The mysterious team that dominated Solana for three months is about to launch a token on Jupiter?

No marketing, no reliance on VCs—how did HumidiFi win Solana's on-chain proprietary market maker war in just 90 days?

Author: SpecialistXBT

A team with no official website, no community, and anonymous members managed to capture nearly half of the trading volume on Jupiter within just 90 days.

To gain a deeper understanding of this mysterious project, we first need to delve into a silent on-chain trading revolution currently unfolding on Solana.

HumidiFi accounts for 42% of the total trading volume processed on Jupiter

Source: Dune, @ilemi

How Prop AMMs Are Reshaping On-Chain Trading

In the context of AMMs, toxic order flow refers to high-frequency arbitrageurs leveraging low-latency connections and advanced algorithms to quickly capture price discrepancies and rapidly flatten the spread between on-chain prices and those at price discovery venues (typically centralized exchanges like Binance). The profits taken by these toxic flows ultimately come at the expense of traders, liquidity providers, and on-chain market makers.

In traditional financial markets that use centralized limit order books (CLOBs) for trade matching, professional market makers can respond to toxic order flow in various ways (such as adjusting spreads or pausing quotes). By analyzing order flow patterns, they can identify traders with informational advantages and adjust their quotes accordingly, thus reducing losses from "adverse selection." As a result, market makers operating on Solana naturally chose DEXs like Phoenix, which use CLOBs. However, during the Solana "meme frenzy" from 2024 to early 2025, the network was overwhelmed by unprecedented demand, causing market makers' orders to frequently fail to reach the chain, while updating quotes consumed a large amount of expensive compute units, sharply increasing market makers' costs.

A series of thorny practical issues is forcing some of the most experienced AMM market makers to fundamentally rethink how on-chain markets operate, giving rise to a revolutionary new market structure.

This new paradigm is called "Prop AMM" (Proprietary AMM), aiming to provide tighter spreads and more efficient liquidity on-chain while minimizing the risk of being exploited by high-frequency arbitrageurs.

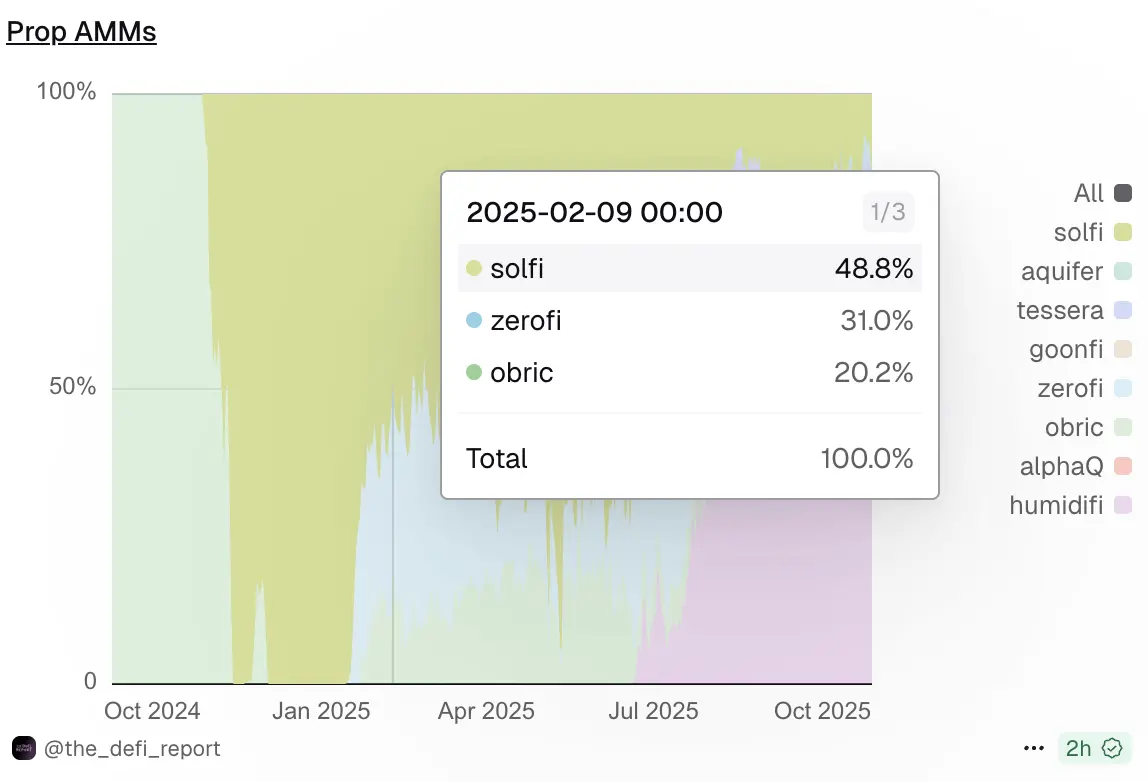

SolFi, ZeroFi, and Obric were the original "big three" of Prop AMMs. They do not publicly expose contract interfaces but instead provide them directly to major trade routers like Jupiter, requiring Jupiter to route orders into their AMMs. This design makes it extremely difficult for external professional arbitrageurs like Wintermute to interact natively with the contracts, as they cannot understand or predict the trading logic, thus preventing market makers' quotes from being replaced and mitigating the "adverse selection" problem posed by informed traders.

In February 2025, SolFi, ZeroFi, and Obric were the main three Prop AMMs

Source: Dune @the_defi_report

HumidiFi's Blitzkrieg

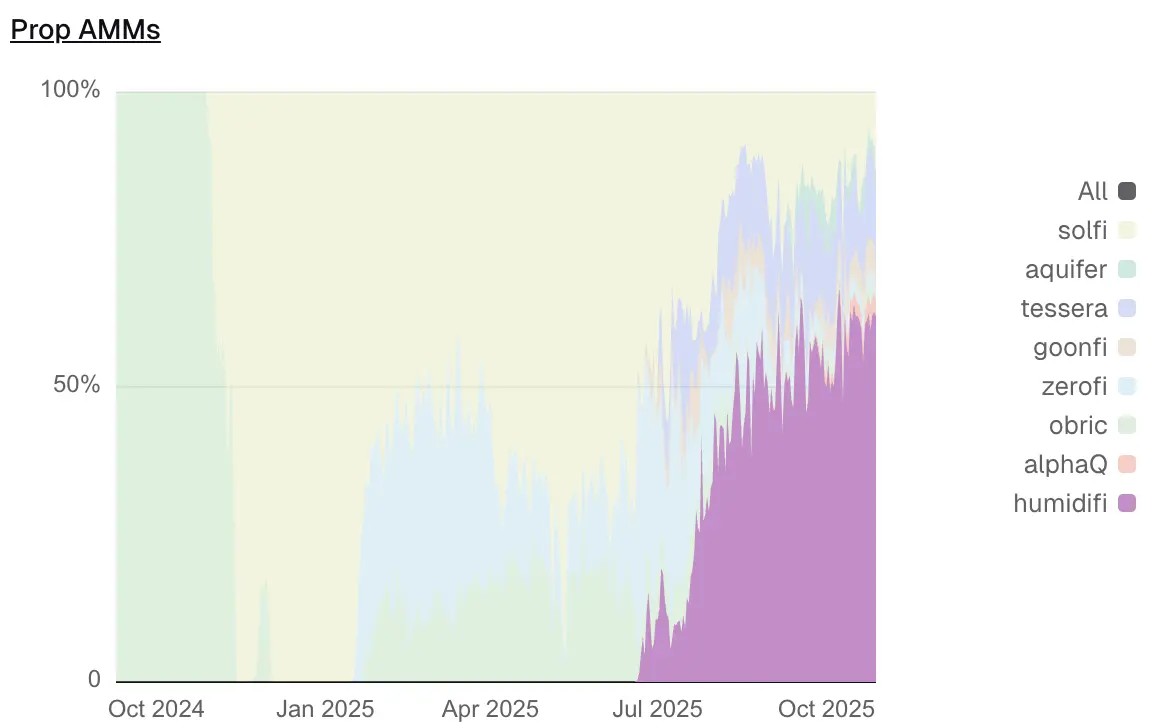

The competition among Prop AMMs reached a fever pitch by July 2025, and a project named HumidiFi rewrote the entire market landscape at a staggering pace.

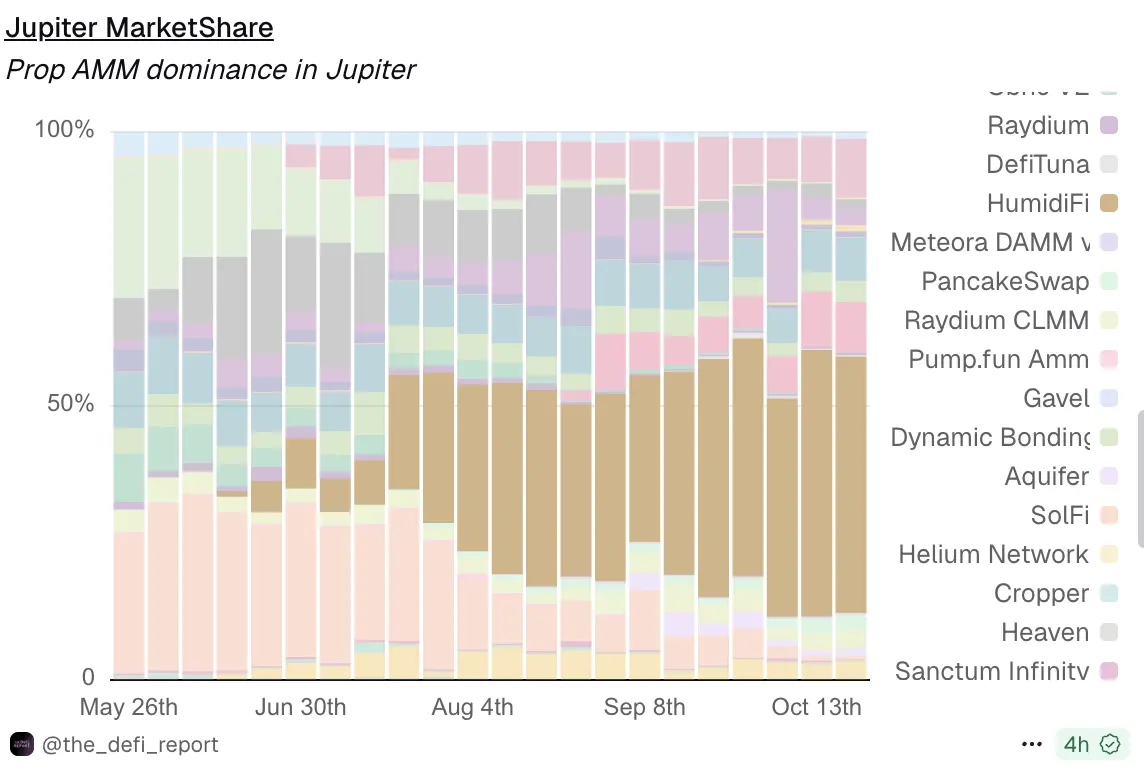

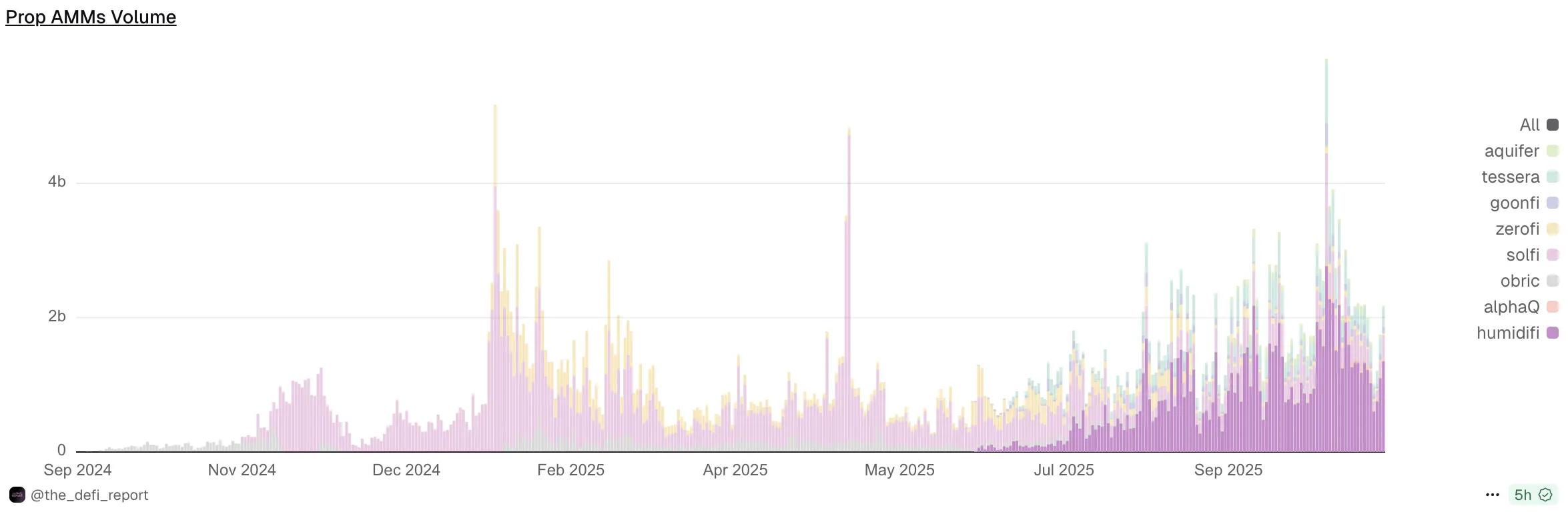

HumidiFi officially launched in mid-June 2025, and just two months later, it had captured 47.1% of all Prop AMM trading volume, becoming the undisputed market leader. In contrast, former leader SolFi saw its market share plummet from 61.8% two months prior to just 9.2%.

Source: Dune @the_defi_report

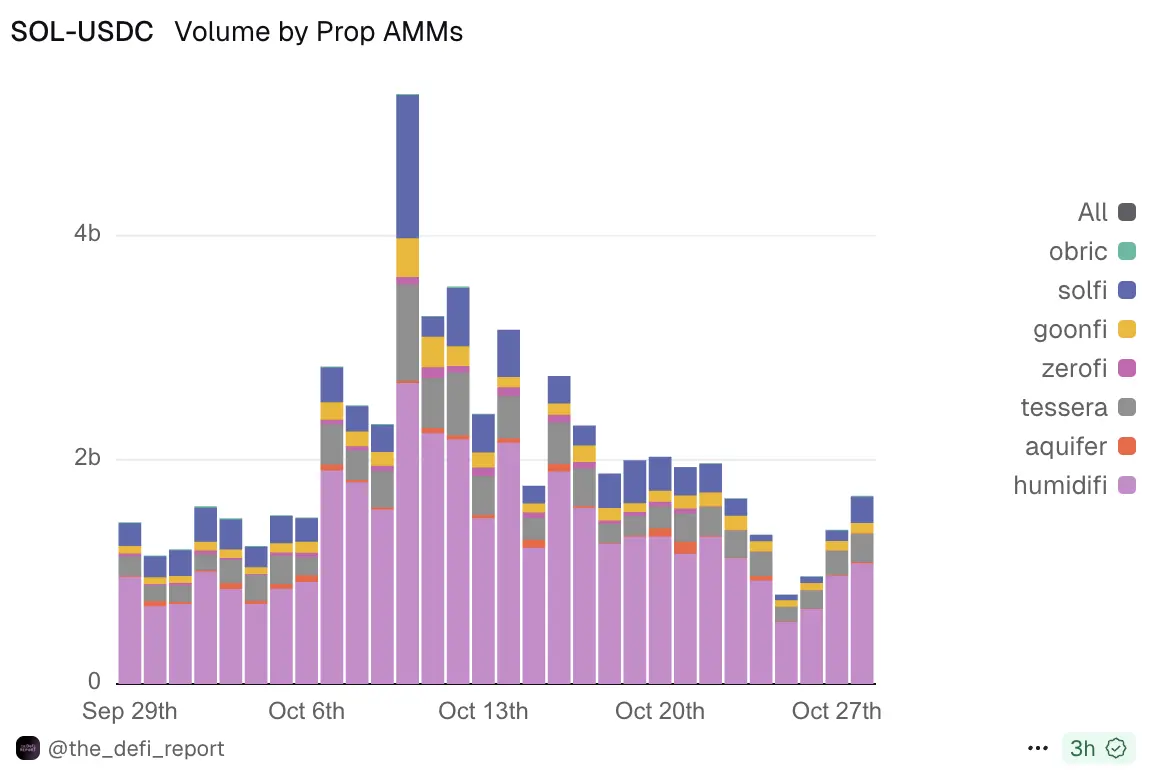

HumidiFi's dominance is especially evident in the SOL/USDC trading pair. On October 28 (UTC+8), HumidiFi processed $1.08 billions in SOL/USDC trades in a single day, accounting for 64.3% of the total volume for that pair on that day.

Source: Dune @the_defi_report

HumidiFi also has a very high penetration rate in Jupiter routing. As an aggregator holding 86.4% market share on Solana, Jupiter's routing choices largely determine the actual trading experience for users. Data from October 20 (UTC+8) shows that HumidiFi's market share within Jupiter reached as high as 46.8%, more than four times that of the second place, TesseraV (10.7%).

Source: Dune @the_defi_report

Expanding the view to the entire Prop AMM ecosystem, HumidiFi's dominance remains solid. On October 28 (UTC+8), the total trading volume for all Prop AMMs reached $2.18 billions, with HumidiFi alone accounting for $1.35 billions, or 61.9%. This figure not only far surpasses the second place SolFi's $309 millions, but even exceeds the combined trading volume of all competitors ranked 2nd to 8th.

Source: Dune @the_defi_report

HumidiFi's victory was achieved almost entirely in "stealth mode." It had no official website, no early Twitter account, and no public information about its team members.

HumidiFi doesn't need marketing, airdrops, or storytelling. All it needs is to offer better spreads and better execution prices on every trade compared to its competitors. As Jupiter's routing algorithm repeatedly chose HumidiFi, the market cast its vote in its own way.

The Ultimate Race of Speed and Cost

The key to HumidiFi's success lies in its extreme compression of oracle update compute costs, and its clever use of the Jito auction mechanism to turn this technical edge into absolute market dominance.

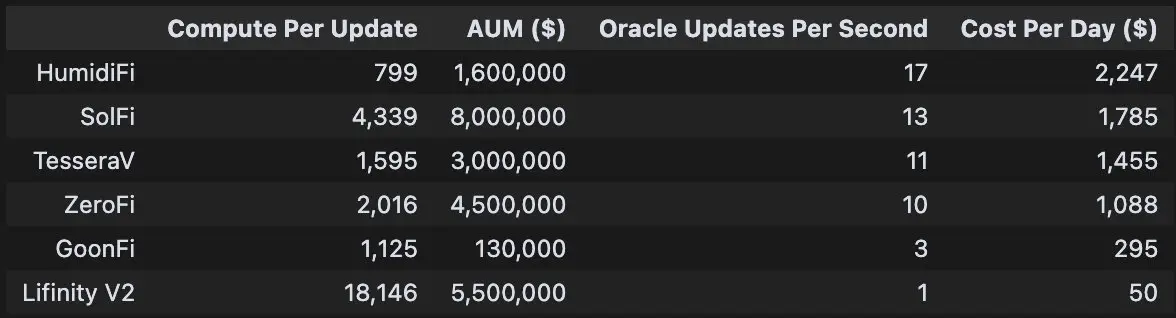

First, HumidiFi consumes very little compute resources. According to data from @bqbrady, each oracle update by HumidiFi uses only 799 CUs (compute units). In comparison, its main competitor SolFi requires 4,339 CUs. TesseraV, operated by top market maker Wintermute, also needs 1,595 CUs—twice that of HumidiFi.

Source: X, @bqbrady

HumidiFi also fully leverages its low CU consumption to gain absolute transaction priority in Solana's MEV infrastructure, the Jito auction. In Jito auctions, transaction priority is determined not by absolute tip, but by tip per compute unit (Tip per CU). HumidiFi pays about 4,998 lamports in tips for each oracle update. Due to its extremely low CU usage (799 CUs), its Tip per CU ratio reaches an astonishing 6.25 lamports/CU.

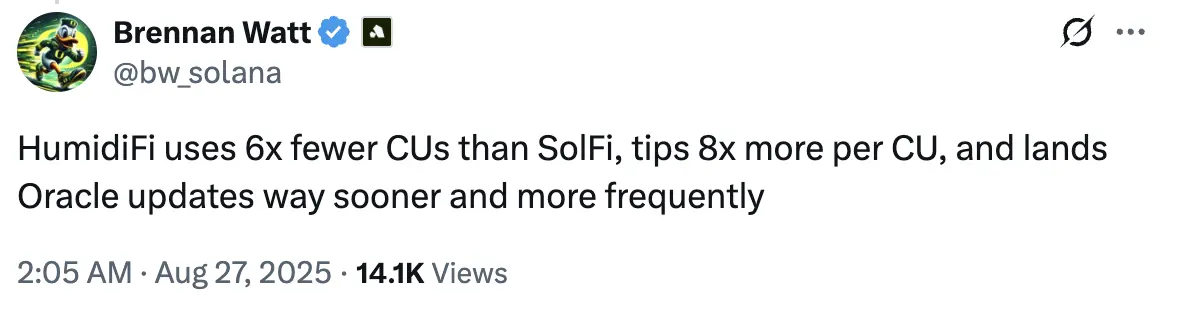

According to data from Brennan Watt, an engineer at Solana core developer Anza, HumidiFi uses six times fewer CUs than former Prop AMM leader SolFi, while paying over eight times more in tips.

Another key advantage for HumidiFi is the frequency of oracle updates. HumidiFi updates its oracle 17 times per second, far surpassing its main competitors (SolFi at 13 times, TesseraV at 11 times, and ZeroFi at 10 times).

In the highly volatile cryptocurrency market, this near real-time price tracking ability allows HumidiFi to always stay close to fair value, leaving no room for arbitrageurs, and providing tighter liquidity without needing to widen spreads for self-protection.

In addition, HumidiFi excels at cost control. Its daily operating cost is only $2,247. In comparison, SolFi, despite managing five times the assets under management (AUM) as HumidiFi ($8 billions vs $1.6 billions), has a daily cost only 20% lower ($1,785).

WET Token Lands on Jupiter DTF

Prop AMMs are a "winner-takes-all" track. HumidiFi has achieved its current dominance through technical prowess, but this also means that if a new competitor makes a breakthrough in CU efficiency or oracle speed, it could quickly erode HumidiFi's market share. Clearly, this Prop AMM war has only just begun.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AiCoin Daily Report (October 31)

Stablecoins Enter the $300 Billion Era: Three Main Themes Reveal the Next Growth Cycle

Trump is going to open his own casino

How the Trump family is reshaping prediction markets and the boundaries of information.

From DeFi Infrastructure to Mainstream Crypto Consumption: In-depth Analysis of the First 11 Innovative Projects in MegaMafia 2.0

The MegaMafia 2.0 Accelerator Program focuses on incubating innovative crypto consumer products aimed at mainstream users.