Bitcoin Updates: Surge in Stablecoin Deposits Signals a Bullish Shift for Bitcoin

- Binance's 102.11% Bitcoin reserve ratio and $41B stablecoin inflows in Q3 2025 signal strong liquidity amid bullish market conditions. - Historical patterns show Bitcoin's current liquidity setup mirrors pre-2020 rally conditions, with SSR at 13 indicating potential price rebounds. - Analysts project $110,000-$115,000 targets for Q1 2026, but caution structural support at current levels could precede deeper corrections.

Recent shifts in Bitcoin's liquidity are drawing parallels to previous bull markets, with both analysts and exchange statistics hinting at a possible price rally in the near future. A combination of increased stablecoin inflows, surplus reserves on exchanges, and recurring historical trends has fueled renewed expectations of a notable upward movement in Bitcoin's value.

One significant update comes from Binance, the largest crypto exchange globally, which published its most recent Proof of Reserves (PoR) on November 1, 2025.

Stablecoin trends further strengthen the bullish case. According to Orbital's Stablecoin Retail Payments Index, net inflows to stablecoins totaled $41 billion in Q3 2025—the largest quarterly increase since 2021, as reported by

Historical data supports this perspective. CryptoQuant’s Moreno pointed out that Bitcoin’s current liquidity conditions are similar to those seen before major price surges since 2020. The Stablecoin Supply Ratio (SSR)—which measures Bitcoin’s market cap against stablecoin supply—has fallen to around 13, a level that has historically marked significant market bottoms, according to the

The relationship between liquidity and Bitcoin extends beyond exchanges. The U.S. Dollar Liquidity Index (USDLiq) remains highly correlated with Bitcoin, showing a correlation coefficient of 0.85—one of the highest among asset classes, according to the

Despite the positive outlook, there are still risks. Moreno warned that the current liquidity range serves as a “last line of structural support,” cautioning that a breakdown here could lead to a deeper pullback before the next upward cycle, as mentioned in the

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Separating Hype from Reality—Crypto Market Shifts as BlockDAG, Ethereum, and XRP Aim for Leadership by 2026

- BlockDAG's $435M presale and hybrid DAG/Proof-of-Work model position it as a top 2026 growth candidate with 3.5M active miners. - Ethereum faces technical risks like potential death cross but retains 53% stablecoin dominance through JPMorgan/BlackRock partnerships. - XRP shows $2.40 recovery amid Bitcoin ETF inflows but needs sustained confidence to maintain $3.95B derivatives open interest. - Market shifts toward projects with institutional validation (CertiK audits) and real-world adoption (Seattle spo

Brazil's Cryptocurrency Clampdown: Combating Illicit Activity or Hindering Progress?

- Brazil's Central Bank enforces strict crypto rules by Feb 2026, requiring VASPs to obtain authorization or exit the market. - Stablecoin transactions and cross-border transfers are reclassified as foreign exchange operations under $100k capital controls. - $2-7 million capital requirements spark industry criticism, with concerns over stifling competition and compliance timelines. - Mandatory reporting for international transactions aims to combat money laundering, aligning with global standards like EU's

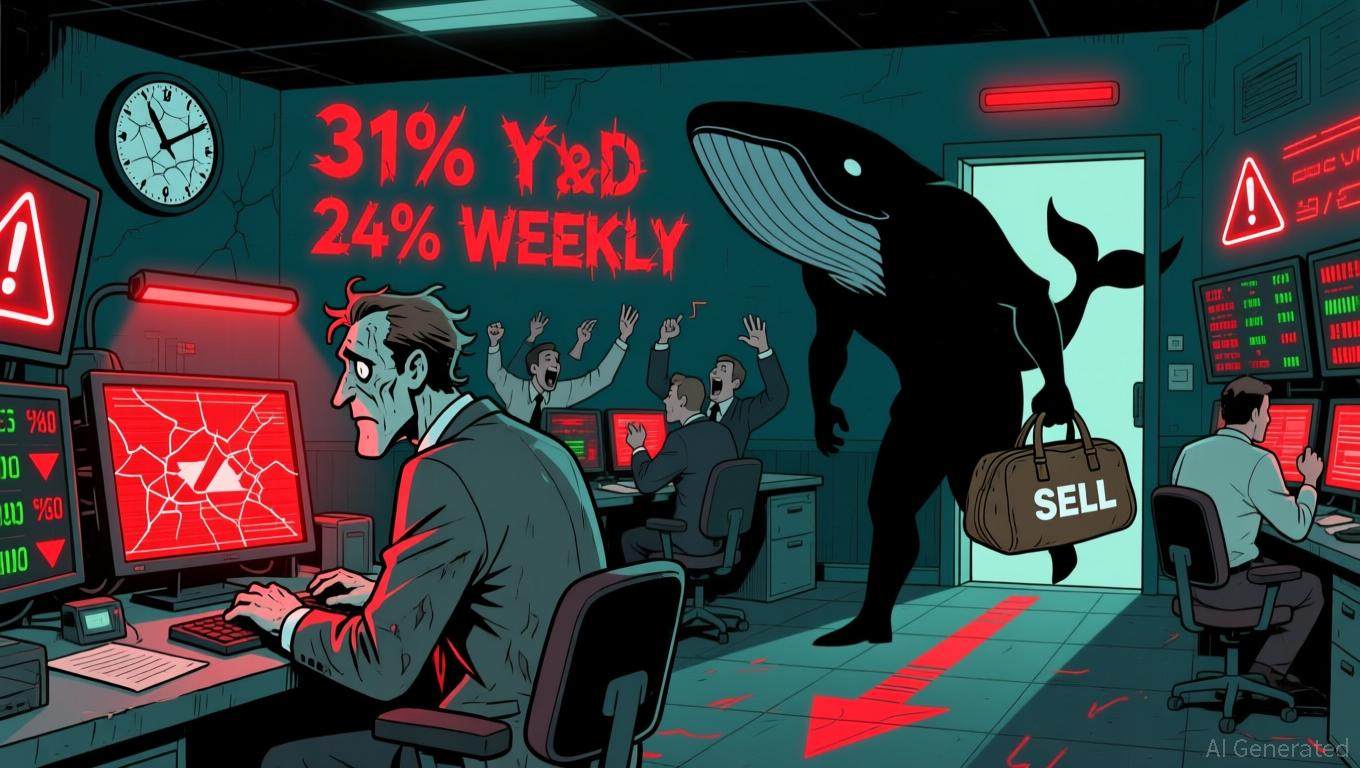

Whales Offload PEPE While Bulls Resist Decline, Forecasting Record High

- A major PEPE whale liquidated a $46M position this week, reflecting broader memecoin market weakness as prices fell 31% year-to-date. - Institutional holders offloaded 0.5% of PEPE holdings amid bearish technical indicators, while some long-term investors predict a new all-time high. - Cross-chain activity highlights volatile memecoin dynamics, with whales shifting focus to ASTER as Coinbase restructures in Texas over regulatory concerns. - Technical analysts warn of continued losses as PEPE forms a "bea

South Korea Seeks to Compete with USD Stablecoins Through Blockchain-Based VAT Reimbursements

- NH NongHyup Bank tests VAT refund system using stablecoin tech with Avalanche , Fireblocks, Mastercard , and Worldpay. - Aims to challenge USD stablecoin dominance by streamlining cross-border refunds via blockchain automation. - South Korea’s FSC plans KRW-pegged stablecoin rules by year-end, restricting non-bank issuers. - Domestic stablecoin transactions exceed $41B, as major banks collaborate on won-backed infrastructure. - Pilot could redefine cross-border payments with faster processing and reduced