XRP News Today: XRP Faces $10 Challenge as ETF Expectations Meet Solana Competition and Ongoing Regulatory Doubts

- XRP surges toward $10 as ETF approvals and institutional inflows boost its $157B market cap. - Evernorth's $1B XRP treasury and Nasdaq listing (XRPN) signal growing institutional confidence. - Seven U.S. XRP ETF applications await SEC decisions by Nov 14, with 99% approval odds on Polymarket. - Solana's ETF debut and XRP's real-world use cases (e.g., $364M tokenized assets) intensify crypto competition. - Regulatory delays and TD Sequential sell signals highlight risks amid bullish 2025 adoption forecast

Ripple's

Ripple-supported company Evernorth Holdings has become a major force, amassing $1 billion worth of XRP to establish an institutional-level treasury. Headed by former Ripple executive Asheesh Birla, Evernorth intends to launch a publicly traded XRP treasury product on Nasdaq under the ticker

XRP's underlying metrics are improving. Its market capitalization reached $157.19 billion by late October, with a 24-hour trading volume of $4.91 billion. Experts believe the next major price surge will depend on ETF approvals, which could unlock substantial institutional investment. Currently, seven U.S. spot XRP ETF proposals are awaiting SEC decisions, expected by November 14,

The launch of the Solana ETF, which saw $56 million in trading volume on its first day, has heightened the competitive landscape,

Ripple's escrow mechanism, which releases 1 billion XRP each month from a reserve of 35 billion tokens, remains a key topic. CTO David Schwartz recently explained that Ripple can sell rights to these escrowed tokens, potentially impacting market supply. Meanwhile, projects like Remittix (RTX) and Digitap (TAP) are gaining attention as possible "XRP 2.0" successors. Remittix, which has secured $27.7 million in private investment and offers a real-world crypto-to-fiat transfer solution, and Digitap, aiming to simplify international payments with Visa-backed cards, showcase ongoing innovation within the ecosystem,

Despite the current bullish trend, there are still risks. XRP's TD Sequential indicator recently signaled a potential sell near $2.80, and some analysts caution that a drop to the $1.35–$1.46 range could occur before any recovery. Additionally, the SEC's postponed ETF decisions—delayed by the government shutdown—add further uncertainty.

XRP's future depends on regulatory developments and increased institutional participation. With Evernorth's upcoming Nasdaq listing, anticipated ETF approvals, and a strong market cap, XRP is well-placed to benefit from a potential crypto surge in 2025. However, competition from Solana and new projects like Digitap, along with ongoing regulatory challenges, will influence its direction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

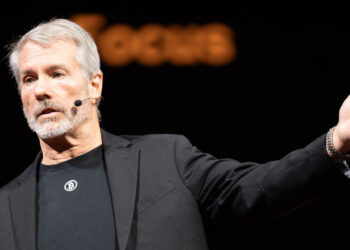

Michael Saylor Says Strategy Won’t Pursue Bitcoin Treasury Acquisitions For Now

DeFi Fees Hit $20 Billion in 2025 as On-chain Applications Drive Explosive Growth

Ripple USD Gains Traction Among Global NGOs for Real-Time Humanitarian Aid

From $0.20 to $110,000: Bitcoin’s 17-Year Journey Since the Whitepaper