Massive $869M Outflow Slams Bitcoin. Is a Crash Coming?

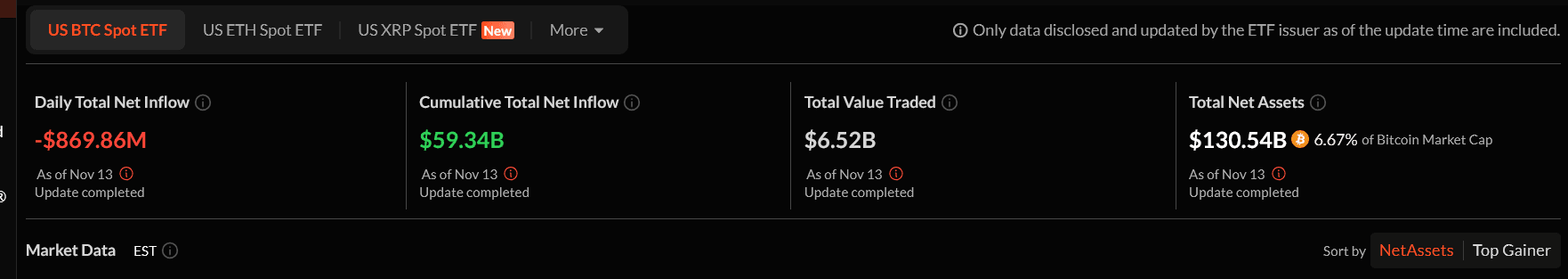

The bitcoin market jus t took another heavy hit. U.S. spot bitcoin ETFs recorded $869.9 million in outflows on Thursday, making it the second-largest daily exit since these products launched. That kind of number doesn’t happen quietly. It rippled through the entire market, dragged prices lower, and sparked fresh questions about whether this is fear taking over or simply a reset before the next leg up.

Why Did Spot Bitcoin ETFs Suddenly See Such Big Outflows?

Thursday’s mass exit wasn’t an accident. According to SoSoValue data , several major funds were hit hard. Grayscale’s Bitcoin Mini Trust saw the biggest drain at $318.2 million. BlockRock’s IBIT wasn’t far behind with $256.6 million slipping out, while Fidelity’s FBTC lost $119.9 million. Even GBTC and funds from Ark, 21Shares, Bitwise, VanEck, Invesco, Valkyrie, and Franklin Templeton were in the red.

This move ranks just behind the all-time record set on February 25, 2025, when investors pulled $1.14 billion in a day.

So what’s going on? The institutional flows tend to move together. When macro conditions start feeling shaky, these players reduce risk in clusters.

Vincent Liu, CIO of Kronos Research, summed it up well . Large outflows reflect a risk-off turn, he said. Institutions are stepping back as macro noise builds, but he doesn’t see it as a collapse in long-term demand. Instead, he views these drops as part of an oversold setup that long-term buyers might soon take advantage of.

What’s Triggering This Risk-Off Mood?

Markets aren’t reacting to a single shock. It’s more of a pile-up of small but worrying signals.

Min Jung of Presto Research noted that investors are rotating out of higher-beta assets and moving toward safety. The uncertainty around the Fed is a big piece of this. Weak ADP and NFIB readings point to a softening labor market. That feeds into expectations that the Fed is preparing to ease, but with caution. And traders hate uncertainty more than bad news.

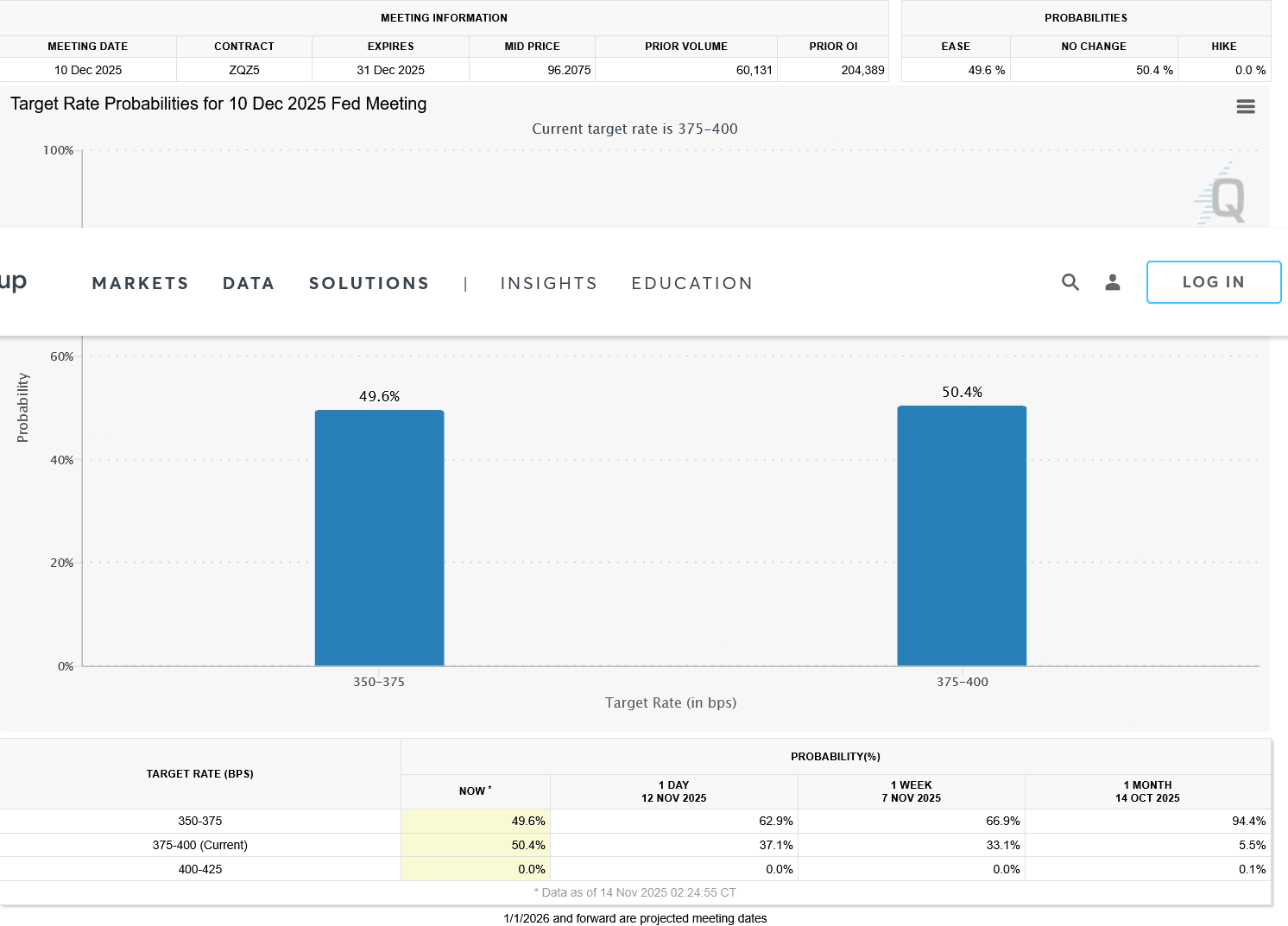

Fed rate-cut odds for December have now slipped to 50.4 % according to the CME FedWatch Tool . When central bank direction becomes fuzzy, money tends to retreat from volatile assets first. Bitcoin is always at the front of that line.

How Did Bitcoin Price React to the Bitcoin ETFs Outflows?

The Bitcoin price action was quick and sharp. Bitcoin price dropped 6.4% over the past 24 hours, touching $96,956 early Friday.

Liu described the sell-off as a liquidity let-down. With cascading liquidations and fewer buyers in the order book, every drop hits harder. According to him, demand is clustering between $92,000 and $95,000, which could act as a cushion if selling continues.

Justin d’Anethan from Arctic Digital echoed the same idea. He pointed out that if bitcoin dips into the lower $90Ks, plenty of sidelined investors will view that zone as an opportunity. Not long ago, BTC was climbing past the mid-$120Ks. Many missed that move and are waiting for a deeper reset.

Is There a Bigger Trend Behind the Sell-Off?

Sometimes a crash has a clear trigger. This wasn’t one of those days. Jung noted that the pullback didn’t come from a single event. Instead, it was a blend of macro uncertainty, weakening risk appetite, and jittery flows ahead of the next FOMC meeting.

When the market feels unsure, even neutral data gets interpreted negatively. That’s the kind of environment bitcoin is dealing with right now.

What Happens Next?

The story isn’t over. The next few sessions will show whether the $92K to $95K range can hold. If it does, $BTC might see a relief bounce as liquidity stabilizes and buyers return. If it breaks, the lower $90Ks could come into focus quickly.

Here’s what matters most right now:

- Bitcoin ETF outflows are a reflection of macro anxiety, not a collapse in bitcoin’s long-term story.

- Liquidity is thin, so volatility stays elevated.

- Support zones are nearby, and long-term buyers are watching closely.

This is the kind of environment where panic selling and strategic accumulation happen at the same time. The next bounce will reveal which side is in control.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Canary XRP ETF attracts $245 million in net inflows on first trading day

Ethereum Updates Today: Surge in Stablecoins Fuels Discussion: Expansion or Threat to International Financial Stability

- Fed's Stephen Miran highlights stablecoins as a transformative force in emerging markets, outcompeting traditional banking systems and driving economic growth. - JPMorgan and DBS develop blockchain-based tokenization frameworks to enable 24/7 real-time cross-bank payments via tokenized deposits. - Ethereum's tokenized assets surge to $201B, with stablecoins dominating DeFi and cross-border transactions, driven by institutional adoption. - Cathie Wood cuts Bitcoin price forecasts due to stablecoin adoptio

Solana News Update: Institutional Investors Drive Solana ETFs Higher While Price Approaches $144 Support Level

- Solana ETFs gained $351M in 11 days as institutional buyers "buy the dip," despite a 20% price drop to $155. - Technical indicators show bearish pressure with RSI at 37 and critical $144 support level at risk of breakdown. - Institutional confidence contrasts with retail profit-taking, while NYSE's new options trading adds complexity to market dynamics. - Analysts debate $173 resistance breakout potential vs. $120-$80 downside risks amid $3.2B+ year-to-date institutional inflows.

COAI Token Fraud: An Urgent Alert for Cryptocurrency Investors

- COAI token's 2025 collapse exposed DeFi and algorithmic stablecoin vulnerabilities, triggering market turmoil and regulatory scrutiny. - Centralized governance (87.9% token control) and opaque liquidity models enabled manipulation, while fragmented regulations (GENIUS Act, MiCA) worsened compliance risks for smaller projects. - Investors now prioritize due diligence on team transparency, regulatory compliance, and tokenomics, as COAI's lack of audits and centralized control highlighted systemic risks. -