Ethereum Updates Today: SharpLink Moves ETH—A Bid for Stability or Signs of Major Overhaul?

- SharpLink Gaming transferred $14M ETH to OKX ahead of Q3 earnings amid crypto market declines. - The move highlights challenges for crypto-holding firms as ETH drops 25% in 30 days and stocks like SBET fall 4.28%. - Institutional investors increasingly use ETH staking for yield, contrasting Bitcoin-focused strategies lacking comparable returns. - CertiK emphasizes treasury management integrity as spot crypto ETFs shift focus to secure asset handling amid governance scrutiny.

SharpLink Gaming recently moved $14 million worth of

The overall cryptocurrency sector has seen a significant drop, with

SharpLink's transfer to OKX has attracted attention due to its possible impact on the company's NAV. The firm's market cap-to-ETH-treasury ratio (mNAV) is currently 0.82, pointing to a notable discount relative to its assets, according to Crypto.News calculations.

This transaction also reflects a growing pattern of institutional investors utilizing Ethereum's staking features to earn returns.

The timing of this transfer raises questions about its underlying purpose. While it is common for companies to adjust their portfolios before earnings releases, the current crypto downturn has heightened the risks involved. Ethereum's 25% decline over the past month—driven by a strong U.S. dollar and ongoing macroeconomic uncertainty—has left many firms facing substantial unrealized losses, as earlier reported by Crypto.News. For SharpLink, the key challenge will be to steer through these conditions while maintaining investor trust in its treasury management.

With the crypto sector awaiting more direction on central bank policies and institutional involvement, SharpLink's recent actions highlight the shifting landscape of corporate crypto asset management. Whether the company's upcoming earnings report will indicate stabilization or a deeper overhaul remains uncertain.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

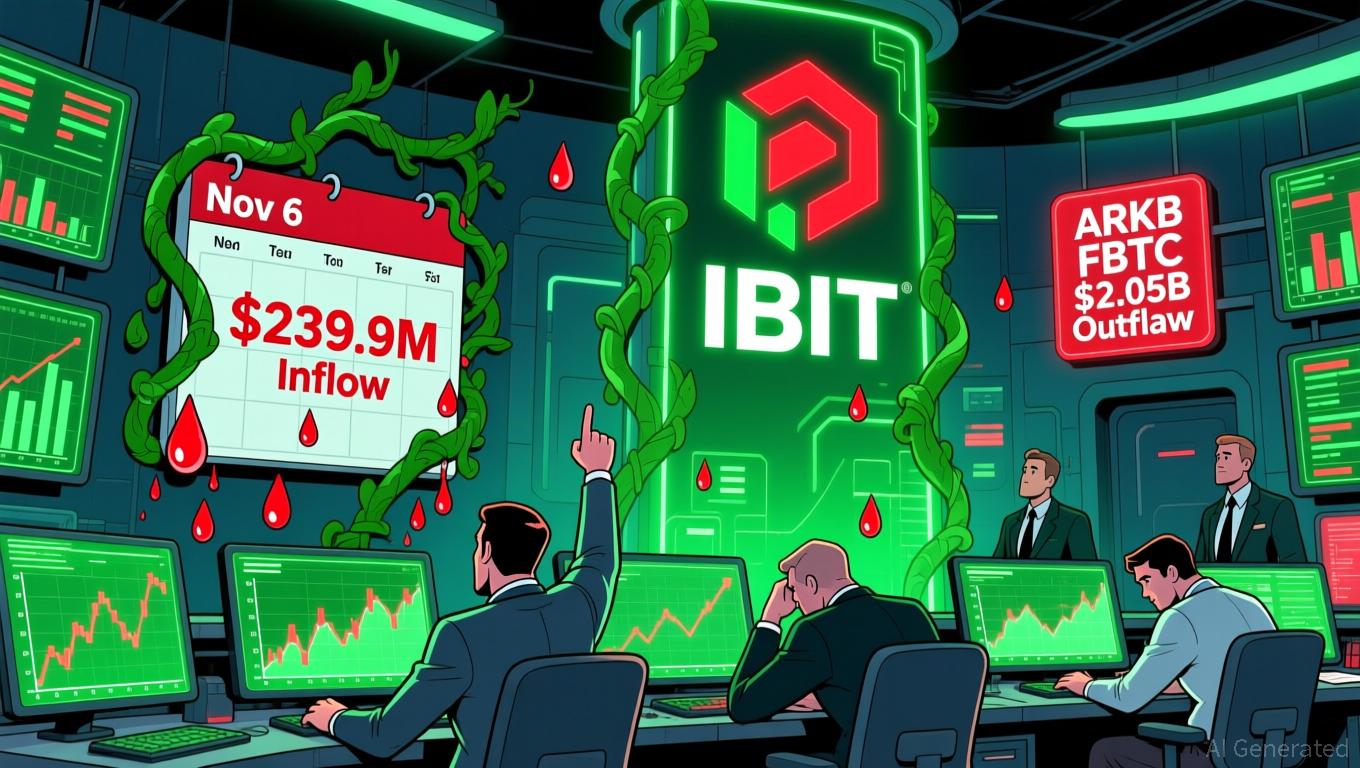

Bitcoin Updates: Investor Optimism Grows as Bitcoin ETFs End Outflow Trend

- U.S. spot Bitcoin ETFs ended a six-day outflow streak with $239.9M net inflows on Nov 6, led by BlackRock's IBIT ($112.4M) and Fidelity's FBTC ($61.6M). - Bitcoin's price rebounded to $103,000 from below $99,000 as improved liquidity and reduced macro volatility drove inflows, though risks persist without sustained buying pressure. - Ethereum ETFs saw smaller $12.5M inflows while Grayscale's ETHE continued outflows, highlighting diverging investor preferences between BTC and ETH. - Solana ETFs emerged as

Bitcoin News Update: Bitcoin Drops Under $100K Amid Diverging Analyst Opinions on Market Direction

- Bitcoin dropped below $100,000 on Nov. 7, driven by macroeconomic risks and $2B+ ETF outflows amid U.S.-China tensions and Fed inaction. - Analysts highlight $113,000 as critical resistance and $100,000 as key support, with breakdowns risking $88,000 liquidation levels. - Institutional views diverge: Ark Invest cut targets to $120,000 while JPMorgan raised fair value to $170,000 amid shifting adoption narratives. - Market eyes December's "Santa Rally" potential but recovery hinges on Bitcoin holding abov

Bitget Connects Speculation and Risk Control through STABLEUSDT Futures

- Bitget launched STABLEUSDT pre-market futures with 25x leverage, offering 24/7 trading since Nov 6, 2025. - The contract features 4-hour funding settlements and 0.00001 tick size to enable flexible positioning. - As the world's largest UEX, Bitget aims to boost market depth for emerging tokens through strategic liquidity initiatives. - Partnerships with LALIGA/MotoGP and a $2M loan program highlight its mission to democratize crypto access. - Risk warnings emphasize volatility concerns for leveraged prod

Token Unlock Releases and Large Holder Sell-Offs Drive Ethena's 80% Value Decline

- Ethena's ENA token dropped 80% to $0.31 amid massive unlocks and whale selling, with 45.4% of tokens released in November. - Robinhood listing and Binance's USDe buyback program offer limited support as 6.8B tokens circulate and 5.99B remain locked until 2026. - USDe's $8.9B TVL and multi-chain expansion highlight potential, but technical indicators signal a possible 37% further price decline. - Analysts warn ongoing unlocks, whale activity, and crypto market volatility could prolong ENA's bearish trend