PayPal stablecoin market cap to reach $4 billion, driven by DeFi protocols

According to ChainCatcher, citing DL News, the circulating supply of PayPal's stablecoin PYUSD has surged by 224% since September, surpassing $3.8 billion and becoming the sixth largest stablecoin.

The DeFi protocol Ethena has become the largest holder of PYUSD, holding $1.2 billion through the custodian Copper. PayPal, in cooperation with liquidity management company Sentora, provides incentives on the decentralized exchange Curve Finance and subsidizes yields for DeFi protocol users.

The Solana lending protocol Kamino currently offers nearly 6% annualized yield for lending PYUSD, with part of the yield subsidized by PayPal. Over the past three months, the scale of PYUSD on Solana has increased from $250 million to over $1 billion.

U.S. Treasury Secretary Scott Besant expects the stablecoin market to reach $3 trillion by 2030.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysts: The Federal Reserve May Be Shifting Toward a Dovish Stance

Bloomberg Analyst: BTC May Fall Below $84,000 by Year-End, 'Santa Claus Rally' Unlikely to Occur

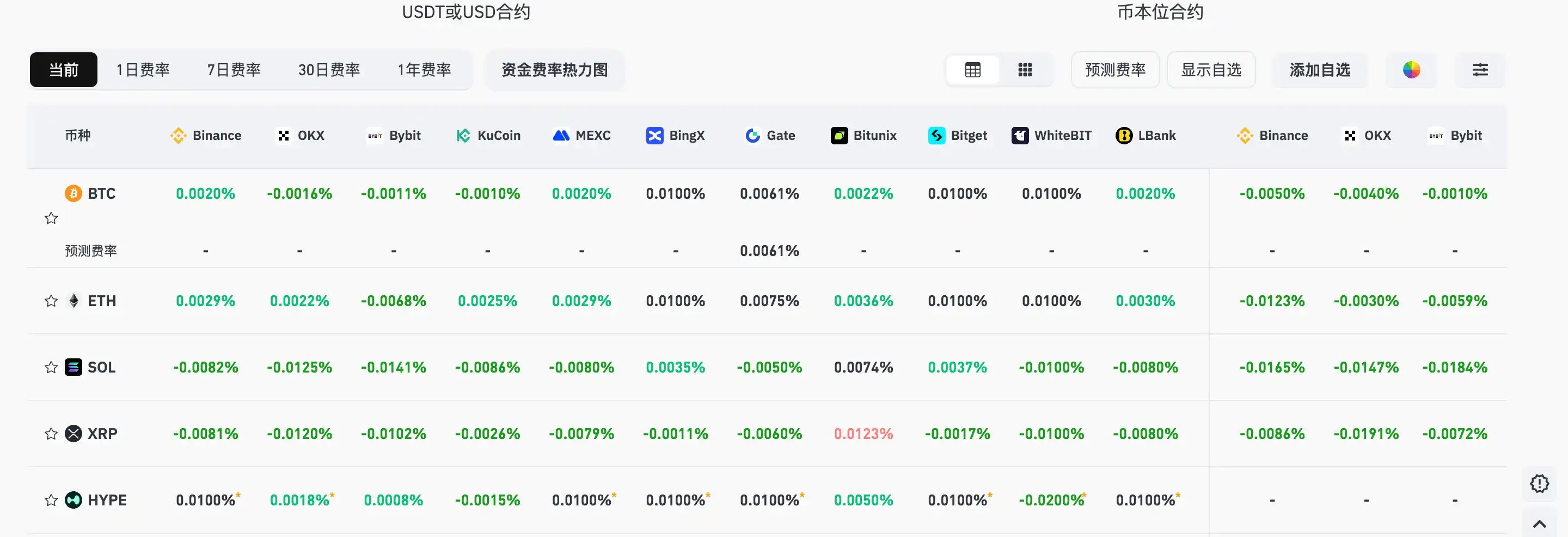

Current mainstream CEX and DEX funding rates indicate that the market remains broadly bearish.

Some Meme coins continue to rise during the market pullback, with JELLYJELLY surging 37% against the trend.