Ethereum News Today: Ethereum’s Expansion and Investor Commitment Drive Altcoin Rarity, Indicating a Mature Market

- Altcoins like Pepe (PEPE) and Chainlink (LINK) show record-low exchange-held supplies, signaling strong institutional/retail accumulation. - Ethereum's institutional adoption (e.g., Tom Lee's $320M ETH purchase) and expanding staking infrastructure reinforce crypto market maturity. - PEPE's 20% exchange supply drop and LINK's 98.9% holder accumulation ratio highlight scarcity-driven bullish sentiment ahead of potential price breakouts. - Regulatory uncertainty (e.g., Trump crypto trading ban) risks short

The cryptocurrency sector is currently experiencing heightened scarcity among certain altcoins, as the amount held on exchanges drops to

Pepe, a token built on Ethereum and categorized as a

Chainlink (LINK) is also seeing significant accumulation on-chain. Large holders,

This scarcity among altcoins is further supported by Ethereum’s increasing appeal to institutions.

Institutional staking solutions are also on the rise.

The ongoing reduction in altcoin supplies on exchanges suggests a shift toward longer-term holding strategies, which often precede price surges. For PEPE, technical signals indicate a possible breakout above $0.000015, with market cap targets ranging from $6 billion to $48 billion. Chainlink’s on-chain data and large investor activity further cement its status as a major force in the DeFi oracle space.

Nonetheless, regulatory ambiguity remains a challenge.

The unprecedented scarcity of altcoins like PEPE and LINK, along with Ethereum’s growing institutional adoption, points to a maturing crypto market where both rarity and utility are key drivers of value. As blockchain technology advances and regulatory guidelines become clearer, these factors could help accelerate mainstream crypto adoption. Investors should keep an eye on on-chain trends and institutional activity for further insights.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

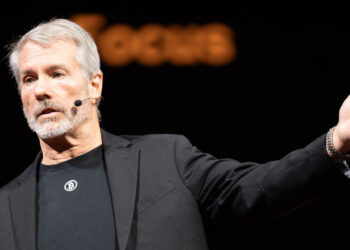

Michael Saylor Says Strategy Won’t Pursue Bitcoin Treasury Acquisitions For Now

DeFi Fees Hit $20 Billion in 2025 as On-chain Applications Drive Explosive Growth

Ripple USD Gains Traction Among Global NGOs for Real-Time Humanitarian Aid

From $0.20 to $110,000: Bitcoin’s 17-Year Journey Since the Whitepaper