Bitcoin Leverage Liquidations Spike in November 2025: Systemic Threats and Institutional Portfolio Adjustment Approaches

- November 2025 Bitcoin price drops triggered $1.27B long-position liquidations and $250M short-position collapses, exposing crypto derivatives market fragility. - Regulatory shifts (CFTC's leveraged spot trading plans) and U.S.-China tensions amplified volatility, forcing traders to reposition amid opaque risk management. - DeFi protocols like Euler and Balancer faced $1.3B+ liquidations, while institutions adopted advanced hedging via derivatives and AI-driven rebalancing strategies. - Experts warn of sy

The November 2025 Liquidation Surge: A Perfect Storm

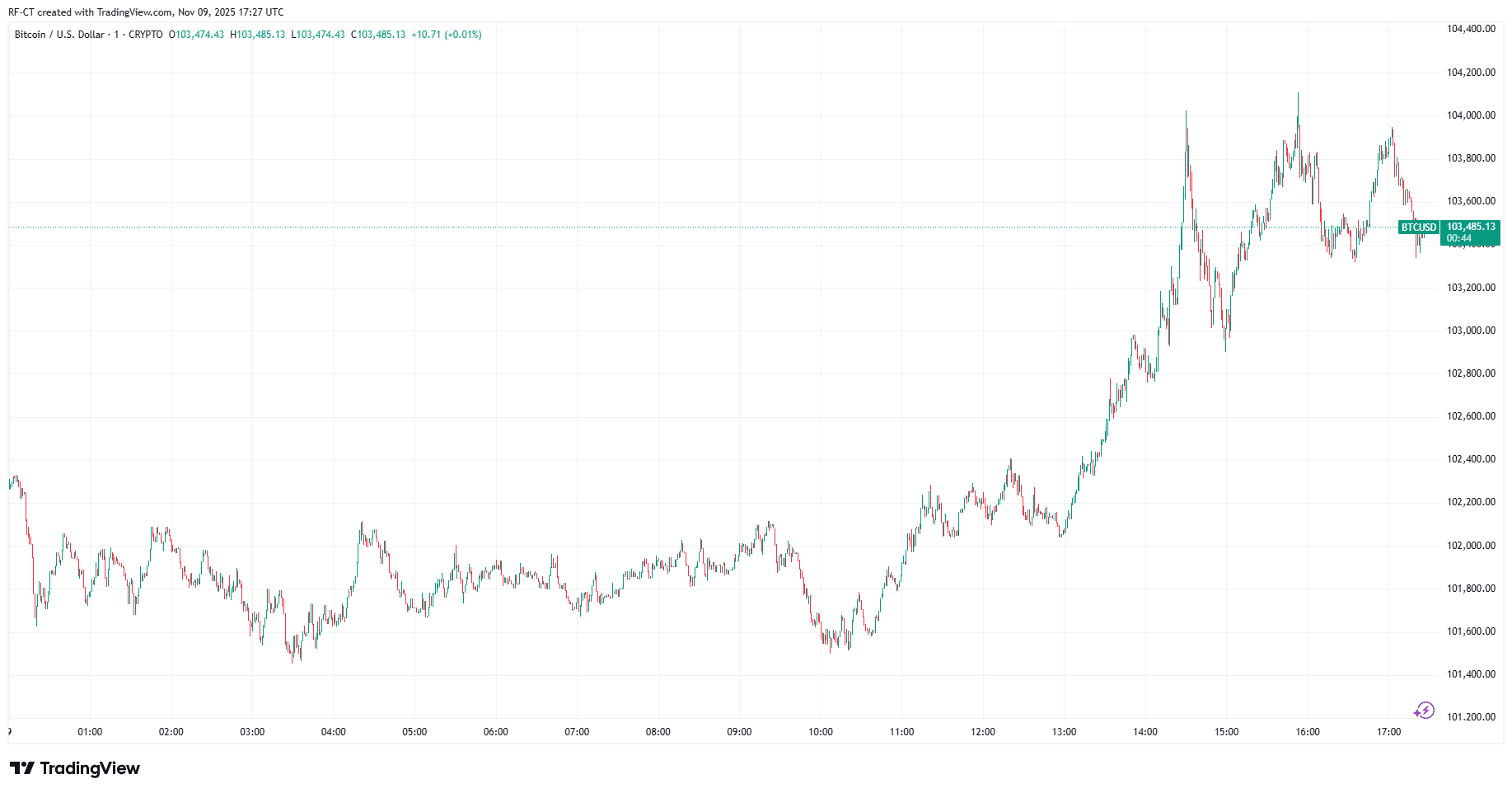

Bitcoin’s plunge from $112,000 to under $106,000 in November 2025 triggered a wave of forced liquidations, with long positions making up 90% of the $1.27 billion in closures, according to

Early November’s $6 billion liquidation, fueled by U.S.-China trade disputes, accelerated deleveraging in perpetual swap markets. Despite these disruptions, open interest in perpetual derivatives remains below $10 billion, showing that the market is cautious and waiting for more certainty on global and economic issues, as noted in a

Regulatory Responses and Systemic Risk Warnings

The CFTC’s initiative for leveraged spot crypto trading, developed in partnership with exchanges such as CME and

Industry specialists caution that the November liquidation crisis revealed significant flaws in DeFi protocols. Platforms including

Institutional Rebalancing and Hedging Strategies

Institutions are increasingly turning to advanced hedging tactics to control risk. Ripple’s Prime platform, for example, provides unified access to spot, swaps, and futures markets, allowing clients to manage collateral efficiently and lower capital needs, according to a

In addition to regulatory measures, hedge funds are focusing more on futures and options, with 57% of institutional trading now centered on derivatives rather than spot assets, as stated by

The Path Forward: Diversification and Resilience

The events of November 2025 highlight the importance for institutional investors to diversify beyond just Bitcoin and

With the CFTC’s December 2025 rollout of leveraged spot trading approaching, institutions must weigh the benefits of regulatory certainty against the need for active risk management. The lessons from November 2025 are clear: systemic threats in crypto derivatives are now a reality. Immediate action is required.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DTCC Lists Five XRP Spot ETFs, Fueling Anticipation for U.S. Market Debut

Trump’s Stimulus Could Spark a Crypto Rally Even Crazier Than 2020

Astar 2.0: Is This a Strong Opportunity for Institutional Investors to Enter?

- Astar 2.0 upgrades blockchain scalability via Polkadot's async protocol, cutting block time to 6 seconds and boosting TPS to 150,000. - Institutional adoption grows with $3.16M ASTR purchase, 20% QoQ wallet growth, and partnerships with Sony , Casio, and Japan Airlines. - Cross-chain liquidity via Chainlink CCIP and hybrid architecture position Astar as a bridge between decentralized innovation and enterprise needs. - Analysts project ASTR could reach $0.80–$1.20 by 2030, though liquidity constraints and

Bitcoin Bounces Back as Trump’s $2,000 Dividend Plan and Michael Saylor’s Hint Spark Market Optimism