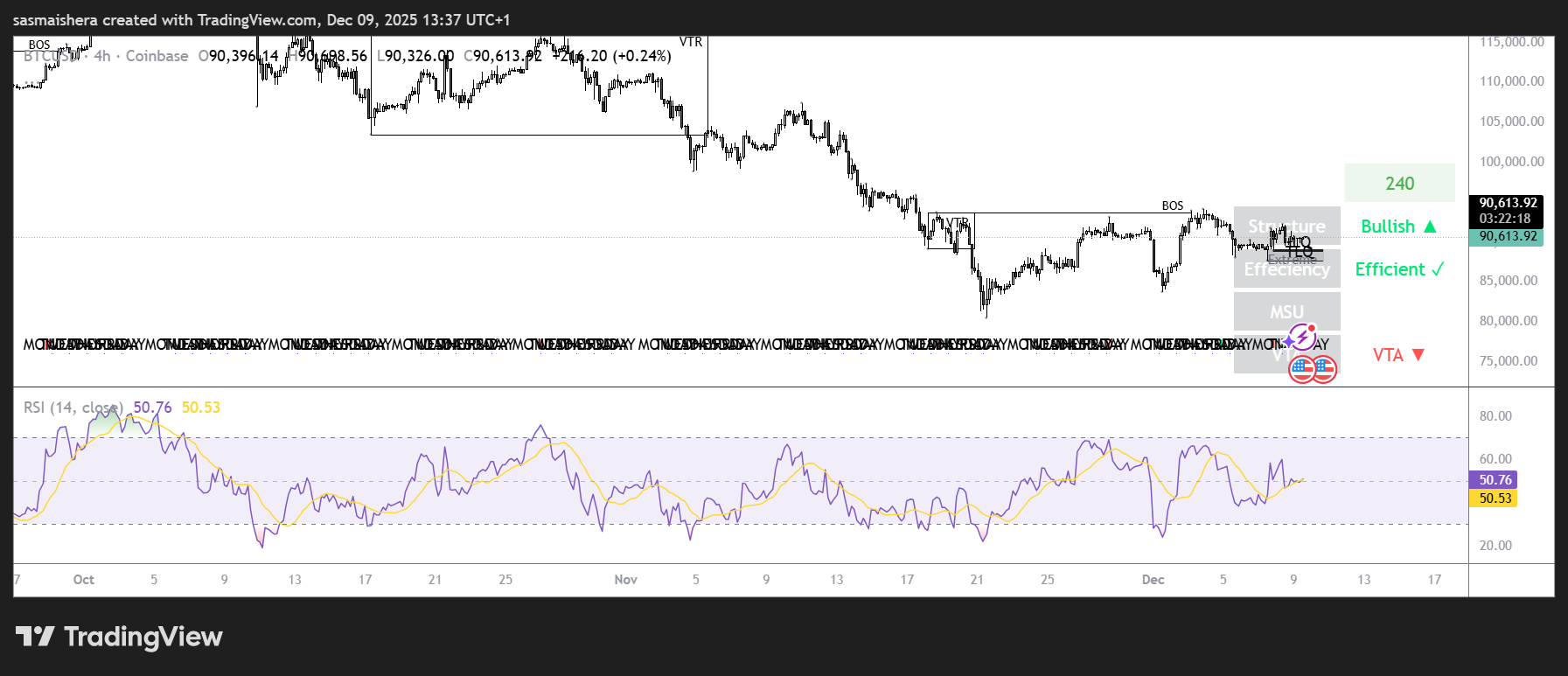

The BTC/USD 4-hour chart is bullish and efficient as Bitcoin has performed positively in recent days. The cryptocurrency faced rejection from the 61.80% Fibonacci retracement level at $94,253 last week, dropping to the $88k level during the weekend.

However, it recovered above $92k on Monday before declining to now trade above $90,500 per coin.

If the rally continues and the daily candle closes above the $93k resistance, BTC could extend its bullish movement toward the next key resistance at $100,000.

The Relative Strength Index (RSI) on the 4-hour chart is 44, near the neutral 50 level, suggesting fading bearish momentum. However, the RSI needs to move past the neutral level if Bitcoin will surmount the $93k resistance level.

The Moving Average Convergence Divergence (MACD) showed a bullish crossover last week, which still holds, supporting a bullish bias.

However, if the bullish recovery fails, Bitcoin could revisit the support level around the $85,569 region.