Cybersecurity’s AI Battle: Doppel Takes the Lead Responding to a 300% Increase in Social Engineering Threats

- Doppel raised $70M in Series C funding at $600M+ valuation to combat AI-powered social engineering attacks, which have surged 300% annually. - The AI platform uses machine learning to detect anomalies like deepfake voice modulation and AI-generated phishing emails in real-time. - While Doppel expands partnerships, VeriSign and C3.ai face scrutiny over stock sales and declining revenues amid AI adoption risks. - Doppel CEO Alex Johnson warns that AI security tools risk becoming vulnerabilities themselves

Doppel, a cybersecurity company focused on AI-powered threat detection, has raised $70 million in Series C funding, pushing its valuation above $600 million. The investment round, led by unnamed backers, highlights increasing worries about AI-driven social engineering threats,

The firm’s system uses machine learning to examine communication behaviors, spotting irregularities such as altered voices in calls or AI-created content in emails. Doppel’s products are

By comparison,

The semiconductor industry also delivered mixed signals.

C3.ai Inc. (AI), which develops AI-based enterprise applications,

The differing outcomes for these companies illustrate the double-edged sword of AI integration. While Doppel and Citigroup are pouring resources into AI to boost security and productivity, firms like C3.ai and VeriSign are contending with the pitfalls of heavy dependence on emerging technologies. As Doppel CEO Alex Johnson remarked, "The battle against AI-enabled threats is just starting. The next challenge is making sure our defensive tools don’t become weaknesses themselves."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

As Walmart Thrives, Target's New CEO Faces Challenge Amidst Three-Year Decline

- Target's Q3 net income fell 19% amid 12-quarter sales decline, citing weak demand, markdowns, and external disruptions like government shutdowns. - New CEO Fiddelke announced a $5B 2026 investment plan to modernize stores, improve product variety, and cut 1,800 corporate jobs as part of turnaround efforts. - Walmart's 4% Q3 sales growth and 12.6% 2025 stock gain contrast with Target's 35% stock drop, highlighting grocery dominance and e-commerce advantages. - Analysts question Target's ability to retain

SUSHI Falls by 3.01% as Market Sentiment Dampens Interest in Cryptocurrencies

- SUSHI token dropped 3.01% in 24 hours to $0.4562, with 66.32% annual decline highlighting long-term struggles. - Lack of project developments and weak differentiation from competitors has driven investors toward more stable crypto alternatives. - Analysts warn SUSHI's recovery depends on macroeconomic shifts or strategic innovations to rebuild market confidence.

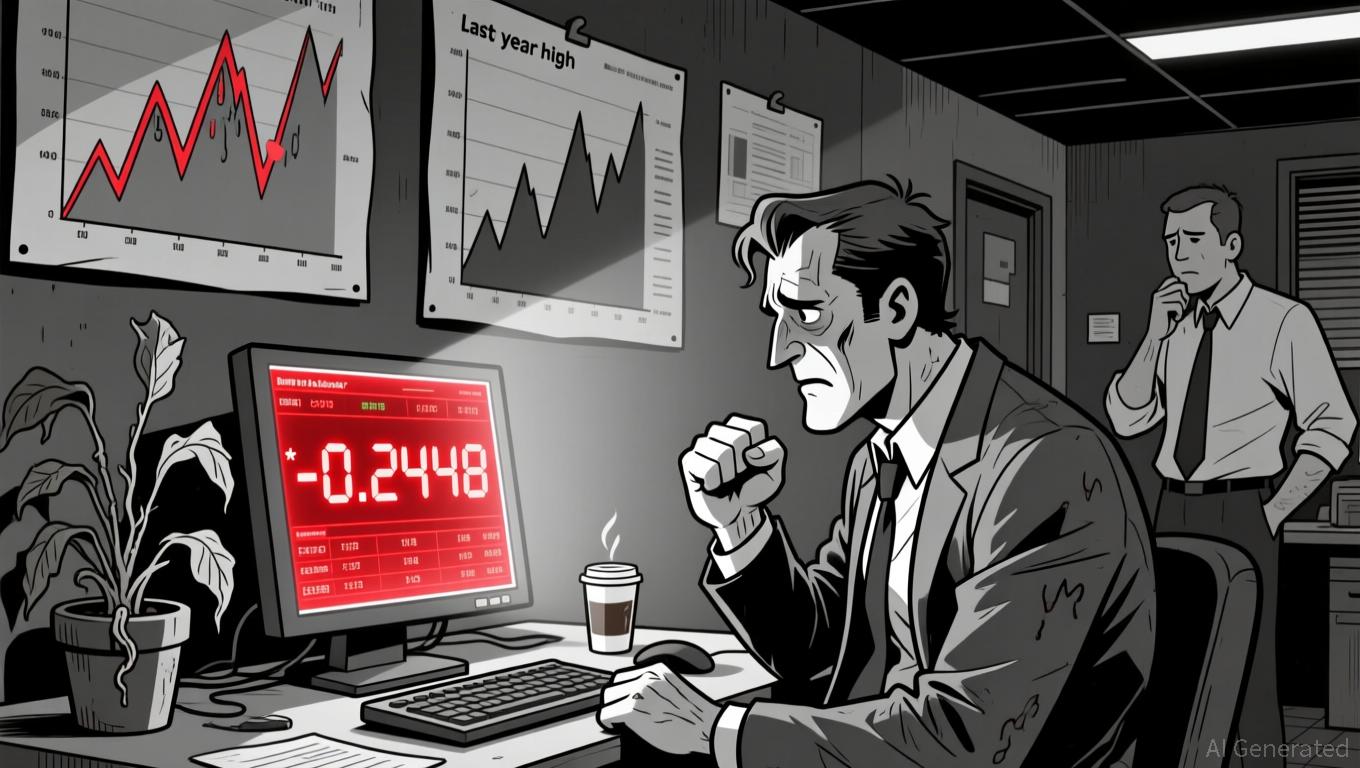

Stellar (XLM) Drops 4.18% Over 24 Hours as Market Fluctuates

- Stellar (XLM) fell 4.18% in 24 hours to $0.2448, with 19.57% monthly and 26.27% annual declines. - The drop reflects broader crypto market volatility, not direct XLM-specific news or catalysts. - While Bitcoin and Ethereum rose, XLM's decline persists independently, lacking short-term momentum. - Analysts cite macroeconomic uncertainty and regulatory shifts as potential future risks for XLM's trajectory.

Bitcoin Updates: Institutional Investments Boost Optimism for Bitcoin as Prediction Markets Remain Wary About 2025

- Institutional bets like Harvard's $443M BlackRock IBIT ETF investment signal growing Bitcoin confidence despite 2025 volatility. - Analyst Tom Lee predicts 2025 selling ahead of 2026 halving could create buying opportunities, contrasting prediction markets' cautious 2025 forecasts. - Bitcoin fell below $90,000 in November amid macroeconomic uncertainty, yet El Salvador's $100M BTC purchase reinforces crypto adoption. - Prediction platforms like Kalshi and Coinbase's new market service highlight instituti