Bitcoin News Update: Bitcoin Faces Uncertain Path as Hash Rate Shifts, Federal Reserve Actions, and Derivatives Leverage Intersect

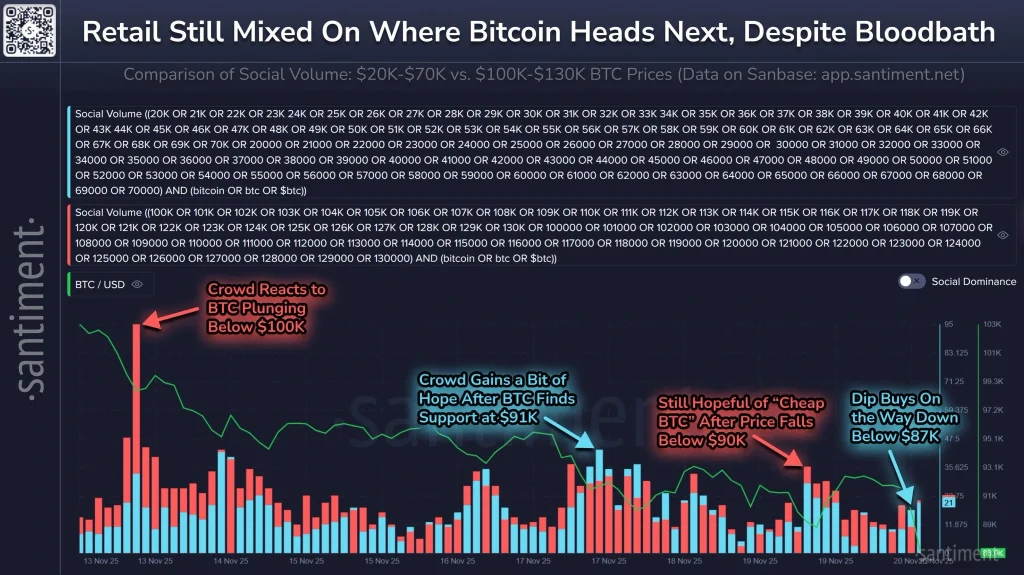

- Bitcoin fell below $93,000 as analysts highlight hash rate declines and November 26 difficulty adjustments as critical for network stability. - Digital asset outflows hit $3.2B in three weeks, with ETF withdrawals and waning institutional demand signaling potential "mini bear market" risks. - Derivatives markets show $3.3B open interest surge, while K33 warns aggressive leverage creates "concentration of risk" ahead of possible 16% declines. - Fed policy uncertainty (55% chance of rate hold) and $523M da

Bitcoin’s recent dip below $93,000 has sparked increased debate about its short-term outlook, with experts such as Peter Brandt from

Across the broader market, there are few signs of recovery. Digital asset investment vehicles have experienced $3.2 billion in outflows over the past three weeks, with U.S. spot

The relationship between Bitcoin’s price swings and traditional financial markets is also under the spotlight. CNBC’s Bret Kenwell pointed out that Bitcoin’s 13% weekly drop has paralleled a 2.8% fall in the S&P 500, reinforcing the idea that the cryptocurrency often acts as a “leading indicator” for equities

Meanwhile, the derivatives sector is showing signs of increased vulnerability. K33 Research has flagged a “worrisome” market setup as traders heavily bet on a rebound,

Glassnode’s “Below the Band” report further highlights the market’s fragile state, noting that Bitcoin has dropped beneath key cost bases for short-term holders and the -1 standard deviation band, triggering panic selling among top buyers

As these challenges persist, market participants are closely watching for possible turning points. The upcoming difficulty adjustment in November, decisions from the Federal Reserve, and shifts in ETF flows are all likely to influence Bitcoin’s direction. For now, however, subdued spot demand, high leverage in derivatives, and cautious institutional behavior point to continued volatility in the near future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

21Shares Adds Six New Crypto ETPs, AAVE, ADA, Link, DOT on Nasdaq Stockholm

Bitcoin Price Drops Below $87k; Here is Why a Rebound Is Likely Ahead

Ethereum News Today: Can Ethereum Hold the $3,000 Mark or Is a Rebound on the Horizon?

- Ethereum stabilizes near $3,000 support amid crypto market correction, with $50.7M in liquidations and mixed technical indicators. - Analysts split between Tom Lee's $7,000 45-day bullish forecast and bearish warnings over 37% declines and "quantitative tightening" pressures. - BlackRock's staked ETH trust registration and Fed rate cut expectations add structural support amid $2.36% daily drop and oversold RSI conditions. - Key resistance at $3,800-$4,000 and liquidity clusters around $2,900–$3,000 deter

Bitcoin News Update: Ark Invest Shows Confidence in Crypto's Endurance Despite Market Slump

- Ark Invest, led by Cathie Wood, bought shares in Coinbase , BitMine, Circle , and Bullish, signaling crypto sector confidence amid market declines. - BitMine became the largest Ethereum treasury holder with 3.6M tokens, while Coinbase launched a new ICO platform to diversify investor options. - Circle reported strong Q3 earnings but faced a 21.3% stock drop, contrasting with upgraded analyst ratings due to USDC growth and regulatory clarity hopes. - Market volatility persisted as Bitcoin and Ethereum dec