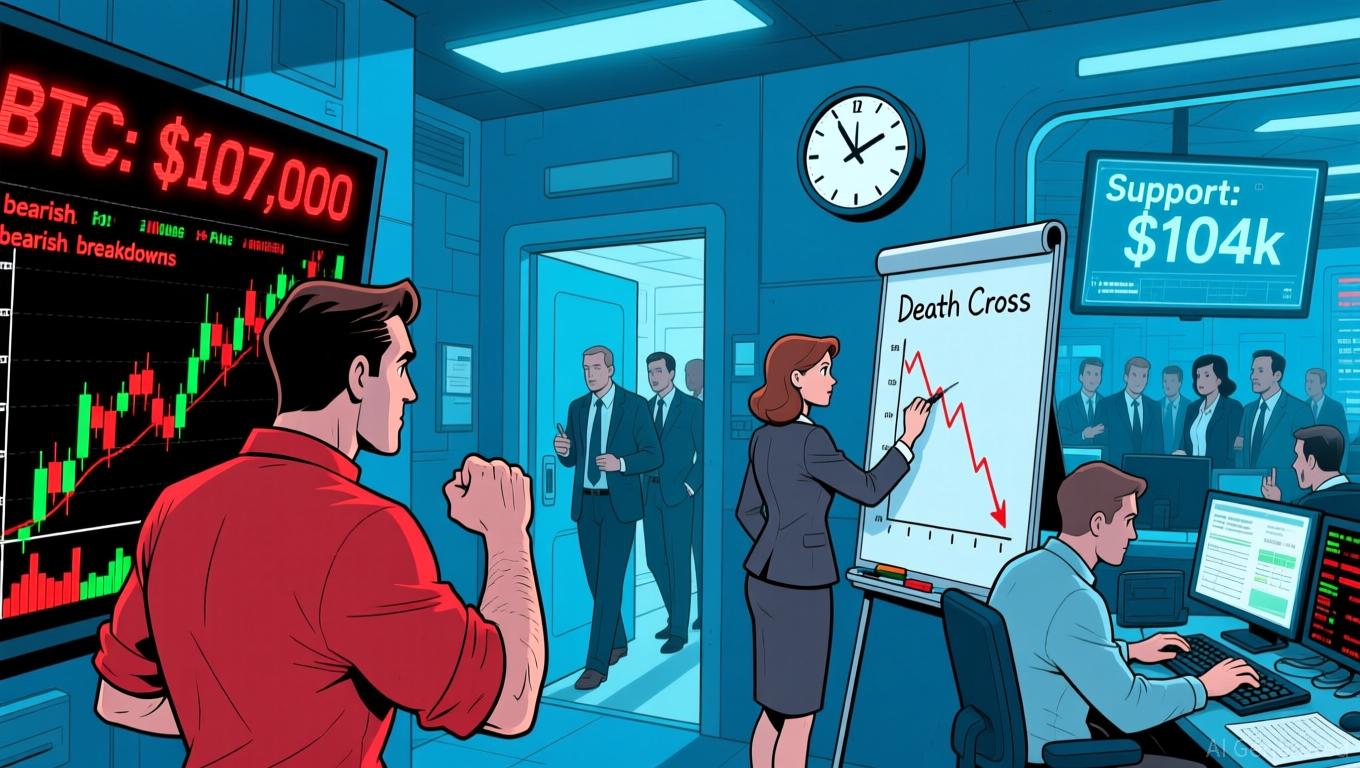

Bitcoin News Update: Bitcoin’s $100,000 Support Falters Amid Rising Death Cross and Increased Miner Sell-Off

- Bitcoin's failed $107,000 breakout triggered a "death cross" bearish pattern as 50-day SMA fell below 200-day SMA, signaling prolonged downward pressure. - Key support at $104,000 becomes critical for stabilizing BTC, with CME futures gaps potentially enabling bounces if buyers intervene. - Institutional panic selling risks accelerating declines below $100,000, with ETF liquidity "air pockets" at $93,000 amplifying volatility concerns. - Miner selling and weak ETF inflows constrain recovery attempts, whi

Bitcoin’s latest price movements have drawn increased attention as the cryptocurrency encounters significant turning points after failing to break past $107,000. The rejection at this resistance level has fueled renewed bearish outlooks, with market observers pointing to the formation of a “death cross”—a negative technical signal where the 50-day simple moving average (SMA) falls below the 200-day SMA. This pattern, initially highlighted in a Coindesk report

The unsuccessful effort to reclaim $107,000 has shifted focus to the next major support at $104,000, with traders preparing for possible sharp price swings. Data from Cointelegraph and TradingView indicate that Bitcoin’s inability to maintain levels above $107,000 has sparked concerns about a potential move back to $100,000

Meanwhile, the selling activity from miners is adding complexity to Bitcoin’s short-term prospects. According to Crypto News, a rise in miner sales, combined with slowing ETF inflows, might limit Bitcoin’s ability to recover within the $100,000–$108,000 band

As Bitcoin approaches these crucial price levels, the next few weeks will reveal whether buyers can regain momentum or if sellers will strengthen their hold on the market’s direction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Blockchain Essentials for the Rave Ecosystem Enable Community Leadership and Charitable Initiatives

- RaveDAO launched Genesis Membership NFTs on Base and BNB Chain, offering four tiers with escalating event access and governance rights. - The $RAVE token economy allocates 30% to community incentives, 31% to ecosystem development, and includes deflationary buyback mechanisms. - Black-tier members ($499) gain backstage access and 7x reward multipliers, emphasizing token-driven tiered participation. - RaveDAO plans 50+ decentralized chapters by 2027 and channels event profits to philanthropy, distinguishin

Trust Wallet Token (TWT) Price Forecast: Could 2026 Mark a DeFi Surge?

- Trust Wallet Token (TWT) surged to $1.6 in 2025, driven by strategic partnerships and expanded utility via Trust Premium and FlexGas features. - Institutional adoption grew through RWA tokenization (e.g., U.S. Treasuries) and Binance CZ's endorsement, boosting TWT's transactional and governance roles. - Analysts project TWT could reach $3 by 2025 and $15 by 2030, but regulatory risks and DeFi competition pose challenges to its 1-billion-user vision. - With 17M active users and 35% wallet market share, TW

TWT's Updated Tokenomics Framework: Driving Sustainable Value and Expanding the DeFi Ecosystem

- Trust Wallet's 2025 TWT tokenomics shift prioritizes utility over governance, using Trust Premium's XP system to drive user engagement and retention. - Strategic integrations like FlexGas (transaction fee payments) and Ondo Finance's RWAs expand TWT's cross-chain utility, bridging DeFi and traditional finance. - TWT's loyalty-driven model reduces circulating supply through locking mechanisms, contrasting inflationary approaches while attracting institutional investors. - Binance's reduced collateral rati

Solana News Today: Solana Holds the Line at $150: Institutional Trust Remains as User Engagement Declines