Will USDT Collapse? A Comprehensive Analysis of Seven Years of FUD, Four Crises, and the Real Systemic Risks of Tether

In every cycle of the crypto market, there is a recurring storyline:

“USDT is about to collapse.”

No matter if the market is rising or falling, whenever panic strikes, Tether becomes the target.

But the irony is—

Every time the “USDT collapse theory” emerges, it often signals the market bottom.

However, most people actually don’t understand:

Why is USDT always subject to FUD?

Why has it never truly depegged?

And—does it currently have any real risks?

This article will systematically review all major crises Tether has faced over the past seven years and provide a probability assessment of whether it could collapse now.

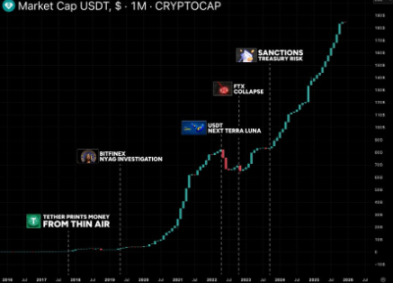

1. 2017: The Initial Panic—“Printing Money Out of Thin Air” Theory

In 2017, the market saw the first large-scale “USDT collapse theory.”

The accusations at the time included:

USDT had no reserves at all

Tether was printing money privately to manipulate the market

Reserves did not exist

However, when the audit team obtained account information:

The reserves did exist

All USDT was redeemed at $1

Even when BTC had a major pullback, USDT still maintained its $1 peg

The first FUD was quickly digested by the market.

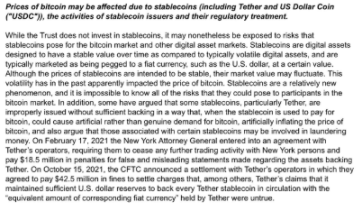

2. 2020: Bitfinex–Tether Investigation—The Most Severe Crisis in History

The New York Attorney General (NYAG) accused Tether of:

Concealing partial losses

Using USDT reserves to cover the gap

This was the most severe legal risk in Tether’s history.

But in the end:

The case was settled

Tether disclosed its reserve structure

USD redemptions continued to remain stable

Although the market panicked for a while, it once again proved:

Tether could maintain liquidity even under regulatory pressure.

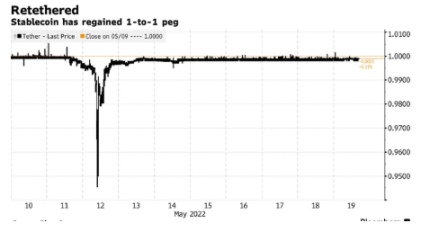

3. 2021: After the Terra Collapse, “USDT is the Next UST” Narrative Erupts

After the Terra/LUNA collapse, the market was gripped by massive panic.

Many KOLs began to claim:

“USDT is the next UST.”

But this was the most critical stress test:

Over $10 billion in USDT was redeemed within 48 hours

The peg was maintained throughout

There was no death spiral like with algorithmic stablecoins

Tether directly crushed all doubts with “real redemptions.”

4. 2022: Panic Returns After the FTX Collapse

The collapse of FTX shattered market confidence.

Once again, people claimed:

Tether had no reserves

Commercial paper was uncontrollable

USDT would blow up

But the result was the same:

Billions of dollars in redemptions were completed smoothly

Tether completely removed commercial paper

Fully transitioned to US Treasuries (T-bills)

This was one of the strongest moments of USDT liquidity in history.

5. 2023–2024: New Fear—“Will Tether Be Sanctioned by the US?”

As Tether held a large amount of US Treasuries, some people began to worry:

“Will Tether be sanctioned due to US regulatory risks?”

The result was:

No sanctions whatsoever

No accounts frozen

USDT supply continued to rise

Even more astonishing:

Tether has become one of the world’s largest holders of short-term US Treasuries.

This means:

Tether is now deeply embedded in the global financial system, and the cost for the US to sanction it is extremely high.

6. Latest Risk Point: Are Arthur Hayes’ Concerns Reasonable?

BitMEX founder Arthur Hayes recently raised a new concern:

Tether has allocated about $23 billion to bitcoin and gold

This exposes them to market volatility risk

If BTC/gold drops 30%, it could wipe out their equity buffer

This may sound alarmist, but we need to look at the actual data.

7. Tether’s Latest Balance Sheet: Stable or Dangerous?

According to the latest disclosure:

Total reserves: $215 billion

Liabilities: $184 billion

Net assets (equity): $6.8 billion

Cash and equivalents: $140 billion

US Treasuries: $135 billion

BTC + gold: $23 billion

Importantly:

Even if BTC drops 50%, Tether still has far more cash and US Treasuries than its liabilities.

In other words:

The asset allocation is more aggressive, but liquidity is far from weakened.

8. Tether’s Business Model Makes It “Hard to Die”

Tether earns just from interest income every month:

About $500 million

Annual profit exceeds $10 billion

With fewer than 150 employees

It is also one of the companies with the highest redemption pressure in the world:

During the 2022 panic, it redeemed $25 billion within a few days without any issues.

In other words:

Tether’s entire history is the world’s largest liquidity stress test, and it has never failed.

9. Why Does USDT Keep Getting Stronger?

Reviewing the past seven years reveals a clear pattern:

Massive FUD

Panic

Redemptions

Peg maintained

Market recovery

USDT supply hits new highs

Why?

Because USDT is the “dollarization engine” of the crypto market:

Largest liquidity

Strongest stability

Most accessible

Widest trading pairs

This is not an emotional issue, but one determined by the structure of the global market.

Conclusion:

Despite Tether experiencing seven years of FUD, regulation, lawsuits, and panic redemptions, its performance has repeatedly proven:

Strong liquidity

Increased asset transparency

US Treasuries as the main support

Extremely high large-scale redemption capability

The latest BTC/gold holdings do make its asset portfolio more volatile, but based on the current asset structure:

Tether is almost impossible to “collapse” in the foreseeable future.

The real systemic risk is not a reserve issue, but changes in the regulatory environment or geopolitics.

In the crypto market,

The USDT collapse theory itself is more like a sentiment indicator at the cycle bottom, rather than a substantive threat.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Key Market Intelligence for December 5: How Much Did You Miss?

1. On-chain funds: Today, $55.7M flowed into Ethereum; $51.4M flowed out of Base. 2. Top gainers and losers: $OMNI, $FTN. 3. Top news: At 23:00 tonight, the US will release the annual Core PCE Price Index for September, with an expected 2.9%.

Bitcoin's ‘momentum is igniting,’ but these are BTC price levels to watch

Bitcoin accumulation trends strengthen as realized losses near $5.8B

Data-Anchored Tokens (DAT) and ERC-8028: The Native AI Asset Standard for the Decentralized AI (dAI) Era on Ethereum

If Ethereum is to become the settlement and coordination layer for AI agents, it will need a way to represent native AI assets—something as universal as ERC-20, but also capable of meeting the specific economic model requirements of AI.