Crypto News: Why Is the Crypto Market Down Today?

The global crypto market is feeling the weight of macroeconomic hesitation and institutional pullbacks, with total capitalization sliding to around $3.39 trillion. Over the last 24 hours, the market fell 1.12%, extending a week-long 7.65% decline. The selloff isn’t isolated; it mirrors a broader “risk-off” tone across global assets as investors wait for crucial economic data and trim exposure before year-end.

Why Is the Crypto Market Down Today?: Macro Uncertainty Freezes Risk Appetite

The delay of the U.S. October CPI report to November 13 has left traders without a key economic cue. With inflation data now postponed, both crypto and equities are drifting without direction. The 7-day correlation between the crypto market and Nasdaq sits at 0.69, meaning risk sentiment in tech stocks directly impacts digital assets. A strong CPI print could revive fears of prolonged high interest rates, while a weaker number may offer short-term relief.

Until then, investors are likely to stay cautious. The Cleveland Fed’s inflation nowcast remains sticky at 2.97% year-on-year, hinting that the Federal Reserve won’t pivot quickly. This uncertainty is enough to keep capital on the sidelines.

Institutional Outflows Add Pressure

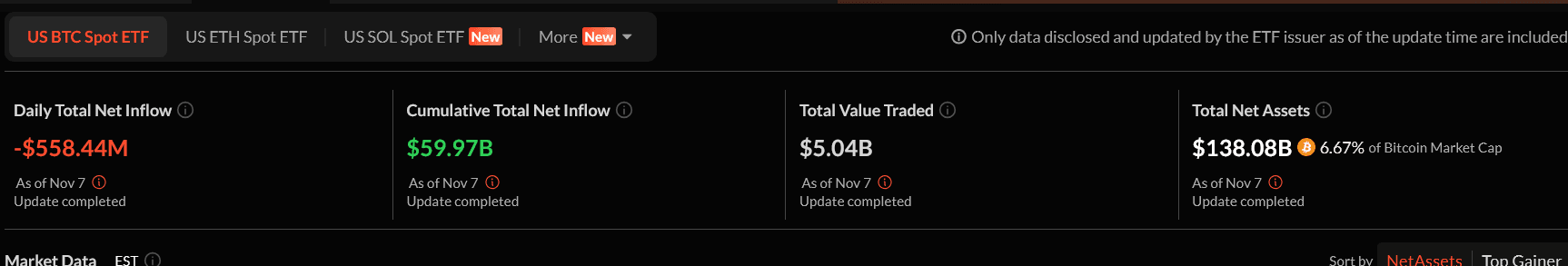

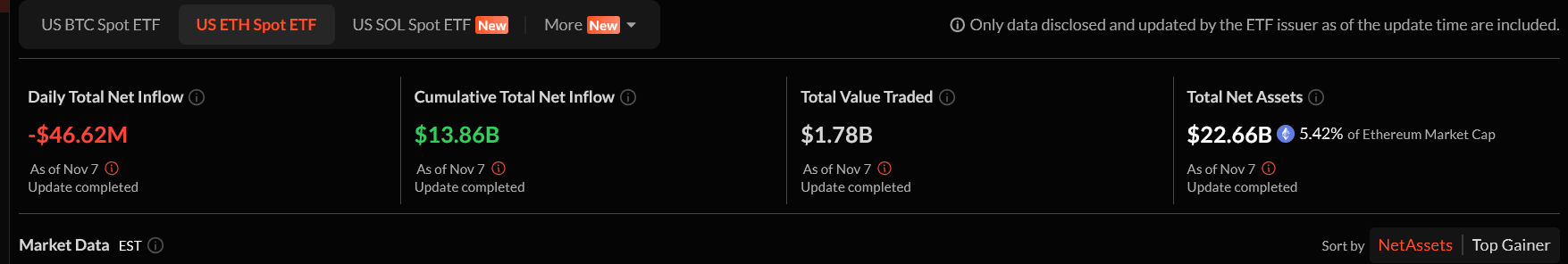

Institutional sentiment has turned defensive . Bitcoin ETFs saw $558 million in net outflows in 24 hours—the largest daily withdrawal since October 10—while Ethereum ETFs recorded $46.6 million in redemptions. Total Bitcoin ETF assets under management have slipped to $138.85 billion, down nearly 2% day-over-day.

This mass pullback signals portfolio de-risking ahead of key macro events and annual rebalancing. The Fear & Greed Index has plunged to 24, marking “Extreme Fear,” its lowest level since March 2025. Institutions typically set the tone for short-term direction, and their retreat underscores that the market may not be ready for aggressive accumulation yet.

Technical Breakdown Deepens the Weakness

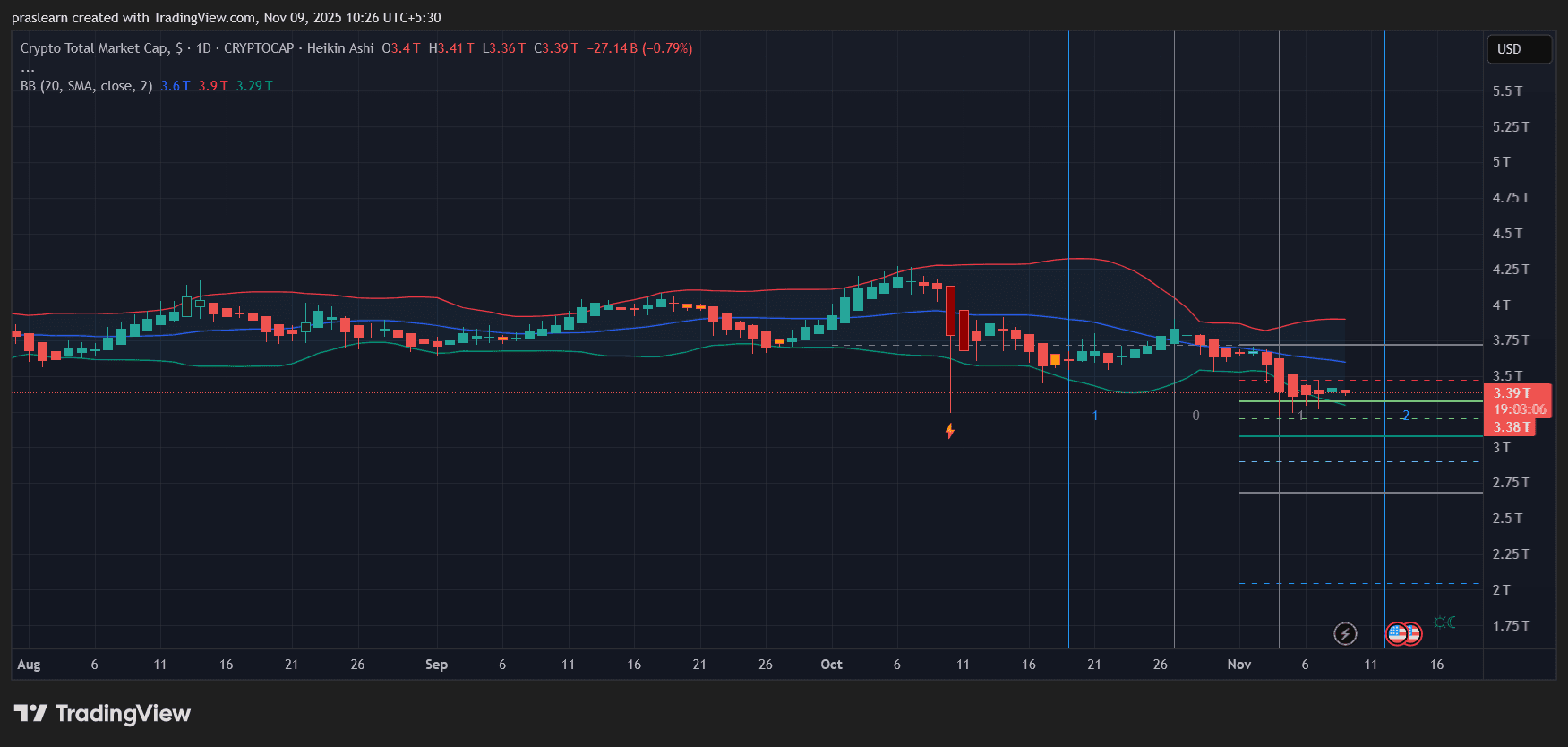

Crypto Market: TradingView

Crypto Market: TradingView

On the charts, total crypto market capitalization has dropped below its 30-day simple moving average (SMA) at $3.67 trillion. The Bollinger Bands show compression after an extended decline, with the lower band sitting near $3.29 trillion—a zone that now acts as support. The RSI at 27.42 indicates an oversold market, but the MACD remains bearish, suggesting downward momentum isn’t exhausted.

From a structural view, $3.25 trillion stands out as a key support area, with potential downside wicks reaching $3 trillion if ETF outflows persist. On the upside, $3.6 trillion acts as resistance, and a daily close above this could trigger a mild recovery.

Crypto Market Down Psychology: Fear and Exhaustion

Beyond the numbers, the sentiment backdrop tells a clear story. Retail traders have reduced leveraged exposure, with open interest across exchanges dropping 11% in a day and 26% month-over-month. This signals fear-driven deleveraging rather than fundamental collapse. Historically, such conditions have preceded contrarian rebounds once selling pressure fades and liquidity stabilizes.

Still, the catalyst for a reversal is missing. Without fresh inflows or bullish macro data, the market’s best hope lies in relief rallies rather than sustained momentum.

Crypto Market: What Comes Next?

All eyes are now on the November 13 CPI release. A softer inflation number could spark renewed optimism and possibly reverse ETF flows. Conversely, a hot print could extend the decline and push total market cap toward the $3 trillion psychological level.

Traders should track ETF inflows, macro announcements, and correlation metrics with equity indices. With leverage already at yearly lows and sentiment near capitulation, a stabilization phase could emerge soon—but only if upcoming economic data aligns with cooling inflation expectations.

The crypto market isn’t crashing out of weakness—it’s retreating under macro fog, institutional caution, and technical fatigue. The setup may look grim today, but historically, such fear-dominated phases often lay the groundwork for the next big recovery wave once the data clears the air.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash rises to second-largest holding in Arthur Hayes' Maelstrom portfolio behind Bitcoin

PENGU Experiences Significant Price Decline in November 2025: An Analysis of Systemic Risk and Regulatory Oversight

- PENGU's 2025 price crash highlighted systemic risks in crypto, driven by regulatory tightening, DeFi exploits, and shifting investor sentiment. - U.S. GENIUS Act and EU MiCA regulations increased compliance costs, while FATF rules restricted liquidity for speculative tokens. - A $128M Balancer DeFi exploit triggered cascading failures, exposing vulnerabilities in interconnected protocols and accelerating PENGU's collapse. - Whale-driven short positions and retail investor panic amplified downward pressur

Nearly One-Third of Russian Traders Buying Bitcoin Amid Market Uncertainty

BitMine Quietly Buys 744K ETH Without Causing Panic

BitMine has accumulated over 744,600 ETH since October 5 without sparking any panic selling in the market.Massive ETH Accumulation by BitMineNo Panic, Only ConfidenceWhat This Means for Ethereum