Amid the crypto market crash, Tether's bitcoin wallet has increased by another 961 bitcoins, worth about $100 million—a piece of news that shines like a lone beacon in a plummeting market.

As bitcoin once again fell below the $100,000 mark in early November and the entire crypto market was in turmoil, Tether, the issuer of the world's largest stablecoin USDT, quietly completed a large-scale bitcoin accumulation.

During this wave of panic, a significant divergence is emerging between institutional and retail investors. This divergence may reveal key clues about the future direction of the crypto market.

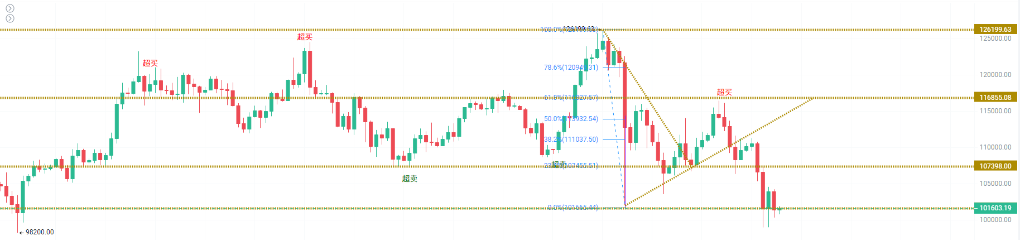

1. Market Plunge: Bitcoin Falls Below the $100,000 Threshold

The cryptocurrency market suffered a heavy blow in early November. Bitcoin's price once fell below $101,000, hitting a new low since June.

● This was not the first major correction in the recent market. As early as October 11, crypto assets experienced a broad decline, with bitcoin dropping from $122,300 all the way below $110,000, a drop of up to 9%.

● In the past 30 days, long-term holders’ net bitcoin holdings have decreased by 405,000 coins. Calculated at the average price during this period, the total value of these sold bitcoins exceeds $40 billion.

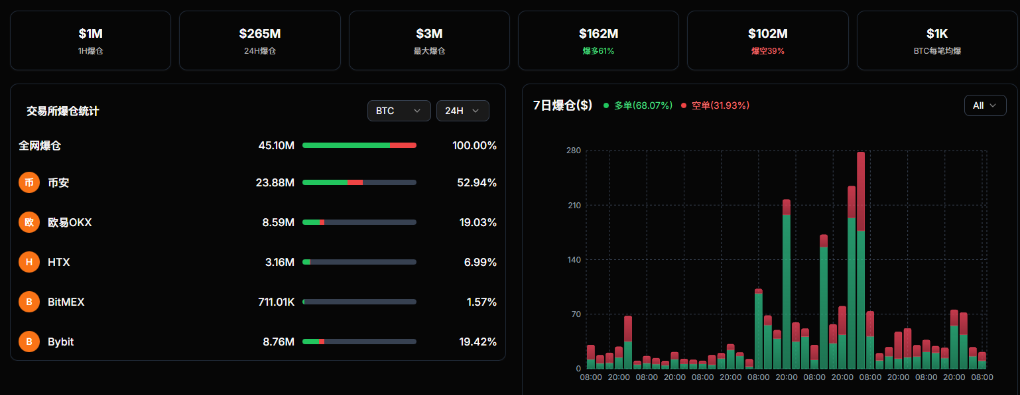

● Panic spread throughout the market, resulting in 479,000 liquidations worldwide over the two days of November 4th and 5th, with a total liquidation amount reaching $2.055 billion, of which long positions accounted for 80%.

2. Tether’s Holdings: Steadily Growing Bitcoin Reserves

Amid the market turmoil, Tether continues to steadily execute its bitcoin accumulation strategy.

● According to on-chain analyst Ai Yi, Tether recently withdrew 961 bitcoins, worth about $100 million, from Bitfinex and transferred them to its bitcoin reserve address.

● After this transaction, Tether’s bitcoin reserve address now holds 86,335 BTC, worth about $9.75 billion, making this address the sixth largest wallet on the bitcoin network.

● Since May 2023, Tether has implemented its bitcoin reserve strategy, deciding to regularly allocate 15% of company profits to purchase bitcoin. This strategy has been firmly executed in various market environments.

3. Institutional Divergence: Retail Retreat and Institutional Entry

The current market presents an interesting divergence: retail investors are panicking and exiting, while institutional investors are steadily entering.

● Bitwise Chief Investment Officer Matt Hougan pointed out that the current market is closer to a cycle bottom rather than the start of a new prolonged bear market. His judgment is based on a core logic: retail is retreating, while institutions are increasing their positions.

● This divergence in sentiment and capital structure is the most enlightening phenomenon of the current cycle. Retail investors are in a stage of "extreme despair," with frequent leveraged liquidations and intensified selling sentiment. Meanwhile, institutional investors and financial advisors remain bullish, continuously increasing their holdings of bitcoin and mainstream crypto assets through ETF channels.

● Asset management firm VanEck confirmed in its October crypto monthly review report that even amid severe market volatility, digital asset treasuries continue to increase their holdings. For Ethereum and Solana, October was one of the strongest months for accumulation this year.

4. Strategic Intent: Tether’s Bitcoin Reserve Strategy

Tether’s continued accumulation of bitcoin is not a short-term speculative move, but part of its long-term reserve strategy.

● Since May 2023, Tether has announced that it will regularly invest 15% of its net profits into bitcoin purchases. This strategy enables it to accumulate bitcoin systematically, rather than attempting to time the market.

This disciplined accumulation strategy stands in stark contrast to speculative behaviors that attempt to buy low and sell high.

● Tether regards bitcoin as an important component of its stablecoin reserves, which differs from other stablecoin issuers who mainly rely on traditional assets as reserves.

● Against the backdrop of continued uncertainty in traditional financial markets, the narrative of bitcoin as "digital gold" continues to gain attention. Tether’s actions are essentially a vote of confidence in bitcoin as a store of value.

5. Industry Trends: Transparency and Compliance as the Way Forward

The current market turmoil is driving the entire cryptocurrency industry toward greater transparency and compliance.

● During this phase of market divergence, exchanges as core hubs are being redefined: they are no longer just venues for matching trades, but have become intersections for regulation, asset custody, reserve disclosure, and risk isolation systems.

The driving force of the market is shifting from emotion-driven to structure-driven.

● In the past, the core feature of the crypto market was "narrative-driven prosperity," where price increases fueled speculation, and speculation in turn reinforced the narrative.

● At the current stage, as narratives recede and emotions clear out, what remains is the slow injection of rational institutional capital. Institutional entry is often accompanied by higher standards, including the security of asset custody, compliance of the trading environment, and assessment of platform robustness.

This means that the competitive logic of the crypto ecosystem is shifting from "who can tell the most compelling story" to "who can provide more reliable infrastructure."

6. Market Outlook: Building Long-Term Confidence

Despite intensified short-term market volatility, the actions of many institutions indicate that they remain confident in the long-term prospects of cryptocurrencies.

● In addition to Tether, public companies such as MicroStrategy are also continuing to accumulate bitcoin. VanEck’s report shows that October was one of the strongest months of the year for digital asset treasuries to increase their holdings of Ethereum and Solana.

● At the same time, demand for "trusted privacy solutions" in the market appears to be rebounding, with a quiet revolution underway in the field of privacy technology.

● The formation of a market bottom has never been simply a matter of price, but a matter of rebuilding trust. When prices plummet and sentiment bottoms out, what truly determines whether the market can rebound is participants’ renewed trust in the system’s security and the reliability of its rules.

Tether currently holds 86,335 bitcoins, worth about $9.75 billion at current market prices. This massive reserve not only consolidates its position as a major bitcoin holder, but also sends a key signal to the market: the company that understands stablecoin mechanisms best is continuously investing 15% of its huge profits into bitcoin.

Market sentiment will eventually pass, but the continuous inflow of institutional funds and the industry’s move toward transparency and compliance are the true cornerstones for building long-term market confidence.