Written by: TechFlow

As the year draws to a close, it is foreseeable that major institutions' 2026 crypto predictions and outlooks will be released one after another in the coming month.

But before looking at new predictions, it’s worth reviewing what these institutions said last year; after all, anyone can make predictions, but accuracy is what really matters.

Looking back to the end of 2024, market sentiment was high, BTC had just broken through $100,000, and everyone’s predictions were generally optimistic:

For example, BTC would hit $200,000, stablecoin market cap would double, AI agents would ignite on-chain activity, and crypto unicorns would flock to IPOs... Now, a year later, have those predictions come true?

We have selected some typical viewpoints from last year’s various prediction reports by institutions and individuals to review one by one and see whose predictions had the highest hit rate.

1. VanEck: 10% Accuracy, Only Got Bitcoin Strategic Reserve Right

At the end of 2024, VanEck made 10 predictions, of which only the Bitcoin strategic reserve was correct.

The other 9 all missed, and most were not just slightly off but were off by orders of magnitude. For example, they predicted crypto would peak in Q1 and Bitcoin would reach $180k, with a new high at year-end; in reality, both the timing and price targets were completely off.

Secondly, their market size predictions were overly optimistic. Tokenized securities were predicted at $50 billion, but the actual figure was about $30-35 billion; DeFi TVL was predicted at $200 billion, but the actual was about $120-130 billion; NFT trading volume was predicted at $30 billion, but the actual estimate was $5-6.5 billion.

Overall, VanEck’s judgment on policy direction was quite accurate, but they systematically overestimated the scale of on-chain economies.

Related reading: VanEck’s Top 10 Crypto Predictions for 2025: New Bull Market Highs by Year-End, U.S. Further Supports Bitcoin Through Strategic Reserve Policy

2. Bitwise: 50% Accuracy, Got the Big Picture Right but Missed on Price Predictions

Bitwise made 10 predictions, hitting 5, mainly in the areas of regulation and institutional adoption; price and scale predictions were also systematically overestimated.

-

Policy and institutional adoption were fully accurate. Coinbase and MicroStrategy entered U.S. stock indices; the year of crypto IPOs materialized, with several crypto companies going public; the number of countries holding BTC increased from 9 to nearly 30.

-

All price targets missed: The predicted prices for BTC, ETH, and SOL were much higher than these tokens’ actual performance this year. Coinbase’s stock price was $250, 65% below the $700 target. The RWA tokenization estimate of $50 billion was clearly an overestimate as well.

Overall, Bitwise showed sharp policy instincts and accurately grasped the regulatory shift and institutional adoption pace.

Related reading: Bitwise’s Top 10 Crypto Predictions for 2025

3. Coinbase: Nearly 100% Accuracy, Only Stated Directions, Not Prices

Coinbase’s predictions were divided into “macro” and “disruptive” categories, mostly directional judgments rather than precise numbers, focusing on trends.

Some core, verifiable predictions are as follows:

Other predictions were generally correct in direction but hard to quantify:

You can see that their predictions clearly avoided specific price targets, focusing on policy inflection points and industry trends. As a result, all the core prediction directions were accurate.

-

All regulatory shifts were validated: Predicted “the most crypto-friendly Congress in history” would bring benefits, and more asset ETFs would be approved; this was indeed the case.

-

Stablecoins and DeFi directions were correct: Predicted explosive growth of stablecoins and their expansion into commercial payments. This year, Mastercard announced support for USDC/PYUSD/USDG in June, Coinbase’s own payment platform integrated with Shopify, and Stripe launched USDC subscription payments.

They predicted a DeFi revival, and in reality, DeFi TVL reached $120 billion, a new high since May 2022.

This “only stating direction, not price” strategy may lack buzz, but in hindsight, it is the most robust and least likely to backfire.

Related reading: Coinbase 2025 Outlook: New Technologies, New Landscape, New Opportunities, Crypto Market to See Transformative Growth

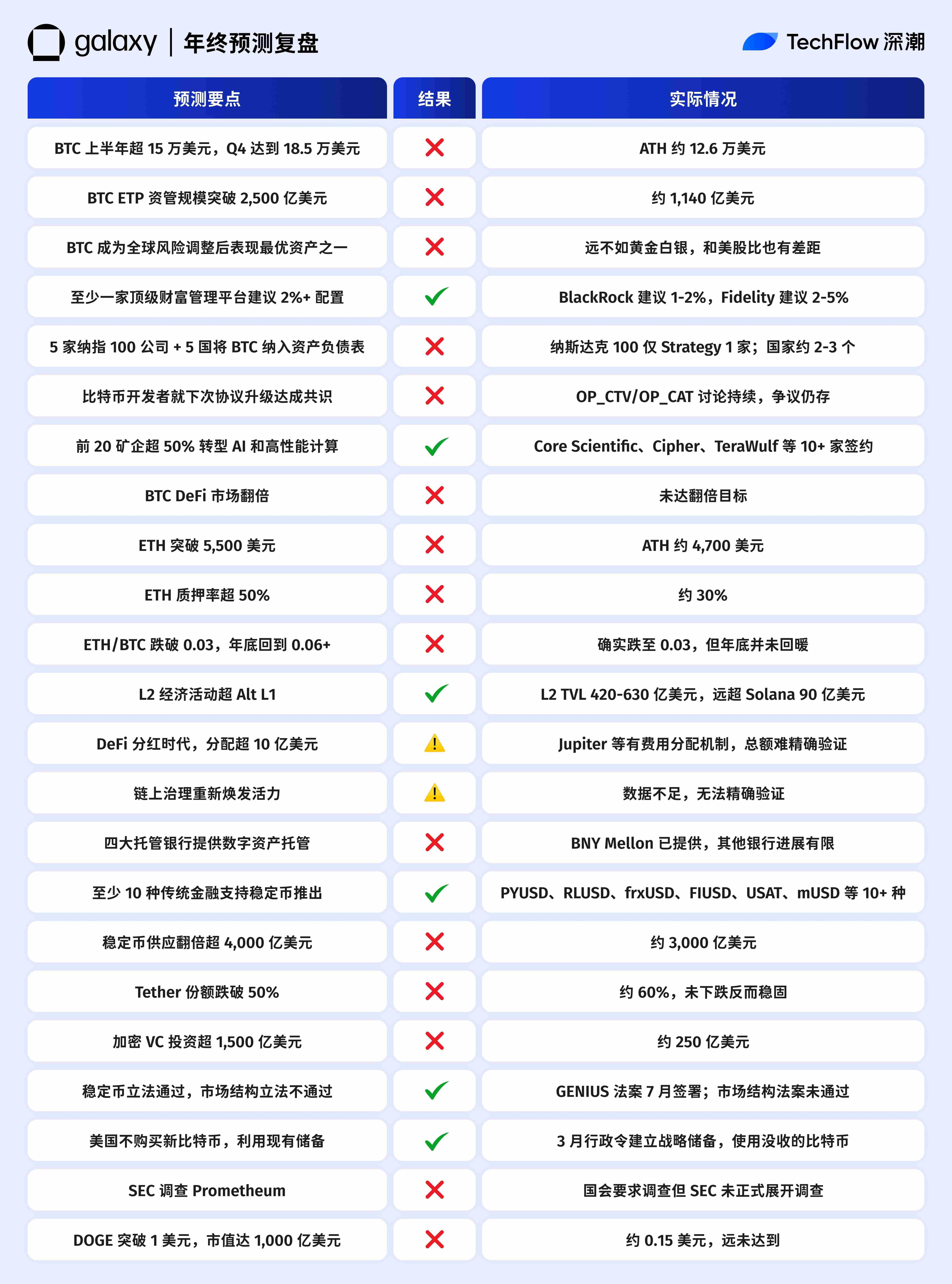

4. Galaxy Research: 26% Accuracy, Almost All Data Predictions Were Wrong

Galaxy’s researchers made a total of 23 predictions, the most quantitative and numerous among all institutions.

Looking back, the policy prediction team performed excellently (100% hit rate), but price and market size predictions were almost all wrong. Especially the prediction that DOGE would break $1, which now seems overly optimistic.

In addition, Galaxy’s predictions on ecosystem development were decent. For example, predicting that most mining companies would pivot to AI and high-performance computing, which indeed became a notable trend in this year’s AI boom.

When the number of predictions is high and granular, even professional research institutions cannot get everything right; the market does not move as everyone expects.

Related reading: Galaxy Research 2025 Predictions: Bitcoin to Hit $185,000, Ethereum to Break $5,500

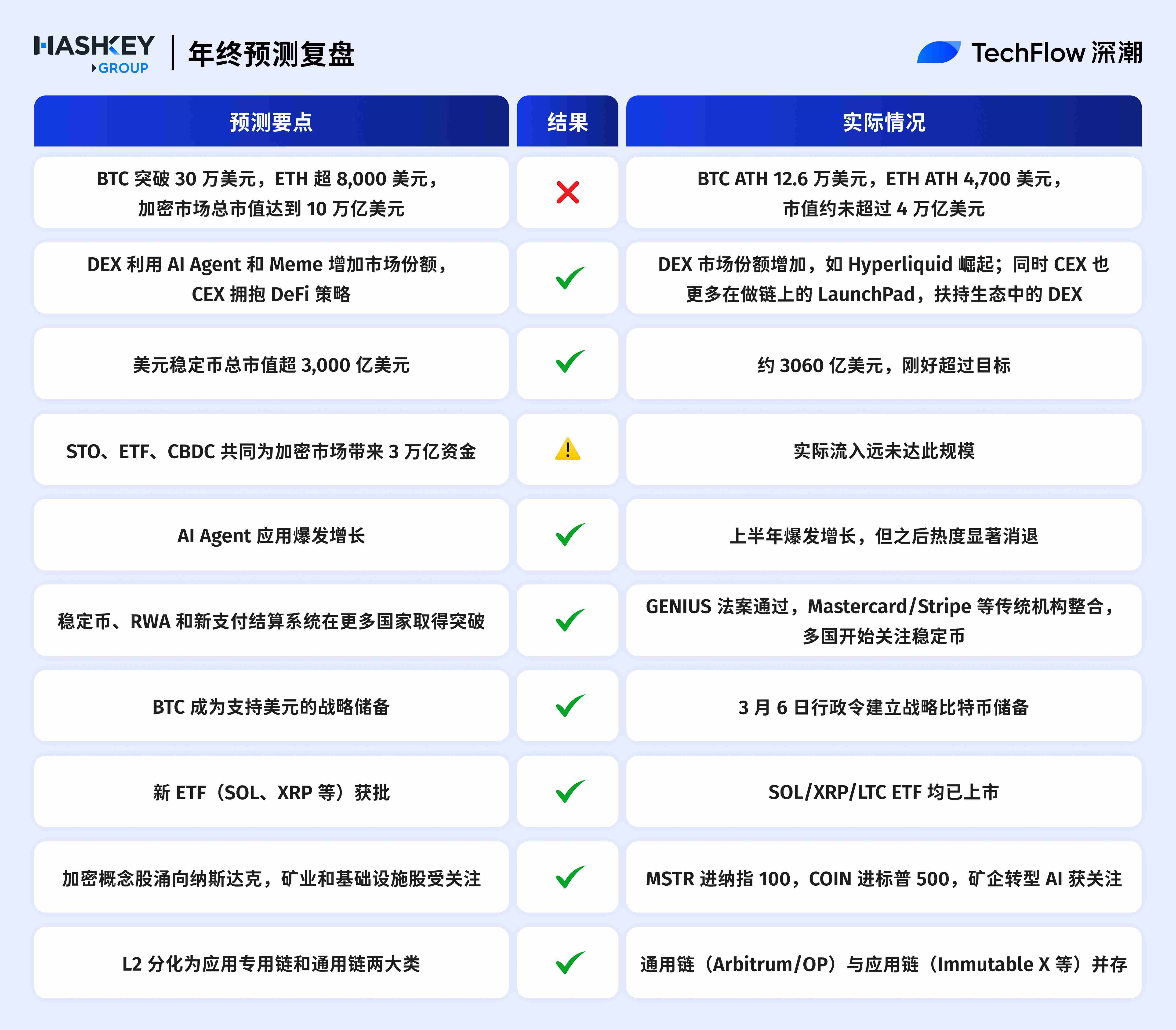

5. HashKey: 70% Accuracy, Price Predictions Overly Optimistic

Overall, HashKey’s predictions were precise regarding regulatory and compliance progress (ETF, stablecoin legislation) and ecosystem structural changes (DEX rise, L2 differentiation), but still overly optimistic about price cycles.

Interestingly, these predictions also reflected the sentiment of the crypto community at the time.

After HashKey Group released its Top 10 Market Predictions for 2025, nearly 50,000 community users voted on the sixteen hottest predictions summarized by HashKey researchers, analysts, and traders;

The results showed that 50% of voters were optimistic about “Bitcoin breaking $300,000, Ethereum surpassing $8,000, and the total crypto market cap reaching $10 trillion.”

Ironically, the prediction with the highest probability of votes now seems the least likely to be realized by the end of this year.

Related reading: HashKey Group’s Top 10 Market Predictions for 2025: USD Stablecoin Market Cap to Exceed $300 Billion, Bitcoin to Break $300,000

6.Delphi Digital: 40% Accuracy, Consumer DeFi Prediction Was a Highlight

Delphi Digital’s predictions were more accurate regarding technical infrastructure and consumer applications; the original wording for the consumer application prediction was:

“2025 will be a key development node for consumer DeFi, with more and more crypto users fully embracing on-chain financial services.”

This year, we did see the emergence of various U cards and tokenized U.S. stocks. In addition, traditional financial apps like Robinhood are gradually embracing on-chain solutions.

Related reading: Delphi Digital’s Top 10 Predictions for 2025: BTC to Rise Further, AI Agents May Become Top VCs

7. Messari: 55% Accuracy, Did Not Involve Specific Price Points

Although Messari is a data analytics platform, its predictions leaned toward “trend direction” rather than “specific numbers.” Looking back, its judgment on major trends was relatively accurate.

8. Framework Co-Founder: 25% Accuracy, More Confidence Given to Invested Projects

Next, we also selected some representative personal predictions from last year to see how they fared.

First is Framework co-founder Vance Spencer’s predictions. We have compiled the crypto-related parts:

It is clear that Vance placed high expectations on projects he invested in, such as Glow, Daylight, and Berachain, representing the energy and public chain sectors, respectively.

In addition, some quantitative targets were too aggressive, such as $1 billion in daily ETH ETF inflows.

Related reading: Framework Co-Founder 2025 Predictions: Fed Will Continue to Cut Rates, ETH ETF Inflows Will Continue

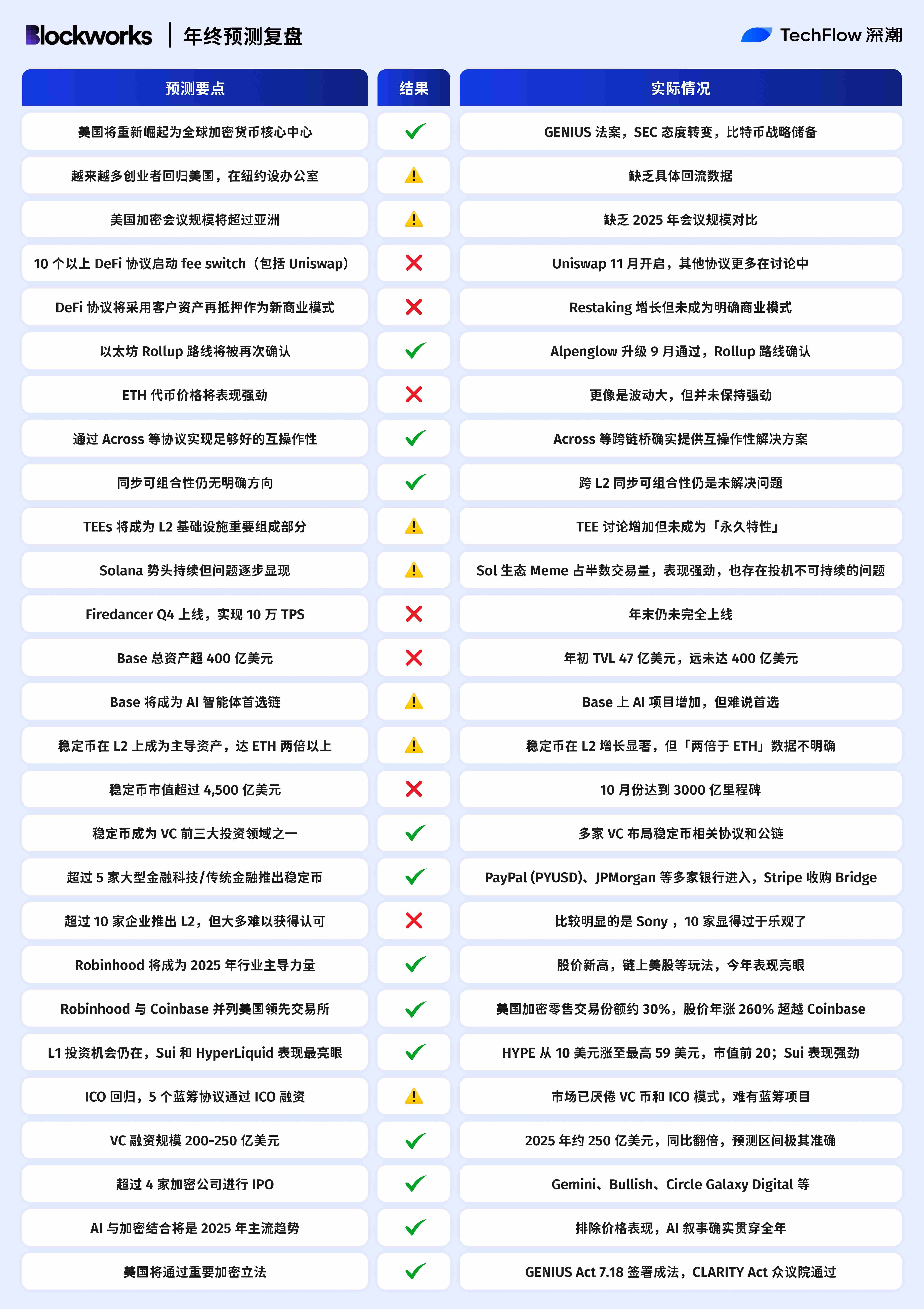

9. Blockworks Co-Founder: 48% Accuracy, Most Predictions Made

Blockworks co-founder Mippo (X: @MikeIppolito_) made the most predictions among the institutions and individuals we reviewed, but his accuracy was quite good, getting almost half right.

The highlight was the accurate prediction of Robinhood’s rise, and he also pinpointed L1 investment opportunities such as Hyperliquid and SUI, both of whose tokens performed well this year.

Related reading: Blockworks Co-Founder’s 27 Predictions for 2025: U.S. to Become Crypto Hub, Base Will Be Solana’s Main Competitor

10. Alliance DAO Wang Qiao & Imran: 50% Accuracy, Overly Optimistic on BTC Price

Alliance DAO’s two founders, WangQiao and Imran, also made predictions for 2025 in a podcast chat.

Related reading: Alliance DAO 2024 Crypto Market Review and 2025 Outlook: Bitcoin Reaching $250K Is Market Consensus

We have compiled their crypto-related viewpoints as follows:

It can be seen that the two founders were overly optimistic about BTC’s performance. Even the lowest prediction of $150K was still some distance from BTC’s highest price this year.

However, their judgment on prediction markets was very precise, and they can be said to have foreseen this key trend a year in advance.

Summary

After reviewing last year’s predictions, several clear patterns emerge:

-

The number of predictions is basically negatively correlated with accuracy—the more you say, the more you get wrong.

-

Attempts to predict specific price points and numbers almost always go awry.

-

Policy predictions are very reliable; improvements in the regulatory environment and the U.S. becoming more crypto-friendly were predicted correctly by almost all institutions and individuals.

Finally, the author believes that the value of these annual institutional predictions is not in “telling you what to buy,” but in “telling you what the industry is thinking.” We can treat these predictions as industry sentiment indicators; but if you use them as investment guides, the results could be disastrous.

At the same time, keep a good habit: always be skeptical of any prediction with specific numbers, no matter which KOL, institution, or industry leader it comes from.

This is not to say that we should criticize these industry elites, but rather that even wrong predictions have value.

They tell you what the market once believed, but no one can predict the future.