TRX News Today: TRX Gold's Cutting-Edge Technology Boosts Output and Prolongs Mine Operations

- TRX Gold accelerates Buckreef Gold Project expansion in Tanzania, targeting 3,000+ TPD throughput and 62,000-ounce annual gold production by 2027. - The $30M dual-circuit upgrade employs advanced tech to concentrate 87-90% of gold into 15% of processed mass, enhancing recovery rates and cost stability. - Analysts raised price targets (up to $1.20) citing execution capability, ESG focus, and phased internal financing reducing external risks. - Risks include equipment delays and recovery targets, but prior

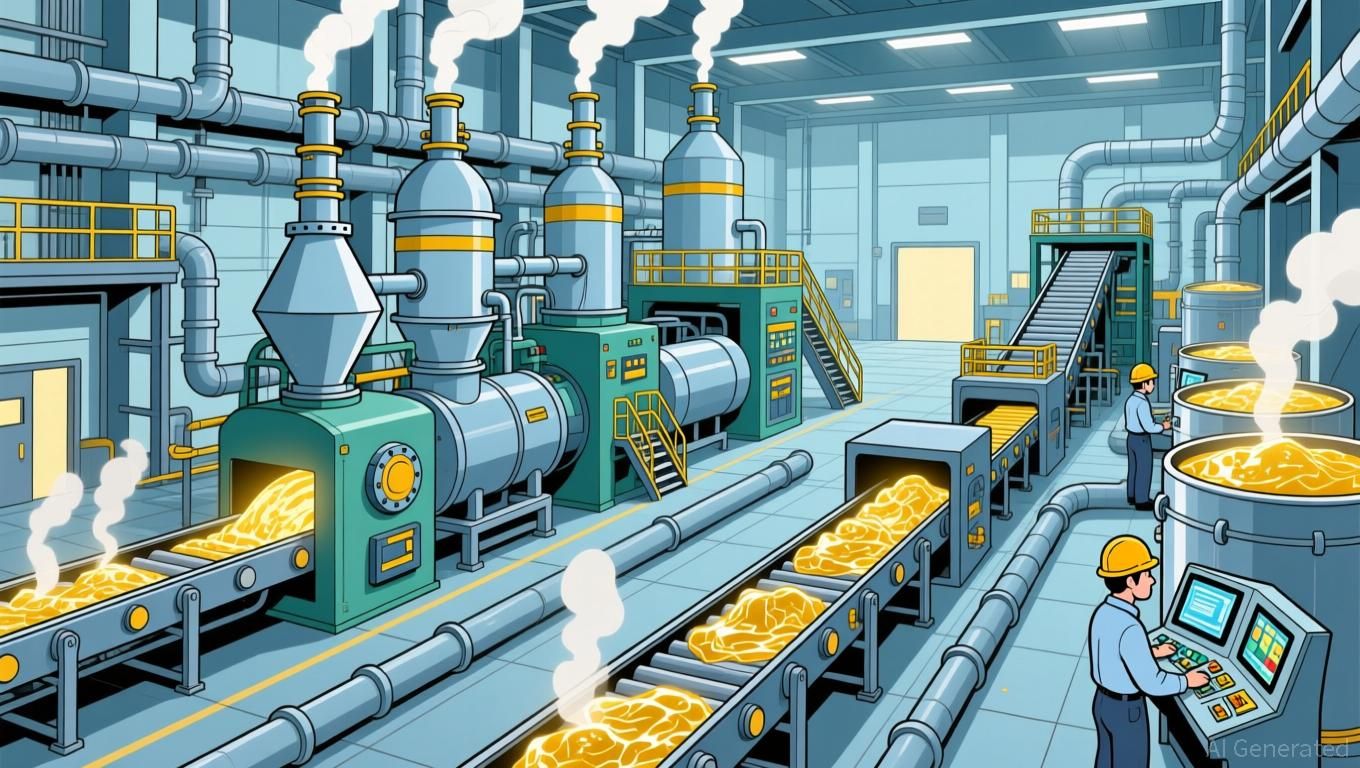

TRX Gold Corporation (TSX: TRX) is moving forward with an accelerated expansion of its processing facility at the Buckreef Gold Project in Tanzania, with the goal of increasing daily throughput to over 3,000 tons and surpassing the annual gold output of 62,000 ounces projected in its May 2025 Preliminary Economic Assessment (PEA), as reported by

This expansion utilizes cutting-edge methods like ultra-fine grinding and high-purity oxygen injection to concentrate 87–90% of gold into just 15% of the processed material, improving recovery rates, as detailed by . These technological upgrades are set to increase throughput and help maintain steady production costs, aligning with TRX Gold’s plan to generate strong cash flow and support additional exploration, Stocktitan reported. The Buckreef Gold Project, which contains 10.8 million tonnes of measured and indicated resources at an average grade of 2.57 grams per tonne gold, stands to gain from the expanded capacity, potentially lengthening mine life and increasing reserves, according to .

Major risks include the timing of equipment deliveries and meeting recovery rate goals within the allocated budget, but the company’s phased strategy and reliance on internal funding help minimize external risks, Stocktitan noted. Since its first gold pour in 2021 and three previous expansions, TRX Gold’s commitment to ESG practices and active stakeholder engagement in Tanzania have further enhanced its operational stability, according to .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Intuitive Machines Purchases Lanteris Amidst Crypto Industry’s Struggles with Penalties and Security Breaches

- Intuitive Machines plans to acquire Lanteris for $800M, merging satellite production with in-space logistics to create a $850M annual revenue entity. - Coinbase Europe faces a €21.5M fine for AML compliance failures, while DWF Labs reportedly lost $44M in a 2022 North Korea-linked hack. - A crypto whale opened $140M leveraged short positions against Bitcoin/XRP, reflecting bearish sentiment amid regulatory and security challenges. - The acquisition aims to leverage Lanteris' production reliability for In

HYPE Token Experiences Rapid Growth: Are We Seeing a Temporary Hype or a Genuine Innovation?

- HYPE token surged 64.8% in 2025, driven by institutional backing, tech innovation, and speculative demand. - Paradigm, holding 19.14M HYPE ($763M), wields governance influence but risks whale-driven market distortion. - Hyperliquid's ecosystem includes HyperEVM, staking, and $400M buybacks, creating a flywheel effect for token value. - Partnerships with Phantom Perps and corporate treasuries (e.g., Eyenovia) expand adoption, while HIP-3 decentralizes market creation. - Skepticism persists due to meme coi

IREN's $9.7B Artificial Intelligence Agreement and Profit Jump Fail to Prevent 12% Share Decline

- IREN shares fell 12.37% despite $9.7B Microsoft AI cloud contract and record $240. 3M Q1 revenue, driven by Bitcoin-to-AI pivot. - $384.6M net income turnaround and $662.7M EBITDA highlight transition to vertically integrated AI infrastructure with 3GW renewable-powered data centers. - 140,000 GPU deployment and $1.8B cash reserves contrast with investor concerns over $1B convertible notes, execution risks, and contract dependency. - Microsoft's 10% capacity access with 20% prepayment ($1.9B annualized)

Kazakhstan's Push for Digital Independence: Crypto Reserves Seek to Broaden Oil-Driven Economy

- Kazakhstan plans a $500M–$1B crypto reserve fund by 2026, managed by AIFC, to diversify its oil-dependent economy. - The fund will invest in crypto ETFs and companies, using seized digital assets and state mining proceeds, avoiding direct crypto holdings. - International partnerships (e.g., Cove Capital, Nvidia) and gold/foreign currency allocations aim to build tech infrastructure and attract investment. - Critics highlight risks around transparency and volatility, while the initiative aligns with globa