Webster, NY: An Undiscovered Treasure in Upstate Property Market with a Roadmap for Expansion

- Webster, NY, secures $9.8M in infrastructure grants to revitalize the Xerox Wilson Campus, targeting advanced manufacturing and semiconductor sectors. - Upgrades include public road access, sewer systems, and electrical planning, creating a "shovel-ready" environment for industrial expansion. - The $650M fairlife® dairy plant, opening by year-end, will generate 250 jobs and validate the region’s appeal for capital-intensive industries. - Low vacancy rates (2%) and proximity to the U.S.-Canada border posi

Webster, NY, stands out as more than just another town in upstate New York—it’s a snapshot of America’s emerging industrial revival. Thanks to a $9.8 million infrastructure award from New York’s FAST NY initiative, the village is removing obstacles to expansion. This investment is focused on the

Here’s how it works. The Xerox Campus, once a major corporate site, is now open for private sector transformation. By converting privately held roads such as Orchard Street and Panama Road for public access, Webster is opening up previously underused land. This move isn’t only about better connections—it’s about making the area “shovel-ready” for businesses looking to expand. The arrival of the fairlife® dairy plant—a $650 million, 745,000-square-foot facility—by the end of the year is already showcasing the region’s potential. This single project will create 250 well-paying jobs and demonstrates how Webster’s infrastructure improvements are attracting capital-heavy industries.

Let’s look at the figures. The industrial sector in Western New York is thriving. Vacancy rates are around 2%, much lower than the national average of 4.8%. With 116 million square feet of industrial space already available and more being developed, demand is outstripping supply. What’s more, Webster’s advantageous location near the U.S.-Canada border, affordable energy, and skilled labor force make it a top choice for companies bringing production back to the U.S. Tariffs may be raising expenses, but they’re also encouraging firms to manufacture locally. For example, Canadian businesses are considering Western New York to sidestep cross-border tariffs—an advantage for property investors.

The NY Forward Program’s $4.5 million commitment to revitalizing Webster’s downtown is another driving force. By transforming Main Street with pedestrian-friendly areas, event spaces, and eco-friendly features, the village is building a vibrant environment that attracts and retains talent. A lively downtown benefits more than just cafes—it supports businesses seeking to hire and keep skilled employees. Combined with the Sandbar Waterfront project—which will add leisure areas, a restaurant, and better parking—the community is becoming more appealing to both residents and enterprises.

But don’t just take my word for it. The numbers speak for themselves. Properties are selling above asking price, often within a matter of weeks. This isn’t a speculative bubble—it’s a market responding to solid fundamentals. The main issue? Limited supply. Zoning laws and environmental review delays are making new projects rare. For astute investors, this is a cue to move quickly.

So, what’s the strategy? Target industrial properties close to the Xerox Campus and the fairlife® plant. These sites will gain from the infrastructure enhancements and the surge in manufacturing employment. Seek out opportunities in cold storage and advanced manufacturing, both of which are growing sectors in Western New York. Also, keep an eye on the Sandbar Waterfront—retail and mixed-use properties there could see increased value as the area evolves into a community focal point.

Of course, thorough research is essential. Zoning and environmental checks are a must. But for those who do their due diligence, Webster presents a rare combination: state-supported infrastructure, a talented workforce, and a location that’s a key logistics hub.

In a market where “location, location, location” still holds true, Webster, NY, is emerging as the next hot spot. This is about more than just acquiring real estate—it’s about investing in a community with a clear vision for growth. In today’s economy, that’s where real opportunity lies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JPMorgan’s Analyst Says Bitcoin Needs to Hit $170k to Match Gold’s Private Investment Value

Samourai Wallet Developer Sentenced to 5 Years and Fined $250k; Can He Appeal After Clarity Act?

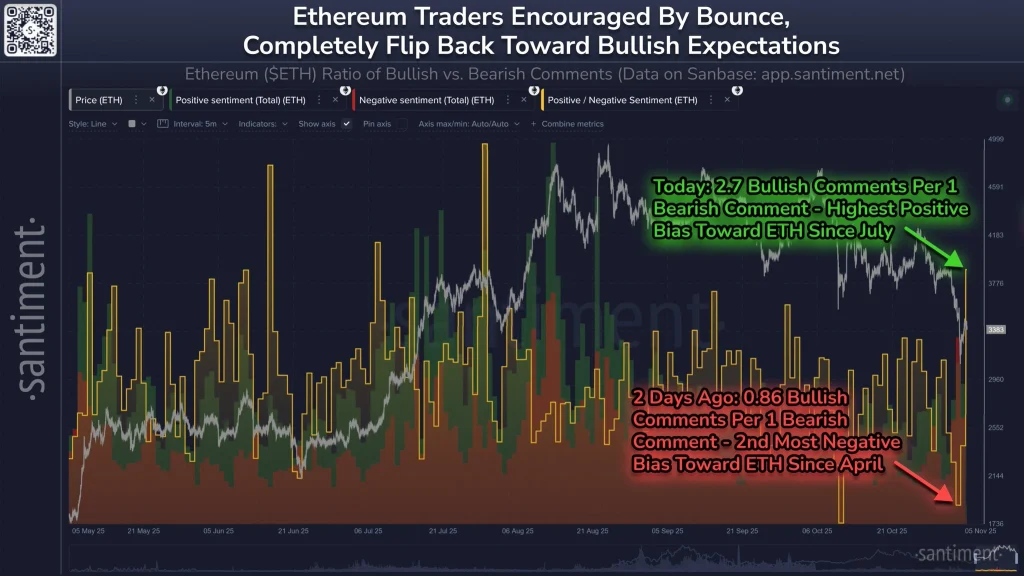

Ethereum Traders Pivot to Extreme Bullish Amid Renewed Whale Demand; Is ETH Price Rebound Next?

Asia Morning Briefing: Bitcoin Stabilizes as Altcoins Flash Early Strength