Bitcoin Updates: As Bitcoin Drops Below $100K, Investors Shift Focus to AI

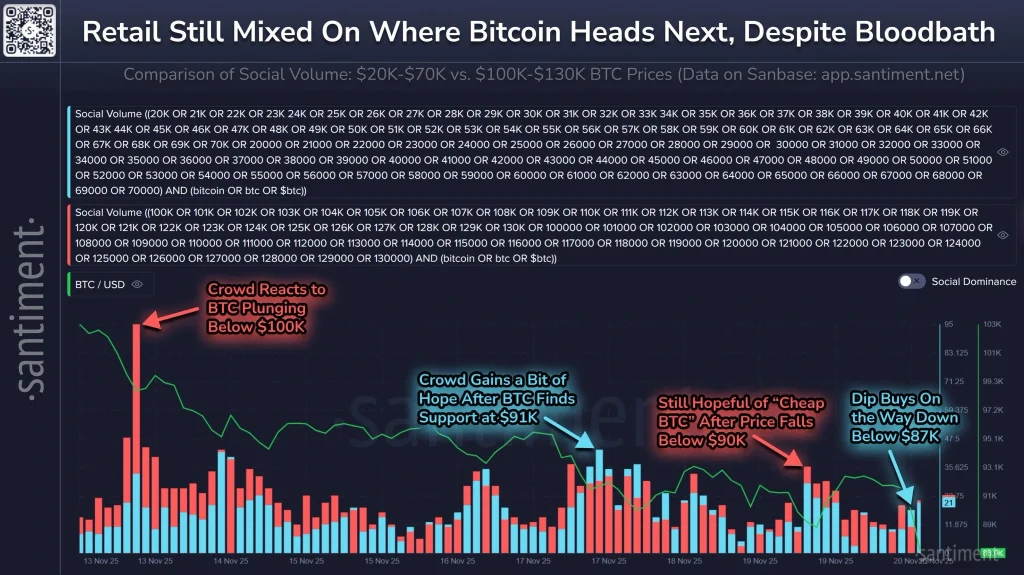

- Bitcoin fell below $100,000 for first time since June 2025, erasing $1 trillion in market value since October's $126,000 peak. - $3.2B in digital asset outflows over three weeks highlight waning institutional demand, with ETFs like iBIT/FBTC seeing record declines. - JEXAI's AI-powered platform claims 60% energy cost reductions and automated crypto portfolio management to address market volatility. - Fed policy uncertainty and negative futures-to-spot basis signal cautious positioning, with Bitcoin stabi

Bitcoin's value has

This downturn has led traders to reconsider their risk strategies, with many exploring new approaches amid increased market swings. JEXAI, an AI-driven crypto asset management platform, has gained attention as a possible answer,

Uncertainty around Federal Reserve policy continues to weigh heavily on the market.

Interest from institutional investors has also diminished.

Technical signals point to oversold territory,

Despite recent instability,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

21Shares Adds Six New Crypto ETPs, AAVE, ADA, Link, DOT on Nasdaq Stockholm

Bitcoin Price Drops Below $87k; Here is Why a Rebound Is Likely Ahead

Ethereum News Today: Can Ethereum Hold the $3,000 Mark or Is a Rebound on the Horizon?

- Ethereum stabilizes near $3,000 support amid crypto market correction, with $50.7M in liquidations and mixed technical indicators. - Analysts split between Tom Lee's $7,000 45-day bullish forecast and bearish warnings over 37% declines and "quantitative tightening" pressures. - BlackRock's staked ETH trust registration and Fed rate cut expectations add structural support amid $2.36% daily drop and oversold RSI conditions. - Key resistance at $3,800-$4,000 and liquidity clusters around $2,900–$3,000 deter

Bitcoin News Update: Ark Invest Shows Confidence in Crypto's Endurance Despite Market Slump

- Ark Invest, led by Cathie Wood, bought shares in Coinbase , BitMine, Circle , and Bullish, signaling crypto sector confidence amid market declines. - BitMine became the largest Ethereum treasury holder with 3.6M tokens, while Coinbase launched a new ICO platform to diversify investor options. - Circle reported strong Q3 earnings but faced a 21.3% stock drop, contrasting with upgraded analyst ratings due to USDC growth and regulatory clarity hopes. - Market volatility persisted as Bitcoin and Ethereum dec