From November 5th to 6th, East 8th District time, global investors felt as if they were riding a high-speed elevator. US stocks fell the previous day amid worries, only to rebound strongly the next; gold swung between safe-haven demand and dollar pressure; cryptocurrencies staged a "V-shaped" reversal, with bitcoin rebounding more than 5% after falling below the key $100,000 support.

All of this happened in less than 48 hours. Capital rapidly rotated among the four major asset classes, putting on a real-life "flash" game.

I. Market Overview: The Battle at Key Levels

The performance of the four major asset classes has concentrated all current market attention.

● US stocks reverse after "Black Tuesday"

After experiencing "Black Tuesday" on November 5th, US stocks quickly rebounded the next day. The Dow rose 0.48%, the S&P 500 rose 0.37%, and the Nasdaq rose 0.65%.

Large tech stocks were mixed: Google rose over 2% to a record closing high, Tesla rose over 4%, while Nvidia fell nearly 2%.

● Gold approaches the $4,000 psychological barrier

On November 5th, COMEX gold futures rose 0.81% to $3,992.6/oz, approaching the key psychological level of $4,000.

As of November 4th, branded jewelry gold prices from Chow Tai Fook, Lao Feng Xiang, and others all reached or exceeded 1,260 yuan/gram, setting a new historical high.

● The US Dollar Index stands at the 100 mark

On November 5th, the US Dollar Index hit a five-month high, reaching 100.360 at its peak, but then turned lower, finally hovering at a high of 100.2.

This position puts it just below the 200-day moving average of 100.383—a technical resistance level that has now become the key battleground for the dollar's trend.

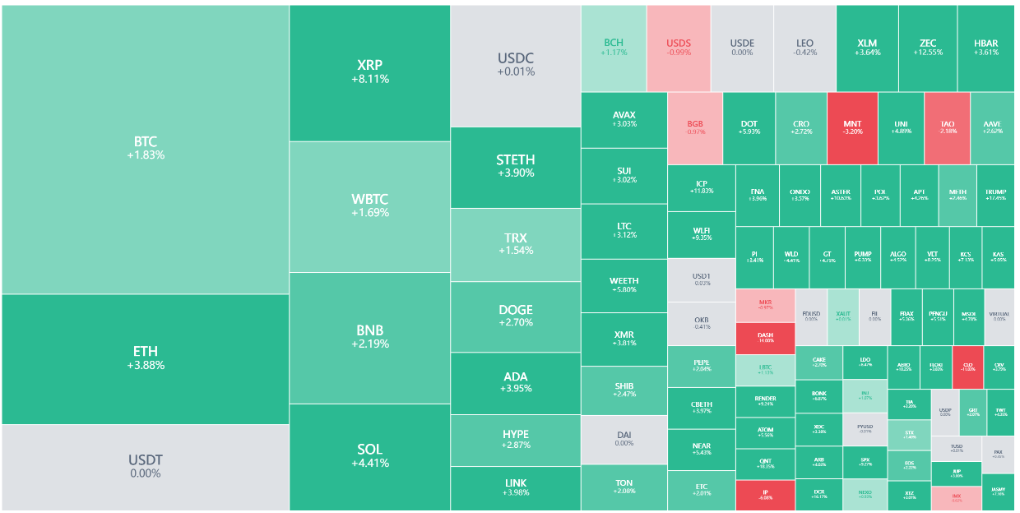

● Cryptocurrencies stage a "V-shaped" reversal

The cryptocurrency market saw another plunge. On November 5th, bitcoin briefly fell below the key $100,000 support, even dipping to $98,944. But it quickly rebounded, returning above $103,000, with an intraday rebound of over 5%.

II. The Interconnection Code

The interrelationship among the four major asset classes reveals the deep logic of global capital flows. When US stocks and cryptocurrencies fall simultaneously, the traditional "safe haven asset" gold fails to attract all the outflowing funds, indicating that the market is redefining safe-haven logic.

"The negative correlation between gold and bitcoin is weakening," noted JPMorgan analyst Lewis. "This suggests investors are starting to allocate both traditional safe-haven assets and digital gold, rather than choosing one or the other." From capital flows, three major patterns are worth noting:

Pattern One: The Negative Correlation Between the Dollar and Gold Is Loosening

● Historical data shows the negative correlation between the dollar and gold is as high as 80%. But recently, this relationship has loosened—gold remains strong even as the dollar strengthens.

● "This shows that safe-haven sentiment is pushing up both the dollar and gold," said First Gold analyst Wen Yi. "Such anomalies are not uncommon during periods of heightened geopolitical uncertainty."

Pattern Two: Positive Correlation Between US Stocks and Cryptocurrencies Strengthens

● The 30-day correlation coefficient between the Nasdaq Index and bitcoin has risen to 0.72, a six-month high. This indicates that investors still view cryptocurrencies as part of high-risk tech assets.

● "When tech stocks are sold off, investors simultaneously reduce crypto holdings to offset losses," explained Pantera Capital crypto fund analyst Morris. "This is a typical chain reaction of leveraged liquidations."

Pattern Three: Capital Rotation Accelerates

● Global equity funds saw the largest weekly inflows and outflows this year, indicating investors' holding periods have significantly shortened. "Capital is moving between assets as quickly as hummingbirds," described Standard Chartered Bank's Head of Wealth Management Stevenson. "The holding period has shortened from weeks to days or even hours."

III. The Driving Forces Behind the Scenes

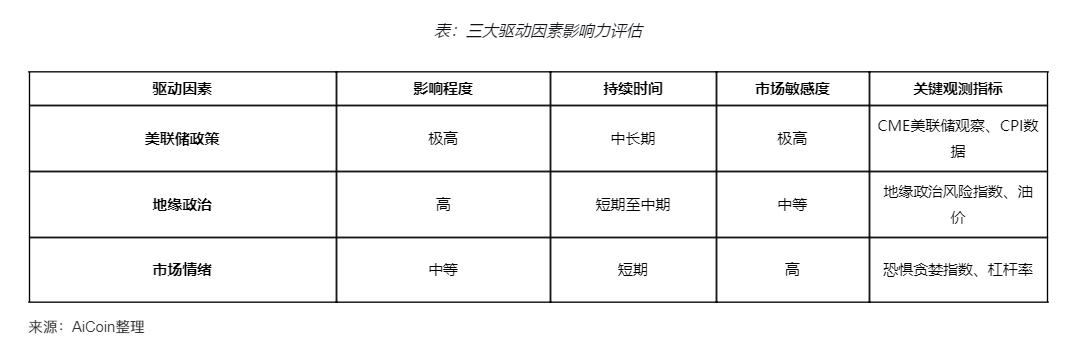

Three core factors are jointly driving this capital migration.

The Fed's "Swing Dance"

● The speech by Fed Governor Milan became a market turning point. His statement that "continued rate cuts are reasonable" instantly changed market sentiment.

● "The market's sensitivity to Fed signals is at an extremely high level," noted former Fed economist Julia Coronado. "Any subtle change in wording can trigger large-scale asset repricing."

● The CME FedWatch Tool shows that the market's probability expectation for a December rate cut rose from 58% to 62.5% within 24 hours, directly triggering the rebound in US stocks.

Geopolitics: The "Multiple Crisis"

● The US government shutdown has entered its 36th day, setting a record for the longest in history. Meanwhile, new turmoil has emerged in the international situation.

● "We are facing triple uncertainty from geopolitics, domestic politics, and economic policy," wrote Goldman Sachs Chief Political Economist Alec Phillips in a client report. "Such a combination is unprecedented in postwar US history."

● The Geopolitical Risk Index has risen to 156, up 12% from last month, approaching the level seen at the outbreak of the Russia-Ukraine conflict in 2022.

Sentiment Cycle: "Extreme Swings"

● Market sentiment indicators have shown rare divergence: the US stock Fear & Greed Index is in the "neutral" zone, while the crypto Fear & Greed Index has dropped to an extremely fearful level of 20. "This divergence creates arbitrage opportunities," said former Quantum Fund Chief Strategist Greg Gay. "The brave are buying bitcoin and shorting tech stocks, betting on the return of their correlation."

IV. Capital Footprints

Tracking capital flows reveals some phenomena that run counter to traditional perceptions.

Cryptocurrency: Opportunity Amid Panic

Bitcoin falling below $100,000 triggered massive liquidations, but on-chain data tells a different story.

● "While retail investors panic sold, addresses holding more than 1,000 bitcoins increased their holdings," said CryptoQuant CEO Ki Young Ju. "These 'whale' addresses net increased their holdings by about 8,000 bitcoins in the past 24 hours."

● Meanwhile, bitcoin spot ETFs experienced large outflows. On November 5th, net outflows reached $488 million in a single day, a near three-month high. "ETF outflows are mainly from short-term traders, while on-chain accumulators are long-term investors," Ki Young Ju added. "This reflects a significant divergence among market participants."

Gold: The Intersection of Old and New Safe-Haven Funds

The gold market is being supported by both traditional safe-haven and inflation-hedging funds.

● Global gold ETFs ended five consecutive months of outflows, achieving a net inflow of $820 million in October. Meanwhile, central banks continued to increase gold holdings. According to the World Gold Council, global central banks' net gold purchases reached 120 tons in Q3.

● "Gold is benefiting from both safe-haven demand and the de-dollarization trend," said World Gold Council Chief Market Strategist John Reid. "It is rare in history for both drivers to be at work simultaneously."

US Stocks: Tech Stocks Remain the "Ballast"

Despite volatility, tech stocks remain the ultimate destination for capital.

● "With every market downturn, we see capital flowing into mega-cap tech stocks," said BlackRock Global Chief Investment Strategist Li Wei. "Investors believe the AI revolution is still in its early stages." Tech giants like Microsoft and Google reported earnings that exceeded expectations, supporting this belief. Google's stock price hit a record high, with its market cap surpassing $2 trillion.

V. Forward Paths

The future trends of each asset class may diverge significantly.

Gold: The Road to $4,500?

● Fundamental factors support gold prices. The global scale of negative-yielding bonds has expanded again, now reaching $5.2 trillion, up 15% from last month. Gold's competitiveness as a zero-yield asset has correspondingly increased.

Cryptocurrency: The Bull Market Test

Whether bitcoin can hold the $100,000 mark will be key to judging the market's health.

● "If bitcoin effectively breaks below $107,000, it may test $100,000," warned 10x Research CEO Markus Thielen. "But if it can hold current levels, a push to $120,000 by year-end is still possible."

● Derivatives data offers a glimmer of hope: bitcoin futures open interest fell by 12% as prices dropped, indicating a healthy reduction in leverage rather than panic selling.

US Dollar: The Side Effects of a Strong Dollar

The US Dollar Index may remain strong in the short term, but concerns are already emerging.

● "Further dollar strength may trigger a new round of intervention," said Société Générale FX strategist Kit Juckes. "Japan's Ministry of Finance has sent strong signals, hinting at possible intervention to prevent excessive yen depreciation."

● Historical data shows that when the US Dollar Index exceeds 100, emerging markets face significantly increased capital outflow pressure. This sign has already begun to appear.

This great capital migration is far from over. The Fed's policy path, geopolitical risks, and corporate earnings prospects will continue to drive capital flows among the four major asset classes.

"A breakthrough at key levels is only the beginning, not the end. The real opportunity lies in identifying the next stop for capital flows, not following its last one."