Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

If you have read my previous articles on macro trends, you may have already seen some clues. In this article, I will break down the true state of the current economy for you: the only engine driving GDP growth is artificial intelligence (AI); all other areas such as the labor market, household finances, affordability, and asset accessibility are on the decline; and everyone is waiting for a "cyclical turning point," but in reality, there is no such "cycle" anymore.

The truth is:

· The market is no longer driven by fundamentals

· AI capital expenditure is the only pillar preventing a technical recession

· A wave of liquidity will arrive in 2026, and the market consensus has not even begun to price this in

· The wealth gap has become a macro resistance forcing policy adjustments

· The bottleneck for AI is not GPUs, but energy

· Cryptocurrency is becoming the only asset class with real upside potential for the younger generation, giving it political significance

Do not misjudge the risks of this transformation and miss out on great opportunities.

Market Dynamics Decoupled from Fundamentals

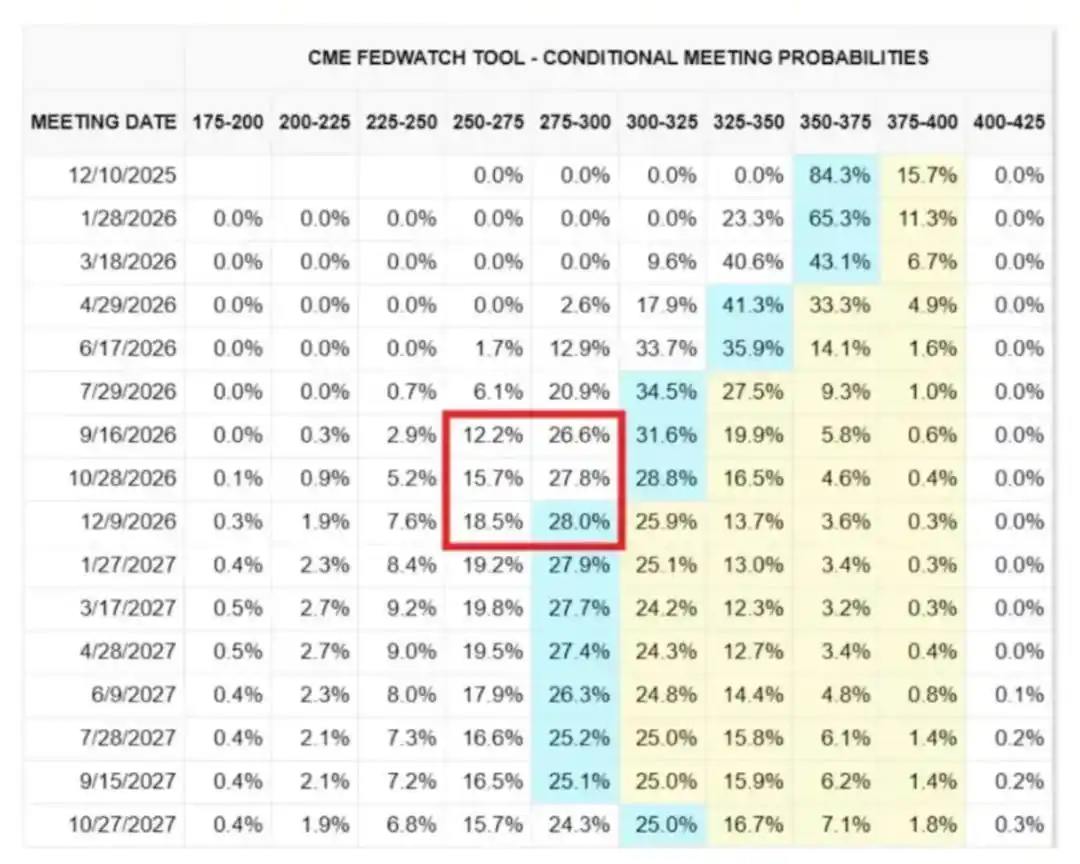

The price fluctuations over the past month have had no support from new economic data, yet have experienced violent swings due to shifts in the Federal Reserve's stance.

Just based on comments from individual Federal Reserve officials, the probability of a rate cut has switched back and forth from 80%→30%→80%. This phenomenon confirms the core feature of the current market: the influence of systemic capital flows far outweighs that of active macro views.

Here is evidence from the microstructure level:

1) Volatility-targeting funds mechanically reduce leverage when volatility spikes and increase leverage when volatility falls.

These funds do not care about the "economy" because they adjust their investment exposure based on a single variable: the degree of market volatility.

When market volatility increases, they reduce risk→sell; when volatility decreases, they increase risk→buy. This causes automatic selling in weak markets and automatic buying in strong markets, amplifying two-way swings.

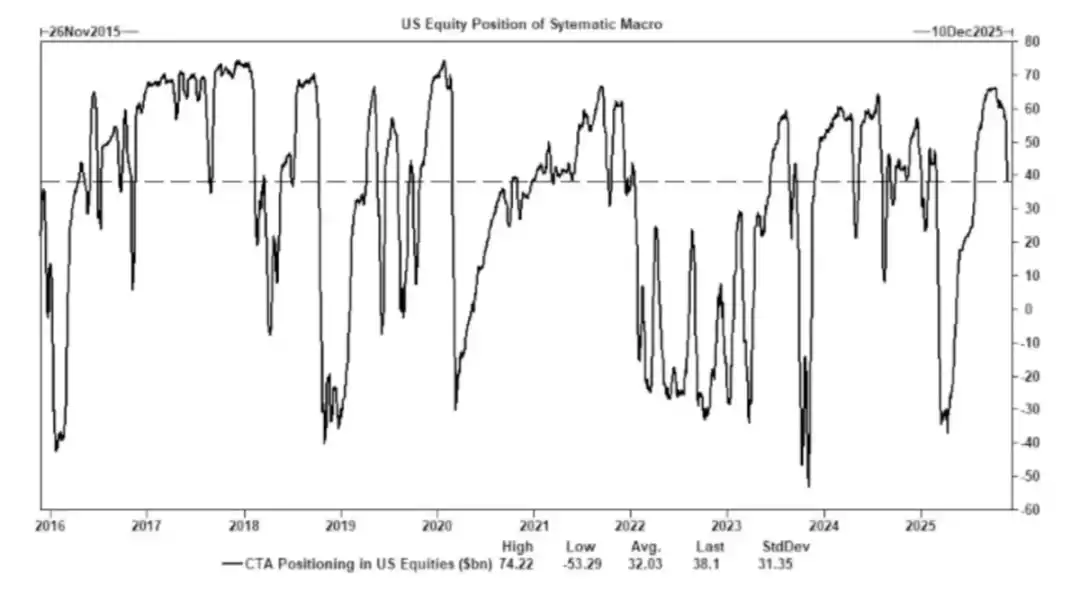

2) Commodity Trading Advisors (CTA) switch between long and short positions at preset trend levels, generating forced flows.

CTAs follow strict trend rules with no subjective "views"—they execute mechanically: buy when the price breaks above a certain level, sell when it falls below a certain level.

When enough CTAs hit the same threshold at the same time, even if fundamentals are unchanged, it can trigger large-scale coordinated buying or selling, even moving the entire index for several consecutive days.

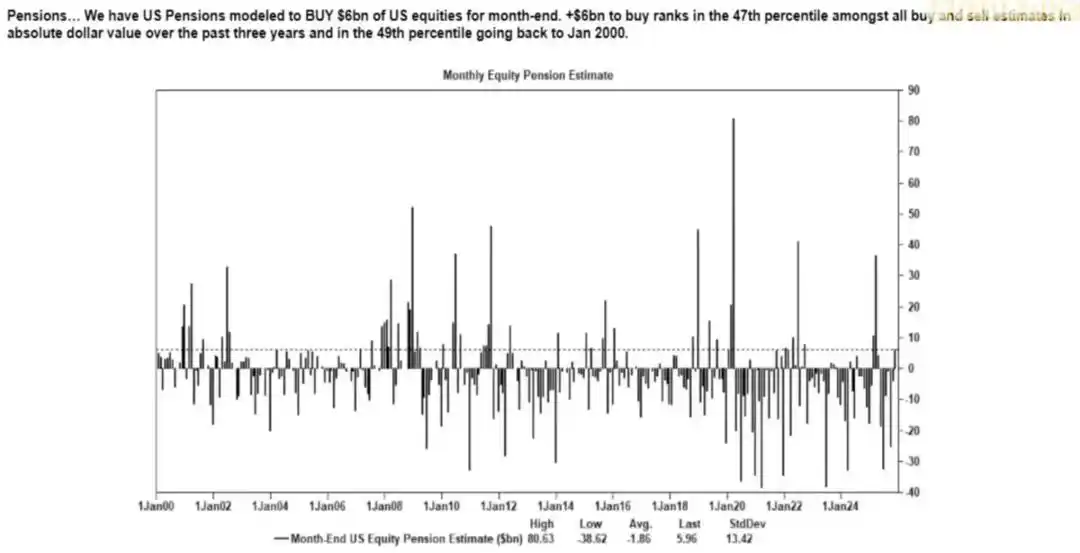

3) The stock buyback window remains the largest source of net equity demand.

Corporate buybacks are the largest net buyers in the stock market, surpassing the buying scale of retail investors, hedge funds, and pension funds.

During open buyback windows, companies inject billions of dollars into the market every week, resulting in:

· An inherent upward momentum during buyback season

· Noticeable market weakness after the buyback window closes

· Structural buying unrelated to macro data

This is also the core reason why the stock market can still rise even when market sentiment is low.

4) The inverted volatility (VIX) curve reflects short-term hedging imbalances, not "panic."

Normally, long-term volatility (3-month VIX) is higher than short-term volatility (1-month VIX). When this relationship reverses, it is often interpreted as "rising panic," but today this is more driven by the following factors:

· Short-term hedging demand

· Option market makers adjusting positions

· Weekly options inflows

· Systematic strategies conducting end-of-month hedging

This means: VIX surges ≠ panic, but rather the result of hedging capital flows.

This distinction is crucial—volatility is now driven by trading behavior, not narrative logic.

The current market environment is more sensitive to sentiment and capital flows: economic data has become a lagging indicator for asset prices, and Federal Reserve communication is now the main trigger for volatility. Liquidity, position structure, and policy tone are replacing fundamentals as the main drivers of price discovery.

AI Is the Key to Avoiding a Full Recession

AI has become the stabilizer of the macroeconomy: it effectively replaces cyclical hiring demand, supports corporate profitability, and maintains GDP growth even when labor market fundamentals are weak.

This means the US economy's dependence on AI capital expenditure far exceeds what policymakers publicly admit.

· Artificial intelligence is suppressing labor demand for the lowest-skilled, most easily replaced third of the labor market. This is usually where cyclical recessions first appear.

· Productivity gains mask what would otherwise appear to be widespread labor market deterioration. Output remains stable because machines absorb work previously done by entry-level labor.

· Fewer employees, higher corporate profit margins, while households bear the socioeconomic burden. This shifts income from labor to capital—a typical recession dynamic.

· AI-related capital formation artificially maintains GDP resilience. Without capital expenditure in the AI sector, overall GDP data would be noticeably weaker.

Regulators and policymakers will inevitably support AI capital expenditure through industrial policy, credit expansion, or strategic incentives, because the alternative is economic recession.

The Wealth Gap Has Become a Macro Constraint

Mike Green's assertion that the "poverty line ≈ $130,000 - $150,000" sparked a strong backlash, which precisely illustrates the deep resonance of this issue.

The core truths are as follows:

· Childcare costs exceed rent/mortgage

· Housing is structurally unaffordable

· Baby boomers dominate asset ownership

· Young people only have income, no capital accumulation

· Asset inflation widens the wealth gap year by year

The wealth gap will force adjustments in fiscal policy, regulatory stances, and asset market interventions. As cryptocurrency becomes a tool for the younger generation to participate in capital growth, its political significance will become increasingly prominent, and policymakers will adjust their attitudes accordingly.

The Bottleneck for AI Scaling Is Energy, Not Computing Power

Energy will become the new core narrative: the scaled development of the AI economy cannot happen without the simultaneous expansion of energy infrastructure.

Discussions about GPUs overlook a more critical bottleneck: electricity supply, grid capacity, nuclear and natural gas capacity construction, cooling infrastructure, copper and key minerals, and data center location restrictions.

Energy is becoming the limiting factor for AI development. In the next decade, the energy sector (especially nuclear, natural gas, and grid modernization) will become one of the most leveraged investment and policy directions.

A Dual-Track Economy Emerges, Gap Continues to Widen

The US economy is splitting into two major sectors: the capital-driven AI sector and the labor-dependent traditional sector, with almost no overlap and increasingly divergent incentive structures.

The AI economy continues to expand:

· High productivity

· High profit margins

· Low labor dependence

· Strategically protected

· Attracts capital inflows

The real economy continues to shrink:

· Weak labor absorption capacity

· High consumer pressure

· Declining liquidity

· Asset concentration

· Inflationary pressure

The most valuable companies in the next decade will be those that can reconcile or leverage this structural divergence.

Outlook

· AI will receive policy support, because the alternative is recession

· Treasury-led liquidity will replace quantitative easing (QE) as the main policy channel

· Cryptocurrency will become a political asset class tied to intergenerational equity

· The real bottleneck for AI is energy, not computing power

· In the next 12-18 months, the market will continue to be driven by sentiment and capital flows

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC returns to $93,000 after a brief dip to $83,000—what exactly happened?

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

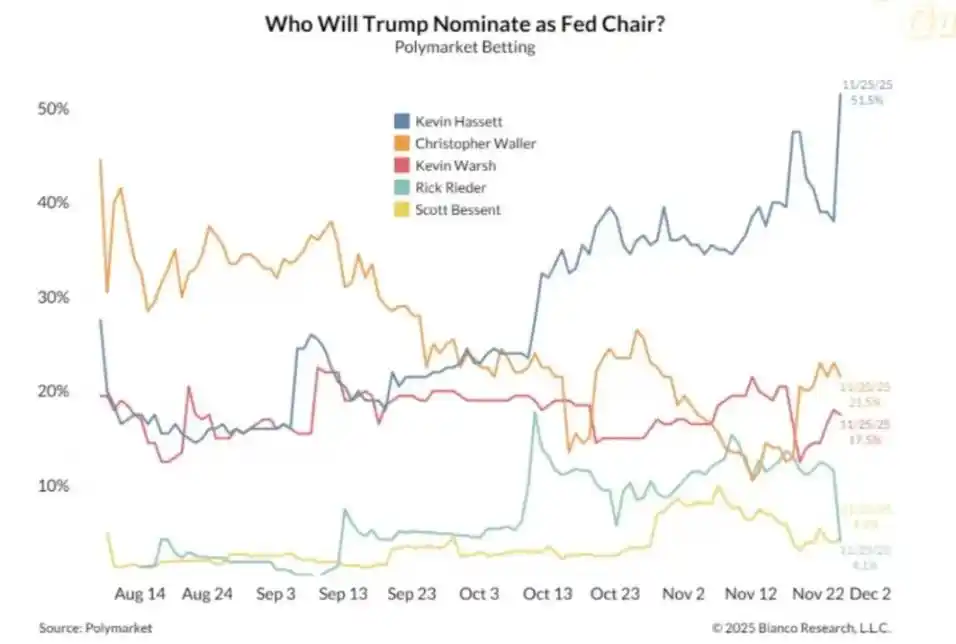

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.