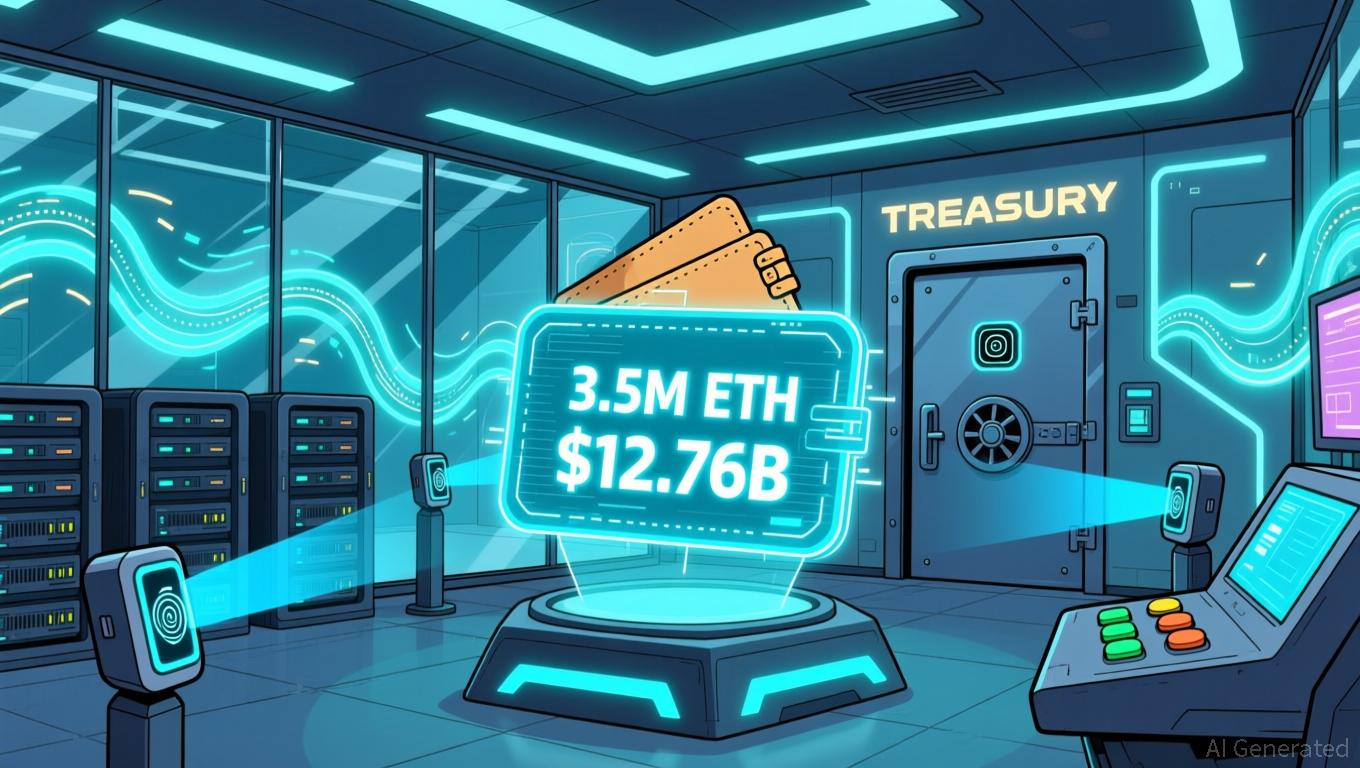

Ethereum Latest Updates: BitMine Commits $12 Billion to ETH—Chairman Predicts $12,000 Despite 13% Market Drop

- BitMine Immersion Technologies (BMNR) surged ETH purchases by 34% to 110,288 tokens weekly, now holding 3.5M ETH (2.9% supply) valued at $12.76B. - Leadership overhaul appoints Chi Tsang as CEO, aligning with chairman Tom Lee's "supercycle" vision and $12K ETH price target by 2025. - Market reacts mixed as ETH dips 13.4% in two weeks, with treasury buys currently underwater and regulatory shifts like CFTC oversight emerging. - Shareholders demand transparency amid unstaked ETH holdings and evolving crypt

BitMine Immersion Technologies (NYSE: BMNR) is ramping up its

This aggressive accumulation comes in the wake of a broader downturn in the market, with ETH trading at $3,561—a 13.4% drop over two weeks. BitMine’s chairman, Tom Lee, described the price decline as a strategic chance to strengthen the company’s position ahead of a possible “supercycle” for Ethereum in the coming decade. “

The shift toward Ethereum comes alongside changes in corporate leadership. On Nov. 14, BitMine named Chi Tsang as CEO and added three independent directors: Robert Sechan (NewEdge Capital), Jason Edgeworth (JPD Family Holdings), and Olivia Howe (RigUp). Tsang, who has a background in technology and DeFi, highlighted BitMine’s function as a link between conventional finance and the Ethereum network. “

Market response to these developments has been varied. BitMine’s stock has climbed 400% this year to $41.15, but its latest ETH acquisitions are facing

Regulatory shifts could also impact BitMine’s future.

As BitMine pursues its “alchemy of 5%” ETH acquisition strategy, the company is facing

With its treasury strategy and leadership team evolving, BitMine’s next steps will be watched closely by both the crypto sector and traditional investors. The company’s ability to combine rapid ETH accumulation with operational effectiveness—and to leverage Ethereum’s long-term promise—will be key to its influence on corporate treasury management in the digital era.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Canary XRP ETF attracts $245 million in net inflows on first trading day

Ethereum Updates Today: Surge in Stablecoins Fuels Discussion: Expansion or Threat to International Financial Stability

- Fed's Stephen Miran highlights stablecoins as a transformative force in emerging markets, outcompeting traditional banking systems and driving economic growth. - JPMorgan and DBS develop blockchain-based tokenization frameworks to enable 24/7 real-time cross-bank payments via tokenized deposits. - Ethereum's tokenized assets surge to $201B, with stablecoins dominating DeFi and cross-border transactions, driven by institutional adoption. - Cathie Wood cuts Bitcoin price forecasts due to stablecoin adoptio

Solana News Update: Institutional Investors Drive Solana ETFs Higher While Price Approaches $144 Support Level

- Solana ETFs gained $351M in 11 days as institutional buyers "buy the dip," despite a 20% price drop to $155. - Technical indicators show bearish pressure with RSI at 37 and critical $144 support level at risk of breakdown. - Institutional confidence contrasts with retail profit-taking, while NYSE's new options trading adds complexity to market dynamics. - Analysts debate $173 resistance breakout potential vs. $120-$80 downside risks amid $3.2B+ year-to-date institutional inflows.

COAI Token Fraud: An Urgent Alert for Cryptocurrency Investors

- COAI token's 2025 collapse exposed DeFi and algorithmic stablecoin vulnerabilities, triggering market turmoil and regulatory scrutiny. - Centralized governance (87.9% token control) and opaque liquidity models enabled manipulation, while fragmented regulations (GENIUS Act, MiCA) worsened compliance risks for smaller projects. - Investors now prioritize due diligence on team transparency, regulatory compliance, and tokenomics, as COAI's lack of audits and centralized control highlighted systemic risks. -