Zcash Latest Updates: ZEC's Soaring Surge Causes 250% Downturn for Hyperliquid's Leading Short Position

- Hyperliquid's largest ZEC short (0xd47) faces $14.5M unrealized loss as ZEC surges past $580, marking 250% losses on a $29.26M bet. - ZEC's 48.74% weekly gain boosts market cap to $8.6B, surpassing Sui/Hedera, driven by institutional interest and Solana integration potential. - Hyperliquid's $780M HYPE buyback generated 65% returns, but HYPE price fell 4.33% amid crypto volatility, contrasting ZEC's bullish momentum. - ZEC futures open interest hits $773.84M all-time high, with 0x96ea whale's $16. 3M lon

Hyperliquid's largest

The

Hyperliquid continues to be a key player in the crypto derivatives space, having recently completed a $780 million token repurchase that yielded a 65% gain, as reported by

ZEC's recent price surge has intensified pressure on short sellers to cover positions. Open interest in ZEC futures reached a record $773.84 million, with the long-to-short ratio approaching monthly highs, according to FXStreet's research. Analysts point out that ZEC's circulating supply on exchanges has fallen by 40% since mid-2025, making it more sensitive to buying activity, a trend highlighted by Coinotag. A whale wallet (0x96ea) that opened a $16.3 million long position three days ago is currently up $2.7 million, underscoring the asset's strong

While ZEC bulls are targeting a breakout above the $575–$580 range, FXStreet's projections indicate further upside, though short sellers remain at risk of deeper losses. The 0xd47 wallet's ZEC short is now the largest position on Hyperliquid, far exceeding the biggest long (0x549) at $13.6 million, according to the earlier Lookonchain report. Meanwhile, Hyperliquid's support fund, which holds 3.44% of HYPE's total supply, continues to conduct buybacks, but its effect on demand seems limited as HYPE declines for a seventh straight day, U.Today reports.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JPMorgan’s Analyst Says Bitcoin Needs to Hit $170k to Match Gold’s Private Investment Value

Samourai Wallet Developer Sentenced to 5 Years and Fined $250k; Can He Appeal After Clarity Act?

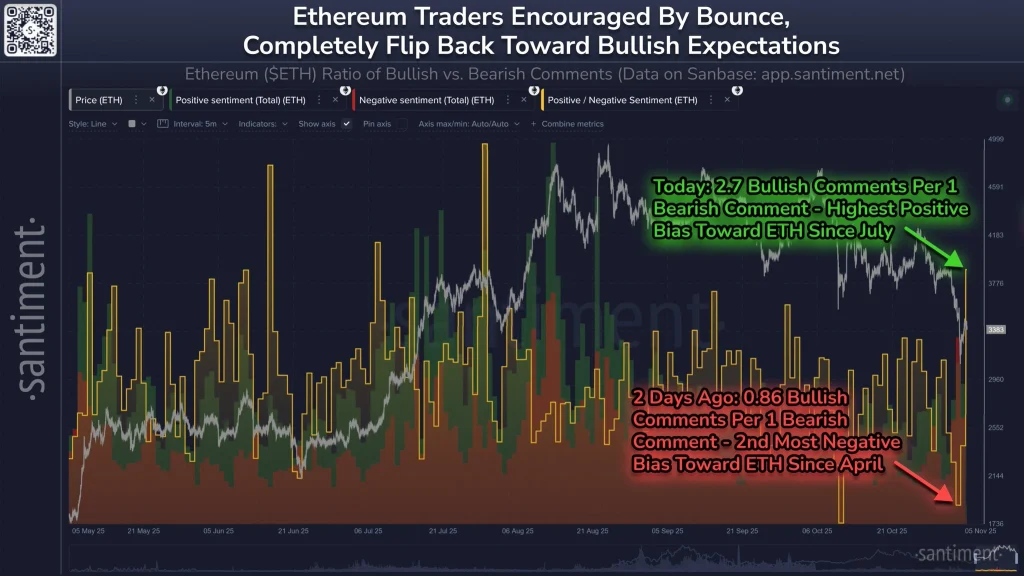

Ethereum Traders Pivot to Extreme Bullish Amid Renewed Whale Demand; Is ETH Price Rebound Next?

Asia Morning Briefing: Bitcoin Stabilizes as Altcoins Flash Early Strength