Trump Warns China Is Growing Fast in Bitcoin, Promises U.S. Lead

U.S. President Donald Trump has once again voiced strong support for the cryptocurrency industry. He warned that China is “getting very big into Bitcoin and crypto right now.” His comments, shared during a recent interview with CBS correspondent Norah O’Donnell at Mar-a-Lago. Which have quickly reignited debate over America’s role in the global digital asset race.

Trump Says U.S. Must Stay Number One in Crypto

Trump made it clear that his goal is to keep the United States at the top of the crypto industry. “I want to keep America number one,” he said. He stressed that crypto has become a massive industry capable of shaping global financial leadership. The president compared the crypto race to artificial intelligence, calling it critical to national competitiveness.

He also said that if the U.S. fails to lead, other nations, particularly China and Japan , will dominate. “If we’re not going to be the head of it, China or someplace else is,” he added. Trump’s renewed enthusiasm for crypto aligns with his recent campaign messaging. Which has leaned heavily on innovation and technology as key areas for U.S. growth.

Defending His Pardon of Binance’s CZ

During the interview, Trump was also asked about his controversial decision to pardon Changpeng Zhao, the Co-founder of Binance. Zhao had pleaded guilty in 2023 to violating anti-money laundering laws. A case the U.S. government said caused “significant harm to national security.” Trump dismissed the allegations, calling the prosecution a “Biden witch hunt.” He claimed that Zhao was unfairly targeted and described him as “a highly respected, successful guy.”

Trump said he knew little about Zhao personally but believed the pardon was justified. “He was a victim, just like I was, of a vicious, horrible group of people in the Biden administration,” Trump said. He also pointed out that his sons are more involved in the crypto space than he is. Emphasizing that he views digital assets as a legitimate and valuable part of the U.S. economy. Therefore, this stance marks a clear shift in perspective.

China’s Rapid Growth in Bitcoin

Trump’s remarks about China came amid concerns. That the country has been quietly reasserting its influence in the crypto sector despite previous bans. “China is getting into it very big, right now,” he said. With a warning that losing ground could harm America’s economic and technological edge.

He argued that U.S. policy under Former President Biden had slowed progress. Also, his own administration’s approach helped push the country ahead in crypto innovation. “We’re number one in crypto in the whole world because I’m the president,” Trump declared confidently.

America’s Position in the Crypto Race

Trump concluded by reiterating that he wants the United States to maintain its dominance in crypto and AI. Specifically, “We are number one, and that’s the only thing I care about,” he said. Therefore, “I don’t want China or anybody else to take it away.”

His comments reflect a broader trend among U.S. political leaders who now view cryptocurrency not just as a financial innovation. But as a matter of national strategy. As China ramps up its involvement, meanwhile, Trump’s warning underscores growing pressure. For the U.S. to strengthen its position in the global digital economy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

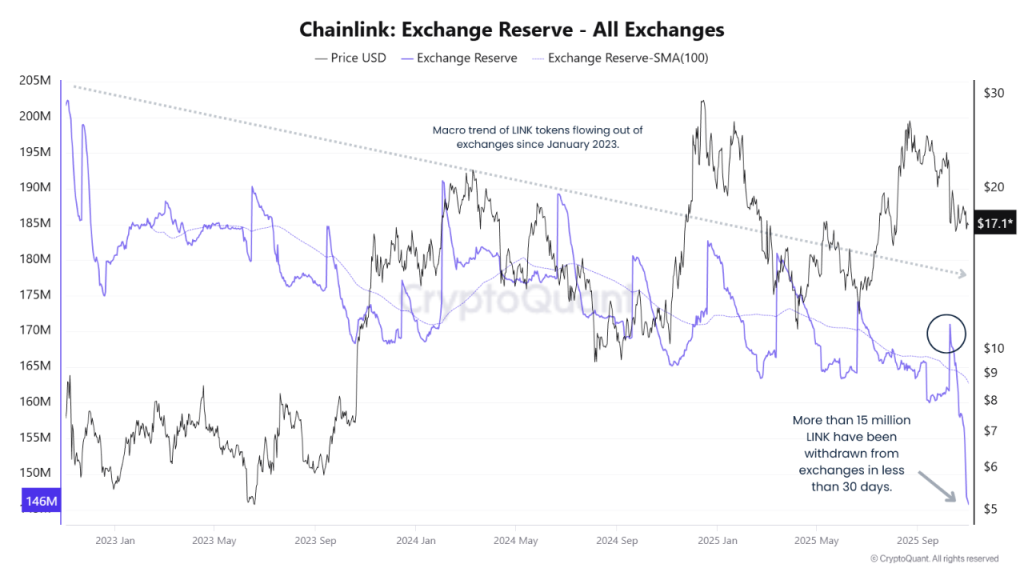

Chainlink Price Prediction 2025: Rising Institutional Adoption Eyes $100 Target

DeFi Faces Confidence Challenges: External Mismanagement Reveals Deep-Rooted Vulnerabilities

- Stream Finance halts deposits/withdrawals after $93M loss from third-party mismanagement, triggering XUSD depegging and systemic risks. - Perkins Coie investigates, highlighting DeFi governance flaws as XUSD’s 58% 24-hour drop impacts $280M in linked loans. - Industry warns of trust fragility; incident coincides with Balancer’s $116M hack, amplifying crypto sector scrutiny. - Stream’s crisis underscores risks in DeFi’s reliance on external managers amid broader economic pressures and regulatory tightenin

Solana Latest Updates: Bitcoin Falters, Solana Shows Uncertainty While MoonBull's Tokenomics Spark November Rally

- Bitcoin fell below $116,000 in late October amid cautious positioning before the Fed meeting, with on-chain metrics showing stable miner holdings. - Solana dropped 6% after Jump Crypto swapped $205M SOL for BTC, highlighting altcoin volatility despite $100B+ market cap support from ETF approvals. - MoonBull ($MOBU) surged 163% in presale with 95% APY staking, leveraging deflationary tokenomics and meme-driven adoption to outpace BNB/AVAX in 2030 ROI forecasts. - Institutional crypto infrastructure deals

Tokenized Treasuries Reach $8.7 Billion as Authorities and Competing RWA Platforms Draw Near

- Tokenized U.S. Treasuries surpassed $8.73B AUM, driven by institutional demand and yield seekers, with BlackRock and Securitize leading the market. - Regulatory scrutiny intensifies as CFTC and Hong Kong tighten oversight, while RWA rivals like tokenized gyms and education assets challenge treasury dominance. - Liquidity constraints and redemption restrictions persist, but ISO 20022 blockchain integration signals progress toward bridging TradFi and digital finance. - Market growth faces hurdles including