El Salvador Buys Bitcoin Dip, Expands Reserves Amid IMF Pressure

Quick Breakdown:

- El Salvador marked the fourth anniversary of adopting Bitcoin as legal tender with a significant purchase of 420 BTC worth $25.6 million.

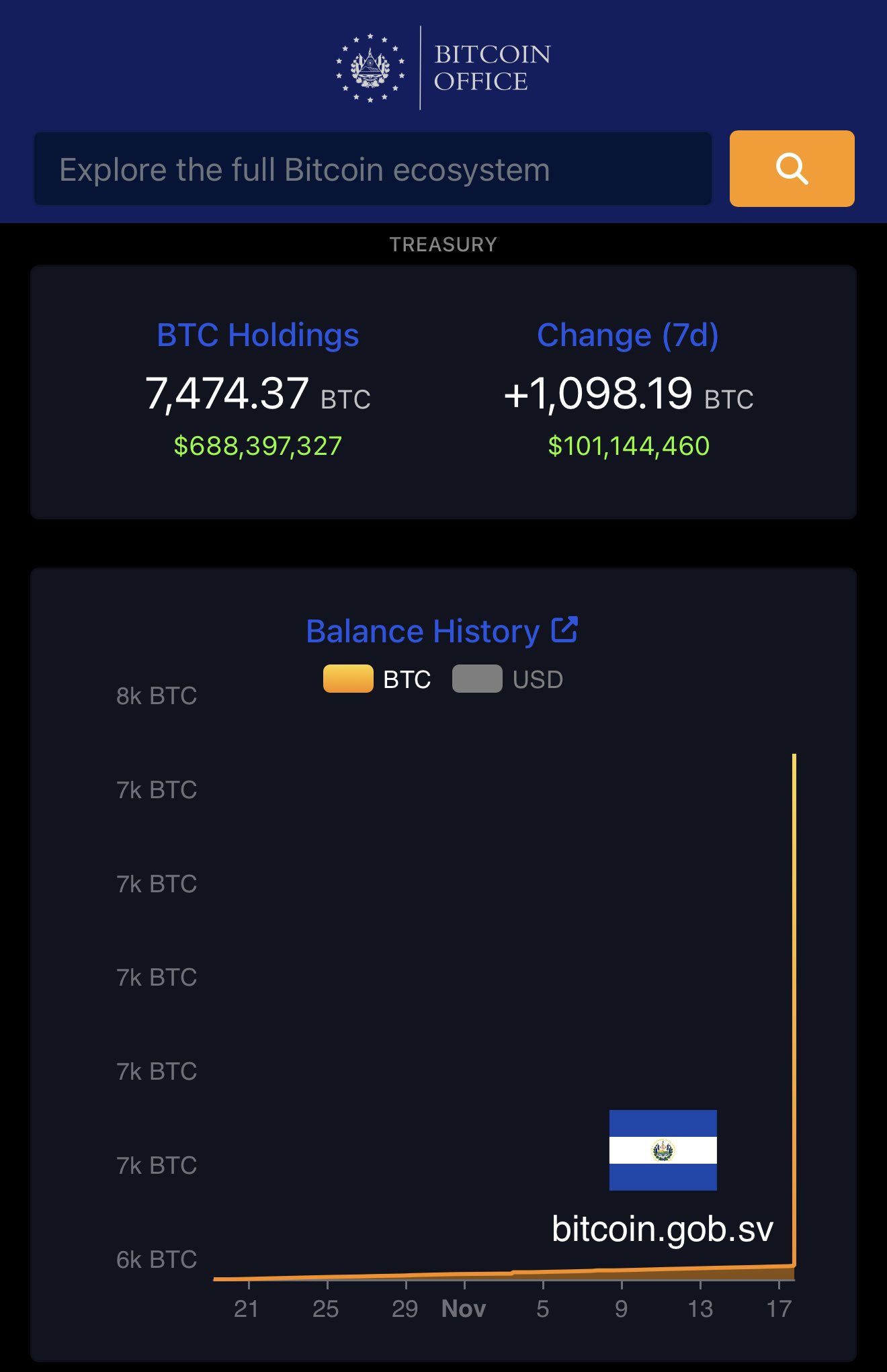

- This move increased its Bitcoin reserves to over 7,474.37 BTC, valued at approximately $700 million, despite the International Monetary Fund’s (IMF) advice to halt acquisitions.

- The government’s proactive buying strategy highlights its commitment to Bitcoin despite market volatility and IMF constraints.

Nation makes record Bitcoin purchase

El Salvador’s Bitcoin Office announced the acquisition of 1,090 BTC, valued at approximately $100 million, marking the country’s largest single-day purchase since adopting Bitcoin as legal tender in 2021. The transaction, occurring during a sharp market dip, signals the administration’s ongoing faith in Bitcoin as a strategic national asset. President Bukele shared the purchase details on social media, reiterating his government’s intention to continue buying the cryptocurrency regardless of prevailing market conditions.

Source:

President Nayib Bukele

Source:

President Nayib Bukele

With this investment, El Salvador’s holdings have increased to 7,474 BTC, valued at nearly $676 million at current market rates. This purchase comes even as the IMF reportedly maintains restrictions on new public-sector Bitcoin purchases due to existing loan agreements, leading to questions about the source and structure of the latest buy. The gap between public statements and blockchain data has prompted debate about transparency in the nation’s reporting and reserves management.

Implications and global reactions

The purchase highlights the Bukele administration’s commitment to positioning El Salvador as a leader in state-level digital asset adoption. While proponents argue this move could boost financial inclusion and reduce remittance costs, critics, including the IMF, point to risks such as market volatility and potential fiscal instability. The IMF had cautioned against further accumulation, and recent discrepancies between official wallet activities and public announcements have intensified calls for greater transparency around El Salvador’s strategy.

El Salvador’s continued accumulation of Bitcoin has attracted both attention and scrutiny. International observers question the long-term impacts on national finances, given the volatile nature of the crypto market, even as the country posts significant unrealized gains amid Bitcoin’s upward price cycles.

Notably, Bolivia’s central bank now views cryptocurrency as a “viable and reliable alternative,” following the formalization of a collaboration with El Salvador, which has made Bitcoin legal tender. Through a memorandum of understanding, the nations will continue to work together on crypto policy and regulation. This partnership aims to modernize Bolivia’s financial system, utilizing El Salvador’s expertise to enhance financial inclusion and establish a regulated digital asset ecosystem, thereby integrating blockchain technology into its long-term economic strategy.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin’s $170K Bet: Will Digital Gold Overtake Traditional Standards?

- JPMorgan predicts Bitcoin could reach $170,000 in 6-12 months, citing market-cap comparisons to gold . - Recent price drops below $90,000 triggered warnings about leveraged liquidations and whale selling pressures. - Institutional adoption grows with BlackRock's $80B iBIT ETF, but Polymarket shows 77% odds of further declines. - New projects like Bitcoin Munari (BTCM) aim to leverage volatility with EVM-compatible Layer 1 blockchain plans. - Macroeconomic factors and regulatory clarity will determine whe

Is Trust Wallet Token (TWT) Set for a Bullish Turn as Institutions Show Interest?

- Trust Wallet Token (TWT) expands on-chain utility in 2025 with gas-free transactions, cross-chain payments, and FlexGas fee payments across major blockchains. - Institutional adoption grows through partnerships like AlphaTON Capital's $4M TON staking via BitGo, validating TWT's security and scalability for corporate Web3 strategies. - With 210M users and $30B secured assets, TWT leverages Trust Premium loyalty program and DeFi synergies to drive utility-driven value creation. - Price surged from $0.7 to

TWT's Revamped Tokenomics: Transforming DeFi Rewards and Token Value

- Trust Wallet Token (TWT) reimagines DeFi incentives in 2025 by shifting from governance to gamified utility via the Trust Premium loyalty program. - Tiered rewards (Bronze→Gold) for swapping/staking TWT, combined with a 2020 burn of 88.9B tokens, create scarcity and utility-driven valuation. - Fixed supply and gas discounts embed TWT into daily use, contrasting inflationary models while stabilizing value through sustained engagement. - Partnerships with Ondo Finance link TWT to real-world assets, bridgin

U.S. Regulator OCC Clarifies How Banks Can Handle Network 'Gas Fees'