SEC Addresses Crypto Privacy Challenge: Balancing Investor Security and Technological Autonomy

- SEC hosts roundtable to address crypto privacy vs. surveillance tensions amid evolving regulatory framework. - Agency shifts focus to core compliance areas, deprioritizing crypto enforcement compared to prior administration. - DOJ intensifies crackdown on privacy tools, convicting Samourai Wallet founders for AML violations. - Regulatory divide between SEC and DOJ creates uncertainty as Congress delays digital asset bill. - Debate highlights tension between investor protection and crypto's decentralizati

The U.S. Securities and Exchange Commission (SEC) plans to convene a roundtable to tackle the intensifying discussion around privacy and monitoring in the crypto space, as regulatory oversight continues to shift under Chair Paul Atkins. This meeting, which is part of a larger initiative to create a "logical, unified, and principled" regulatory approach for digital assets, comes during

Under its current leadership, the SEC has recorded a 30% reduction in enforcement cases against publicly traded firms and their affiliates compared to the previous administration led by Gary Gensler

At the same time, the DOJ has ramped up its scrutiny of crypto privacy, with the recent sentencing of Samourai Wallet’s co-founders highlighting the legal dangers associated with decentralized tools that conceal transaction details

At present, the SEC’s roundtable is regarded as a pivotal moment for shaping its stance on privacy and oversight. Although the agency has yet to release concrete plans, the discussion is expected to explore the balance between protecting investors and upholding the core technological values of crypto, such as decentralization and privacy

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

21Shares Adds Six New Crypto ETPs, AAVE, ADA, Link, DOT on Nasdaq Stockholm

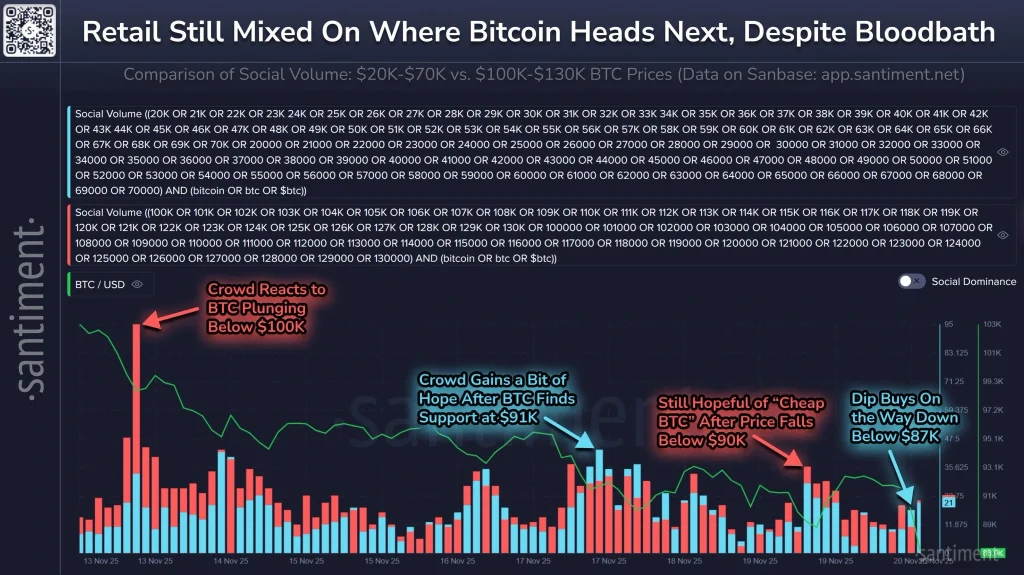

Bitcoin Price Drops Below $87k; Here is Why a Rebound Is Likely Ahead

Ethereum News Today: Can Ethereum Hold the $3,000 Mark or Is a Rebound on the Horizon?

- Ethereum stabilizes near $3,000 support amid crypto market correction, with $50.7M in liquidations and mixed technical indicators. - Analysts split between Tom Lee's $7,000 45-day bullish forecast and bearish warnings over 37% declines and "quantitative tightening" pressures. - BlackRock's staked ETH trust registration and Fed rate cut expectations add structural support amid $2.36% daily drop and oversold RSI conditions. - Key resistance at $3,800-$4,000 and liquidity clusters around $2,900–$3,000 deter

Bitcoin News Update: Ark Invest Shows Confidence in Crypto's Endurance Despite Market Slump

- Ark Invest, led by Cathie Wood, bought shares in Coinbase , BitMine, Circle , and Bullish, signaling crypto sector confidence amid market declines. - BitMine became the largest Ethereum treasury holder with 3.6M tokens, while Coinbase launched a new ICO platform to diversify investor options. - Circle reported strong Q3 earnings but faced a 21.3% stock drop, contrasting with upgraded analyst ratings due to USDC growth and regulatory clarity hopes. - Market volatility persisted as Bitcoin and Ethereum dec